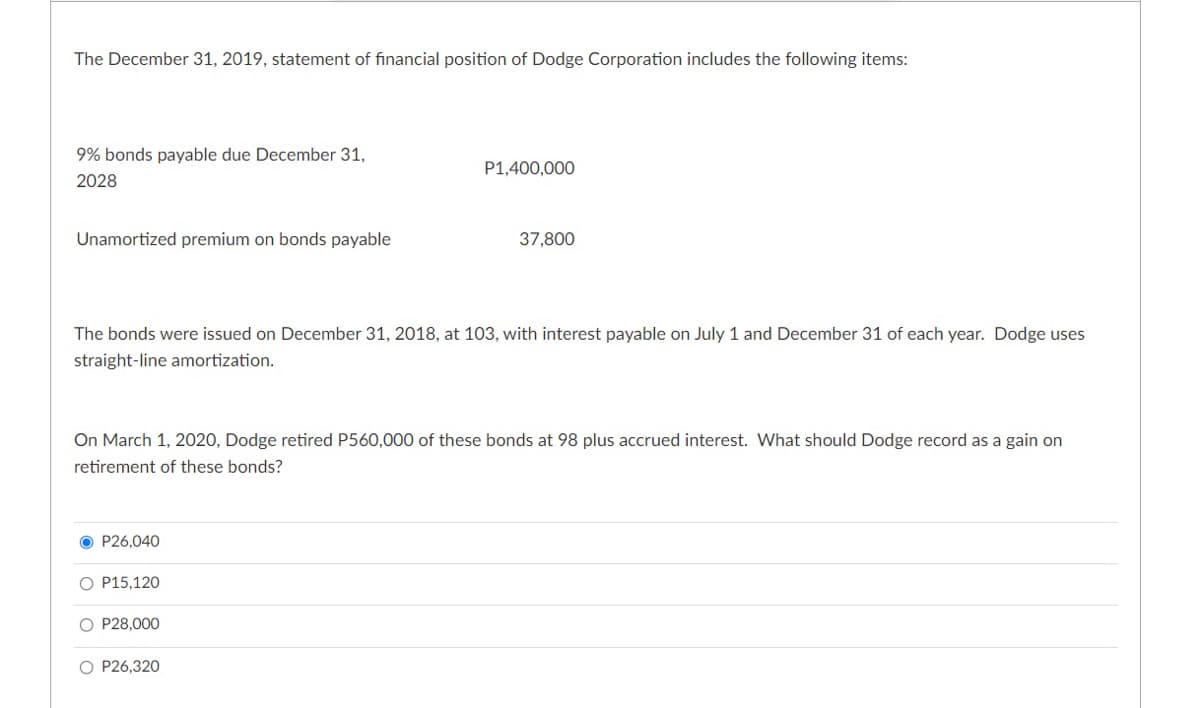

The December 31, 2019, statement of financial position of Dodge Corporation includes the following items: 9% bonds payable due December 31, P1,400,000 2028 Unamortized premium on bonds payable 37,800 The bonds were issued on December 31, 2018, at 103, with interest payable on July 1 and December 31 of each year. Dodge uses straight-line amortization. On March 1, 2020, Dodge retired P560,000 of these bonds at 98 plus accrued interest. What should Dodge record as a gain on retirement of these bonds? P26,040 O P15,120 O P28,000 O P26,320

The December 31, 2019, statement of financial position of Dodge Corporation includes the following items: 9% bonds payable due December 31, P1,400,000 2028 Unamortized premium on bonds payable 37,800 The bonds were issued on December 31, 2018, at 103, with interest payable on July 1 and December 31 of each year. Dodge uses straight-line amortization. On March 1, 2020, Dodge retired P560,000 of these bonds at 98 plus accrued interest. What should Dodge record as a gain on retirement of these bonds? P26,040 O P15,120 O P28,000 O P26,320

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 1RE

Related questions

Question

Transcribed Image Text:The December 31, 2019, statement of financial position of Dodge Corporation includes the following items:

9% bonds payable due December 31,

P1,400,000

2028

Unamortized premium on bonds payable

37,800

The bonds were issued on December 31, 2018, at 103, with interest payable on July 1 and December 31 of each year. Dodge uses

straight-line amortization.

On March 1, 2020, Dodge retired P560,000 of these bonds at 98 plus accrued interest. What should Dodge record as a gain on

retirement of these bonds?

O P26,040

O P15,120

O P28,000

O P26,320

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning