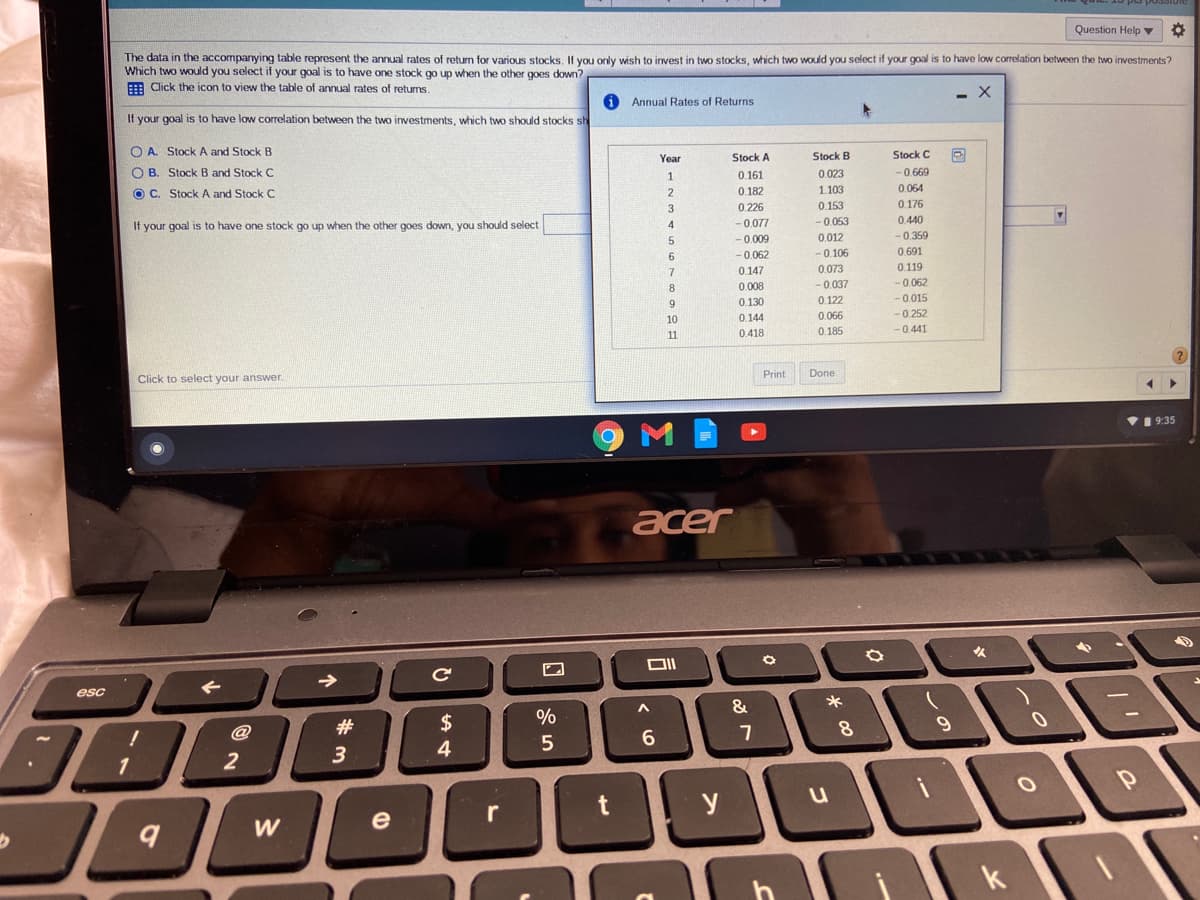

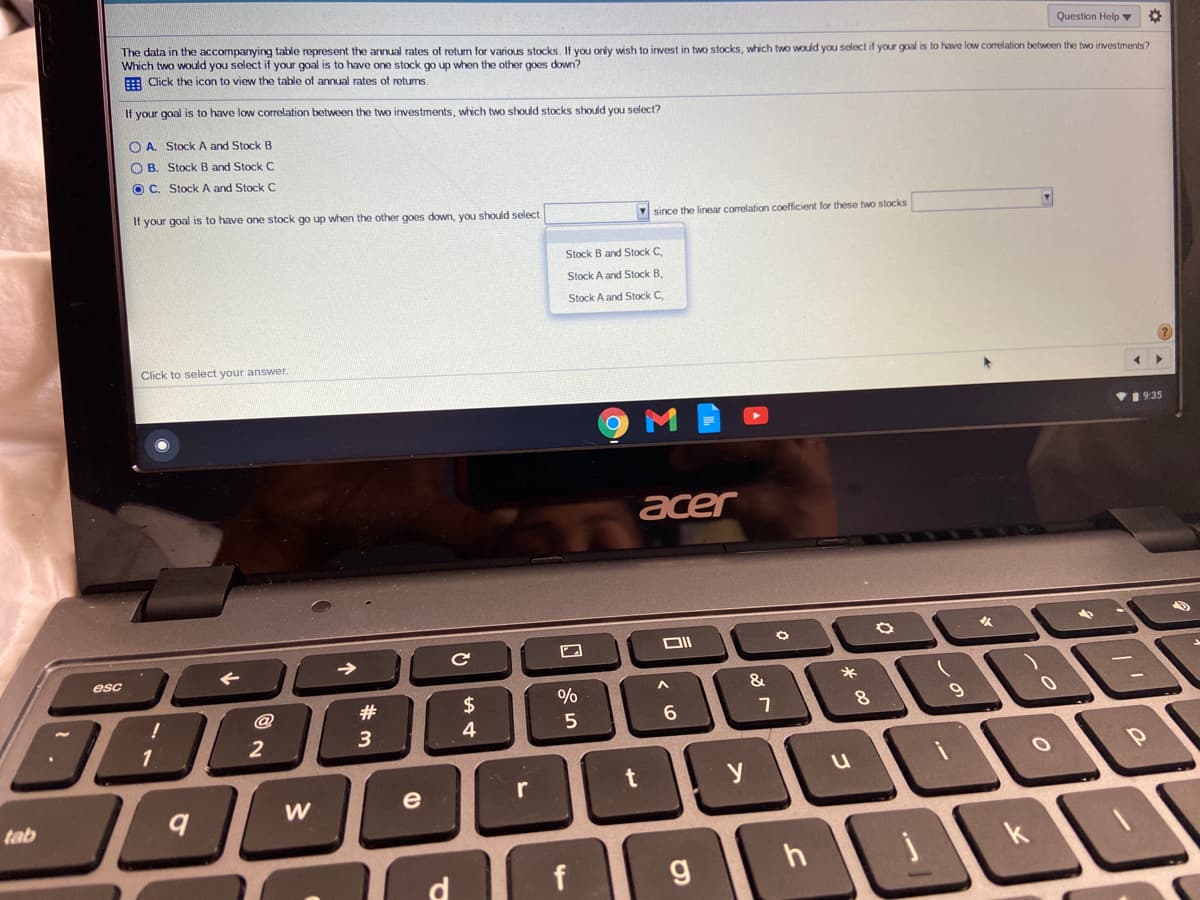

The data in the accompanying table represent the annual rates of return for various stocks. If you only wish to invest in two stocks, which two would you select if your goal is to have low correlation between the two investments? Which two would you select if your goal is to have one stock go up when the other goes down? E Click the icon to view the table of annual rates of returns. O Annual Rates of Returns If your goal is to have low correlation between the two investments, which two should stocks sh O A Stock A and Stock B Stock B Stock C Year Stock A O B. Stock B and Stock C 0.161 0.023 -0.669 1 1. 103 0.153 OC. Stock A and Stock C 2 0.182 0.064 0.176 0.440 3 0.226 If your goal is to have one stock go up when the other goes down, you should select - 0.077 -0 053 -0.009 0.012 - 0.359 6. - 0.062 -0.106 0.691 0.147 0.073 0.119 8. 0.008 -0.037 -0.062 9. 0.130 0.122 -0.015 10 0.144 0.066 -0.252 11 0.418 0.185 -0.441

Correlation

Correlation defines a relationship between two independent variables. It tells the degree to which variables move in relation to each other. When two sets of data are related to each other, there is a correlation between them.

Linear Correlation

A correlation is used to determine the relationships between numerical and categorical variables. In other words, it is an indicator of how things are connected to one another. The correlation analysis is the study of how variables are related.

Regression Analysis

Regression analysis is a statistical method in which it estimates the relationship between a dependent variable and one or more independent variable. In simple terms dependent variable is called as outcome variable and independent variable is called as predictors. Regression analysis is one of the methods to find the trends in data. The independent variable used in Regression analysis is named Predictor variable. It offers data of an associated dependent variable regarding a particular outcome.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps