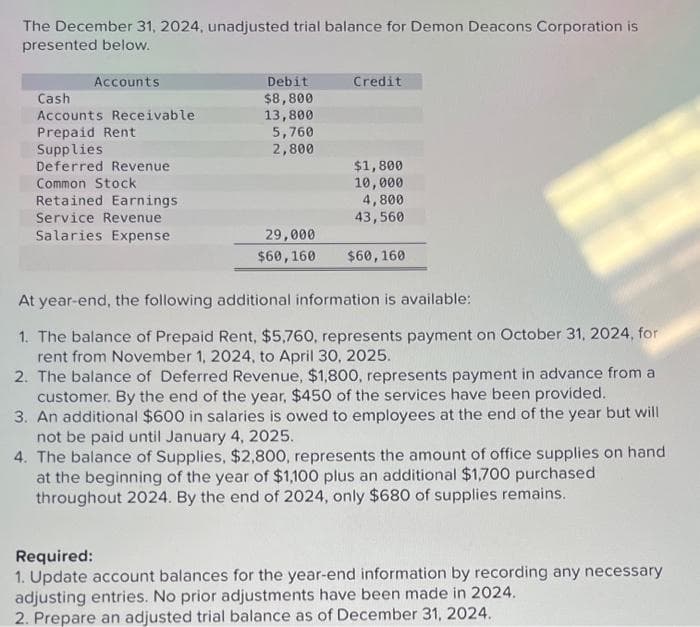

The December 31, 2024, unadjusted trial balance for Demon Deacons Corporation is presented below. Accounts Cash Accounts Receivable Prepaid Rent Supplies Deferred Revenue Common Stock Retained Earnings Service Revenue Salaries Expense Debit $8,800 13,800 5,760 2,800 Credit $1,800 10,000 4,800 43,560 29,000 $60,160 $60, 160 At year-end, the following additional information is available: 1. The balance of Prepaid Rent, $5,760, represents payment on October 31, 2024, for rent from November 1, 2024, to April 30, 2025. 2. The balance of Deferred Revenue, $1,800, represents payment in advance from a customer. By the end of the year, $450 of the services have been provided. 3. An additional $600 in salaries is owed to employees at the end of the year but will not be paid until January 4, 2025. 4. The balance of Supplies, $2,800, represents the amount of office supplies on hand at the beginning of the year of $1,100 plus an additional $1,700 purchased throughout 2024. By the end of 2024, only $680 of supplies remains. Required: 1. Update account balances for the year-end information by recording any necessary adjusting entries. No prior adjustments have been made in 2024. 2. Prepare an adjusted trial balance as of December 31, 2024.

The December 31, 2024, unadjusted trial balance for Demon Deacons Corporation is presented below. Accounts Cash Accounts Receivable Prepaid Rent Supplies Deferred Revenue Common Stock Retained Earnings Service Revenue Salaries Expense Debit $8,800 13,800 5,760 2,800 Credit $1,800 10,000 4,800 43,560 29,000 $60,160 $60, 160 At year-end, the following additional information is available: 1. The balance of Prepaid Rent, $5,760, represents payment on October 31, 2024, for rent from November 1, 2024, to April 30, 2025. 2. The balance of Deferred Revenue, $1,800, represents payment in advance from a customer. By the end of the year, $450 of the services have been provided. 3. An additional $600 in salaries is owed to employees at the end of the year but will not be paid until January 4, 2025. 4. The balance of Supplies, $2,800, represents the amount of office supplies on hand at the beginning of the year of $1,100 plus an additional $1,700 purchased throughout 2024. By the end of 2024, only $680 of supplies remains. Required: 1. Update account balances for the year-end information by recording any necessary adjusting entries. No prior adjustments have been made in 2024. 2. Prepare an adjusted trial balance as of December 31, 2024.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 16E: Dudley Company failed to recognize the following accruals. It also recorded the prepaid expenses and...

Related questions

Topic Video

Question

(3).

Transcribed Image Text:The December 31, 2024, unadjusted trial balance for Demon Deacons Corporation is

presented below.

Accounts

Cash

Accounts Receivable.

Prepaid Rent

Supplies

Deferred Revenue

Common Stock

Retained Earnings

Service Revenue

Salaries Expense

Debit

$8,800

13,800

5,760

2,800

29,000

$60, 160

Credit

$1,800

10,000

4,800

43,560

$60, 160

At year-end, the following additional information is available:

1. The balance of Prepaid Rent, $5,760, represents payment on October 31, 2024, for

rent from November 1, 2024, to April 30, 2025.

2. The balance of Deferred Revenue, $1,800, represents payment in advance from a

customer. By the end of the year, $450 of the services have been provided.

3. An additional $600 in salaries is owed to employees at the end of the year but will

not be paid until January 4, 2025.

4. The balance of Supplies, $2,800, represents the amount of office supplies on hand

at the beginning of the year of $1,100 plus an additional $1,700 purchased

throughout 2024. By the end of 2024, only $680 of supplies remains.

Required:

1. Update account balances for the year-end information by recording any necessary

adjusting entries. No prior adjustments have been made in 2024.

2. Prepare an adjusted trial balance as of December 31, 2024.

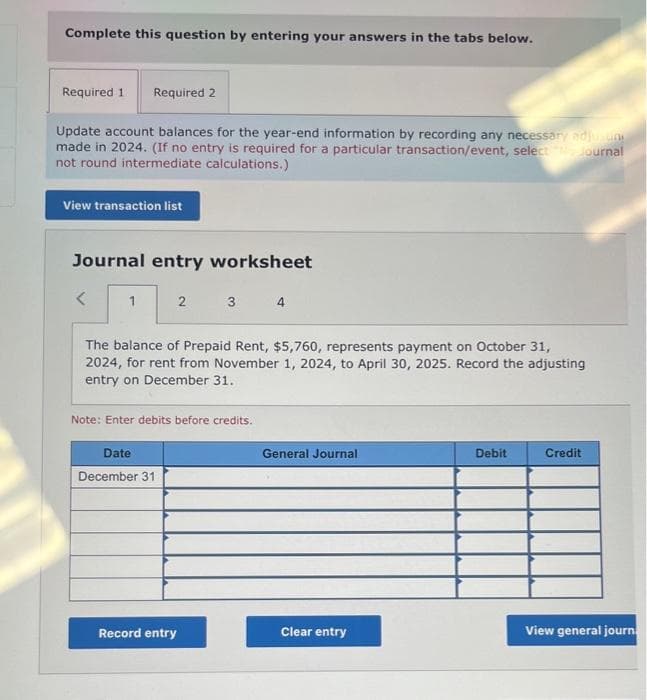

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Update account balances for the year-end information by recording any necessary adjusuni

made in 2024. (If no entry is required for a particular transaction/event, select "No Journal

not round intermediate calculations.)

View transaction list

Journal entry worksheet

<

1

2

Date

December 31

3

The balance of Prepaid Rent, $5,760, represents payment on October 31,

2024, for rent from November 1, 2024, to April 30, 2025. Record the adjusting

entry on December 31.

Note: Enter debits before credits.

Record entry

4

General Journal

Clear entry

Debit

Credit

View general journ

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning