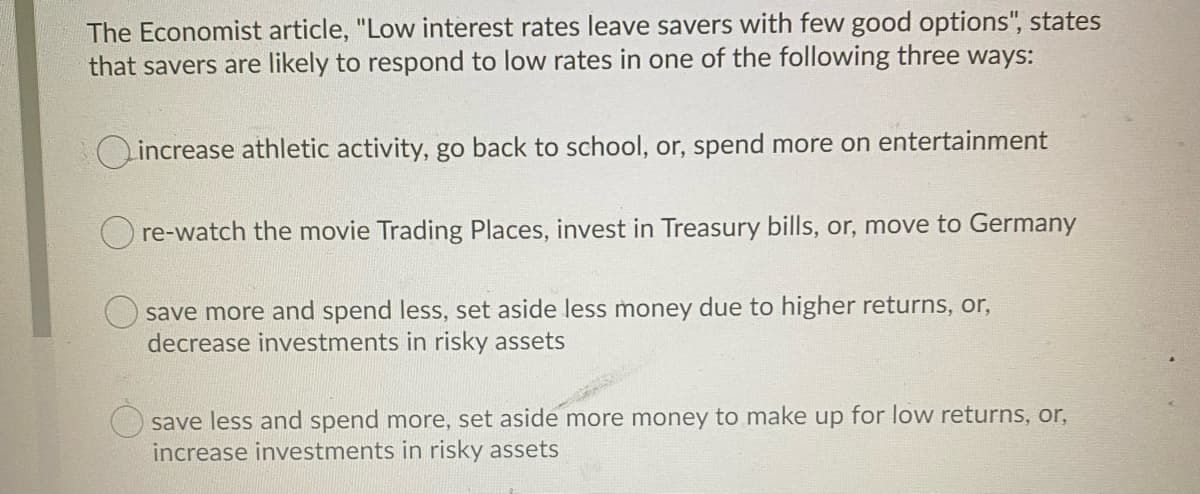

The Economist article, "Low interest rates leave savers with few good options", states that savers are likely to respond to low rates in one of the following three ways: Lincrease athletic activity, go back to school, or, spend more on entertainment O re-watch the movie Trading Places, invest in Treasury bills, or, move to Germany save more and spend less, set aside less money due to higher returns, or, decrease investments in risky assets save less and spend more, set aside more money to make up for low returns, or, increase investments in risky assets

The Economist article, "Low interest rates leave savers with few good options", states that savers are likely to respond to low rates in one of the following three ways: Lincrease athletic activity, go back to school, or, spend more on entertainment O re-watch the movie Trading Places, invest in Treasury bills, or, move to Germany save more and spend less, set aside less money due to higher returns, or, decrease investments in risky assets save less and spend more, set aside more money to make up for low returns, or, increase investments in risky assets

Essentials of Economics (MindTap Course List)

8th Edition

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter18: Savings,investment And The Financial System

Section: Chapter Questions

Problem 5PA

Related questions

Question

Transcribed Image Text:The Economist article, "Low interest rates leave savers with few good options", states

that savers are likely to respond to low rates in one of the following three ways:

Lincrease athletic activity, go back to school, or, spend more on entertainment

O re-watch the movie Trading Places, invest in Treasury bills, or, move to Germany

save more and spend less, set aside less money due to higher returns, or,

decrease investments in risky assets

save less and spend more, set aside more money to make up for low returns, or,

increase investments in risky assets

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning