the current cash flows, find the current IRR on this project. Use linear interpolation with x, = 7% and x, 8% to find your answer. ent IRR of this project is O percent he final answer to two decimal places as needed. Round all intermediate values to six decimal places as needed.) is the current MARR? ant MARR is O percent he final answer to two decimal places as needed. Round al intermediate values to six decimal places as needed) s they invest? es, they should invest, as the current rate of retum exceeds the MARR. o, they should not invest, as the irrigation system is an extraneous purchase. 1o, they should not invest, as the project's first cost is too high. to, they should not invest, as the current rate of return exceeds the MARR.

the current cash flows, find the current IRR on this project. Use linear interpolation with x, = 7% and x, 8% to find your answer. ent IRR of this project is O percent he final answer to two decimal places as needed. Round all intermediate values to six decimal places as needed.) is the current MARR? ant MARR is O percent he final answer to two decimal places as needed. Round al intermediate values to six decimal places as needed) s they invest? es, they should invest, as the current rate of retum exceeds the MARR. o, they should not invest, as the irrigation system is an extraneous purchase. 1o, they should not invest, as the project's first cost is too high. to, they should not invest, as the current rate of return exceeds the MARR.

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter11: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 8P: The Rodriguez Company is considering an average-risk investment in a mineral water spring project...

Related questions

Question

100%

As soon as possible . Thank you

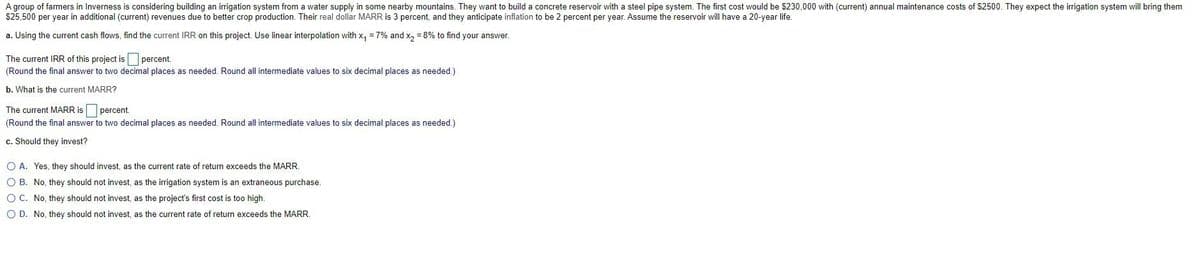

Transcribed Image Text:A group of farmers in Inverness is considering building an irrigation system from a water supply in some nearby mountains. They want to build a concrete reservoir with a steel pipe system. The first cost would be $230,000 with (current) annual maintenance costs of $2500. They expect the irrigation system will bring them

$25,500 per year in additional (current) revenues due to better crop production. Their real dollar MARR is 3 percent, and they anticipate inflation to be 2 percent per year. Assume the reservoir will have a 20-year life.

a. Using the current cash flows, find the current IRR on this project. Use linear interpolation with x, = 7% and x, = 8% to find your answer.

The current IRR of this project is percent.

(Round the final answer to two decimal places as needed. Round all intermediate values to six decimal places as needed.)

b. What is the current MARR?

The current MARR is percent.

(Round the final answer to two decimal places as needed. Round all intermediate values to six decimal places as needed.)

c. Should they invest?

O A. Yes, they should invest, as the current rate of return exceeds the MARR.

O B. No, they should not invest, as the irrigation system is an extraneous purchase.

O C. No, they should not invest, as the project's first cost is too high.

O D. No, they should not invest, as the current rate of return exceeds the MARR.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College