the due date of the note. the maturity value of the note. Assume 360 days in a year. the entry to record the receipt of the payment of the note at maturity. Refer to the chart c CNOW journals do not use lines for journal explanations. Every line on a journal page

the due date of the note. the maturity value of the note. Assume 360 days in a year. the entry to record the receipt of the payment of the note at maturity. Refer to the chart c CNOW journals do not use lines for journal explanations. Every line on a journal page

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 15EA: Resin Milling issued a $390,500 note on January 1, 2018 to a customer in exchange for merchandise....

Related questions

Concept explainers

Depreciation Methods

The word "depreciation" is defined as an accounting method wherein the cost of tangible assets is spread over its useful life and it usually denotes how much of the assets value has been used up. The depreciation is usually considered as an operating expense. The main reason behind depreciation includes wear and tear of the assets, obsolescence etc.

Depreciation Accounting

In terms of accounting, with the passage of time the value of a fixed asset (like machinery, plants, furniture etc.) goes down over a specific period of time is known as depreciation. Now, the question comes in your mind, why the value of the fixed asset reduces over time.

Topic Video

Question

100%

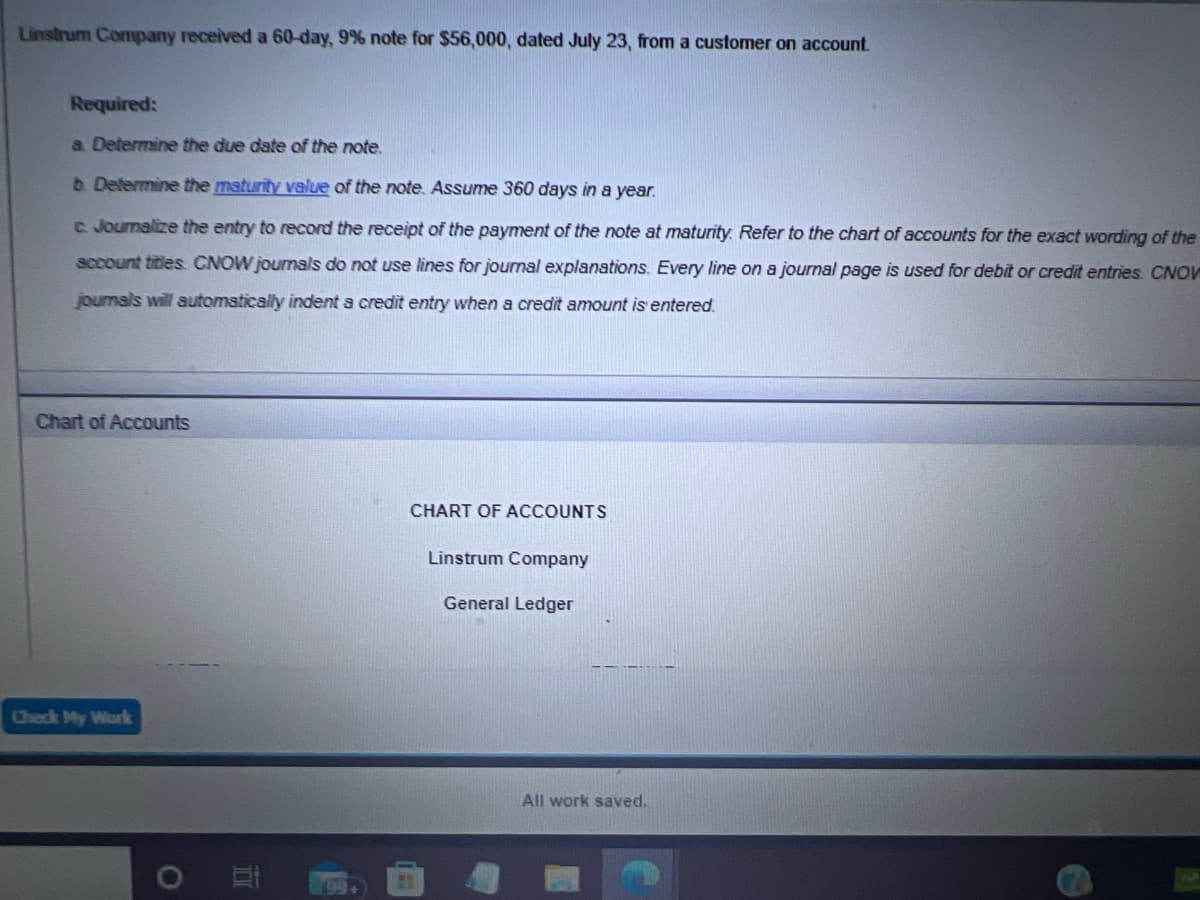

Linstrum Company received a

60-day, 9% note for $56,000, dated July 23, from a customer on account.

Transcribed Image Text:Linstrum Company received a 60-day, 9% note for $56,000, dated July 23, from a customer on account.

Required:

a. Determine the due date of the note.

b. Determine the maturity value of the note. Assume 360 days in a year.

e Journalize the entry to record the receipt of the payment of the note at maturity. Refer to the chart of accounts for the exact wording of the

account titles CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries CNOV

journals will automatically indent a credit entry when a credit amount is entered.

Chart of Accounts

Check My Work

II

CHART OF ACCOUNTS

Linstrum Company

General Ledger

All work saved.

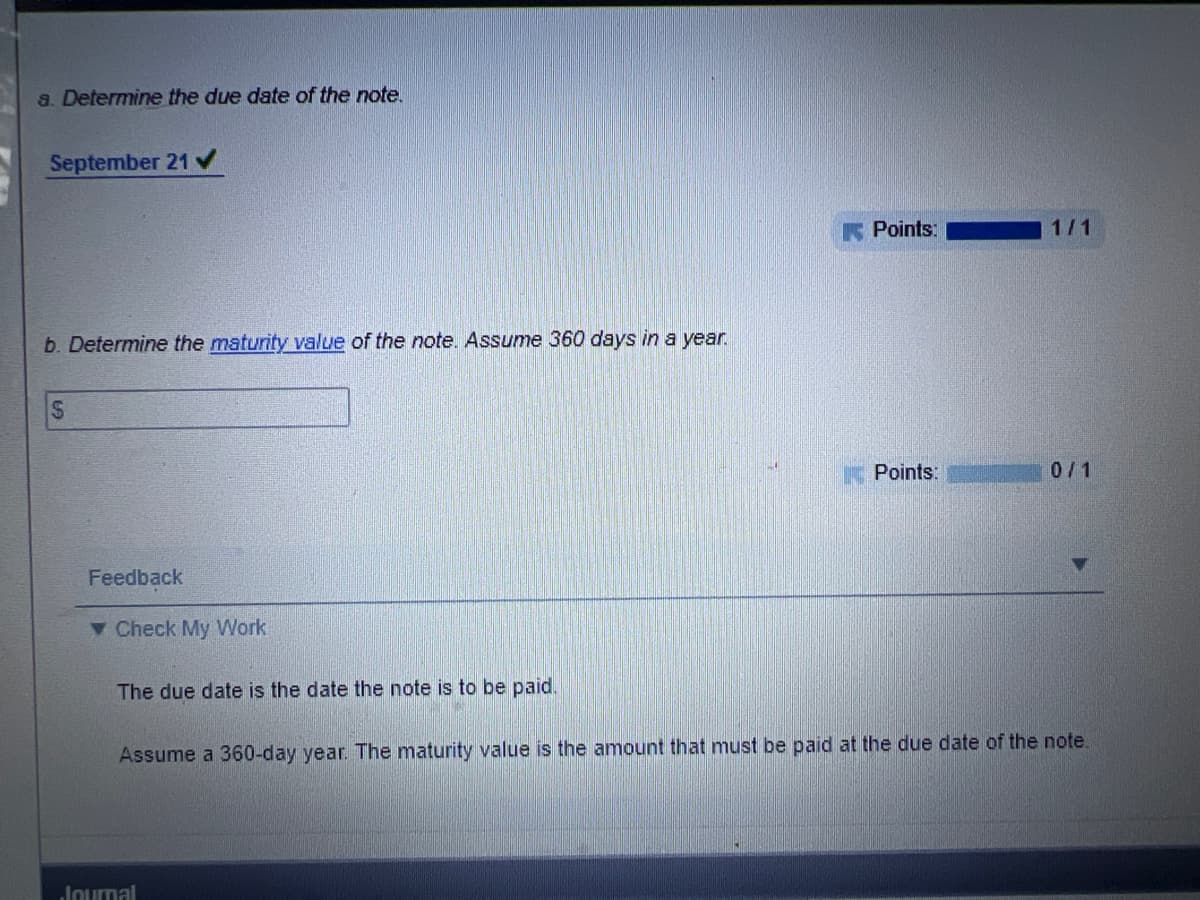

Transcribed Image Text:a. Determine the due date of the note.

September 21 ✔

b. Determine the maturity value of the note. Assume 360 days in a year.

S

Feedback

▼ Check My Work

The due date is the date the note is to be paid.

Points:

Journal

Points:

1/1

0/1

Assume a 360-day year. The maturity value is the amount that must be paid at the due date of the note.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage