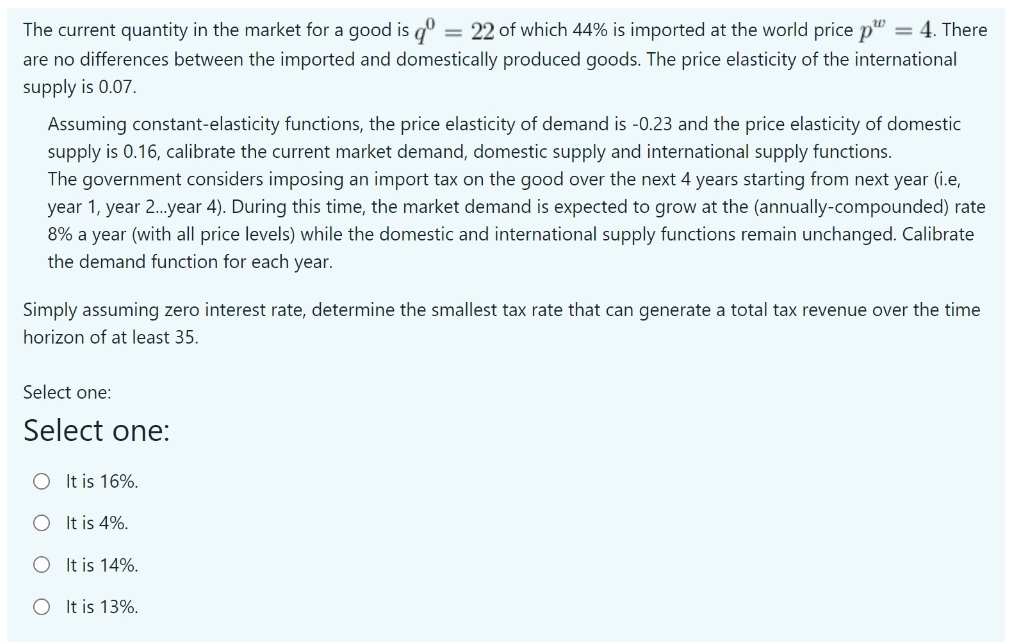

The current quantity in the market for a good is = 22 of which 44% is imported at the world price p" = 4. There %3D are no differences between the imported and domestically produced goods. The price elasticity of the international supply is 0.07. Assuming constant-elasticity functions, the price elasticity of demand is -0.23 and the price elasticity of domestic supply is 0.16, calibrate the current market demand, domestic supply and international supply functions. The government considers imposing an import tax on the good over the next 4 years starting from next year (i.e, year 1, year 2.year 4). During this time, the market demand is expected to grow at the (annually-compounded) rate 8% a year (with all price levels) while the domestic and international supply functions remain unchanged. Calibrate the demand function for each year. Simply assuming zero interest rate, determine the smallest tax rate that can generate a total tax revenue over the time horizon of at least 35. Select one: Select one: O It is 16%. O It is 4%. O I t is 14%. O It is 13%.

The current quantity in the market for a good is = 22 of which 44% is imported at the world price p" = 4. There %3D are no differences between the imported and domestically produced goods. The price elasticity of the international supply is 0.07. Assuming constant-elasticity functions, the price elasticity of demand is -0.23 and the price elasticity of domestic supply is 0.16, calibrate the current market demand, domestic supply and international supply functions. The government considers imposing an import tax on the good over the next 4 years starting from next year (i.e, year 1, year 2.year 4). During this time, the market demand is expected to grow at the (annually-compounded) rate 8% a year (with all price levels) while the domestic and international supply functions remain unchanged. Calibrate the demand function for each year. Simply assuming zero interest rate, determine the smallest tax rate that can generate a total tax revenue over the time horizon of at least 35. Select one: Select one: O It is 16%. O It is 4%. O I t is 14%. O It is 13%.

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter4: Estimating Demand

Section: Chapter Questions

Problem 6E

Related questions

Question

Transcribed Image Text:The current quantity in the market for a good is dº = 22 of which 44% is imported at the world price p"

= 4. There

are no differences between the imported and domestically produced goods. The price elasticity of the international

supply is 0.07.

Assuming constant-elasticity functions, the price elasticity of demand is -0.23 and the price elasticity

domestic

supply is 0.16, calibrate the current market demand, domestic supply and international supply functions.

The government considers imposing an import tax on the good over the next 4 years starting from next year (i.e,

year 1, year 2.year 4). During this time, the market demand is expected to grow at the (annually-compounded) rate

8% a year (with all price levels) while the domestic and international supply functions remain unchanged. Calibrate

the demand function for each year.

Simply assuming zero interest rate, determine the smallest tax rate that can generate a total tax revenue over the time

horizon of at least 35.

Select one:

Select one:

O It is 16%.

It is 4%.

It is 14%.

O It is 13%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc