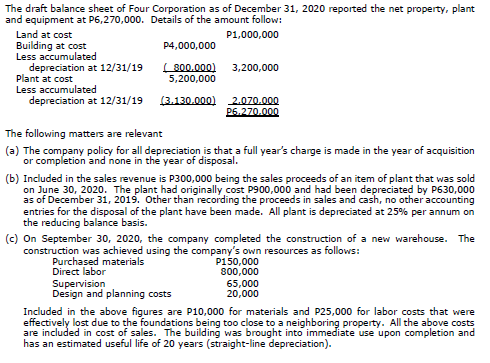

The draft balance sheet of Four Corporation as of December 31, 2020 reported the net property, plant and equipment at P6,270,000. Details of the amount follow: Land at cost Building at cost Less accumulated depreciation at 12/31/19 Plant at cost Less accumulated depreciation at 12/31/19 (3.130.00o) 2.070.000 P1,000,000 P4,000,000 ( 800.000) 3,200,000 5,200,000 P6.270.000 The following matters are relevant (a) The company policy for all depreciation is that a full year's charge is made in the year of acquisition or completion and none in the year of disposal. (b) Included in the sales revenue is P300,000 being the sales proceeds of an item of plant that was sold on June 30, 2020. The plant had originally cost P900,000 and had been depreciated by P630,000 as of December 31, 2019. Other than recording the proceeds in sales and cash, no other accounting entries for the disposal of the plant have been made. All plant is depreciated at 25% per annum on the reducing balance basis. (c) On September 30, 2020, the company completed the construction of a new warehouse. The construction was achieved using the company's own resources as follows: Purchased materials Direct labor P150,000 800,000 65,000 20,000 Supervision Design and planning costs Included in the above figures are P10,000 for materials and P25,000 for labor costs that were effectively lost due to the foundations being too close to a neighboring property. All the above costs are included in cost of sales. The building was brought into immediate use upon completion and has an estimated useful life of 20 years (straight-line depreciation).

The draft balance sheet of Four Corporation as of December 31, 2020 reported the net property, plant and equipment at P6,270,000. Details of the amount follow: Land at cost Building at cost Less accumulated depreciation at 12/31/19 Plant at cost Less accumulated depreciation at 12/31/19 (3.130.00o) 2.070.000 P1,000,000 P4,000,000 ( 800.000) 3,200,000 5,200,000 P6.270.000 The following matters are relevant (a) The company policy for all depreciation is that a full year's charge is made in the year of acquisition or completion and none in the year of disposal. (b) Included in the sales revenue is P300,000 being the sales proceeds of an item of plant that was sold on June 30, 2020. The plant had originally cost P900,000 and had been depreciated by P630,000 as of December 31, 2019. Other than recording the proceeds in sales and cash, no other accounting entries for the disposal of the plant have been made. All plant is depreciated at 25% per annum on the reducing balance basis. (c) On September 30, 2020, the company completed the construction of a new warehouse. The construction was achieved using the company's own resources as follows: Purchased materials Direct labor P150,000 800,000 65,000 20,000 Supervision Design and planning costs Included in the above figures are P10,000 for materials and P25,000 for labor costs that were effectively lost due to the foundations being too close to a neighboring property. All the above costs are included in cost of sales. The building was brought into immediate use upon completion and has an estimated useful life of 20 years (straight-line depreciation).

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 24CE

Related questions

Question

The revaluation surplus as of December 31, 2020 is

a. P1,720,000 c. P1,800,000

b. P1,710,000 d. P 960,000

Transcribed Image Text:The draft balance sheet of Four Corporation as of December 31, 2020 reported the net property, plant

and equipment at P6,270,000. Details of the amount follow:

Land at cost

Building at cost

Less accumulated

depreciation at 12/31/19

Plant at cost

Less accumulated

depreciation at 12/31/19

P1,000,000

P4,000,000

800.000)

5,200,000

3,200,000

(3.130.000)

2.070.000

P6.270.000

The following matters are relevant

(a) The company policy for all depreciation is that a full year's charge is made in the year of acquisition

or completion and none in the year of disposal.

(b) Included in the sales revenue is P300,000 being the sales proceeds of an item of plant that was sold

on June 30, 2020. The plant had originally cost P900,000 and had been depreciated by P630,000

as of December 31, 2019. Other than recording the proceeds in sales and cash, no otheraccounting

entries for the disposal of the plant have been made. All plant is depreciated at 25% per annum on

the reducing balance basis.

(c) On September 30, 2020, the company completed the construction of a new warehouse. The

construction was achieved using the company's own resources as follows:

Purchased materials

Direct labor

Supervision

Design and planning costs

P150,000

800,000

65,000

20,000

Included in the above figures are P10,000 for materials and P25,000 for labor costs that were

effectively lost due to the foundations being too close to a neighboring property. All the above costs

are included in cost of sales. The building was brought into immediate use upon completion and

has an estimated useful life of 20 years (straight-line depreciation).

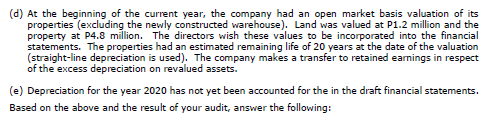

Transcribed Image Text:(d) At the beginning of the current year, the company had an open market basis valuation of its

properties (excluding the newly constructed warehouse). Land was valued at P1.2 million and the

property at P4.8 million. The directors wish these values to be incorporated into the financial

statements. The properties had an estimated remaining life of 20 years at the date of the valuation

(straight-line depreciation is used). The company makes a transfer to retained eamings in respect

of the excess depreciation on revalued assets.

(e) Depreciation for the year 2020 has not yet been accounted for the in the draft financial statements.

Based on the above and the result of your audit, answer the following:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning