The economy of a hypothetical country has been stable for two or three years with very low unemployment. Wages have been gradually increasing during this time. Now stock market prices begin significant increases, causing peoples’ investments, such as their retirement accounts and other investments to increase in value. People feel very good about the future, that they will keep their jobs, get regular pay raises and life will be good. With this positive feeling, people feel better about making purchases that perhaps they had been delaying earlier. They now use their new-found sense of wealth to buy many things that they had been hesitant to purchase in the past. Given this scenario, insert your answers below each of the following questions. What kind of economic gap will start to occur (inflationary or recessionary)? Which of these graphs, Figure 1 or Figure 2, depicts this economic gap? What part of the Federal Reserve’s congressional mandate does this scenario trigger (price stability and maximum sustainable employment)? What kind of monetary policy might be helpful to stabilize the economy (expansionary or contractionary)? What specific monetary policy tools does the Federal Reserve have available to use in this scenario? Explain in detail, how should the Federal Reserve use each of these tools to maximize their effect in stabilizing the economy, what will be the likely effect of each monetary tool’s use on the money supply, and the resulting impact on the economy?

The economy of a hypothetical country has been stable for two or three years with very low unemployment. Wages have been gradually increasing during this time. Now stock market prices begin significant increases, causing peoples’ investments, such as their retirement accounts and other investments to increase in value. People feel very good about the future, that they will keep their jobs, get regular pay raises and life will be good. With this positive feeling, people feel better about making purchases that perhaps they had been delaying earlier. They now use their new-found sense of wealth to buy many things that they had been hesitant to purchase in the past. Given this scenario, insert your answers below each of the following questions. What kind of economic gap will start to occur (inflationary or recessionary)? Which of these graphs, Figure 1 or Figure 2, depicts this economic gap? What part of the Federal Reserve’s congressional mandate does this scenario trigger (price stability and maximum sustainable employment)? What kind of monetary policy might be helpful to stabilize the economy (expansionary or contractionary)? What specific monetary policy tools does the Federal Reserve have available to use in this scenario? Explain in detail, how should the Federal Reserve use each of these tools to maximize their effect in stabilizing the economy, what will be the likely effect of each monetary tool’s use on the money supply, and the resulting impact on the economy?

Chapter9: Demand-side Equilibrium: Unemployment Or Inflation?

Section: Chapter Questions

Problem 6TY

Related questions

Question

- The economy of a hypothetical country has been stable for two or three years with very low

unemployment . Wages have been gradually increasing during this time. Now stock market prices begin significant increases, causing peoples’ investments, such as their retirement accounts and other investments to increase in value. People feel very good about the future, that they will keep their jobs, get regular pay raises and life will be good. With this positive feeling, people feel better about making purchases that perhaps they had been delaying earlier. They now use their new-found sense of wealth to buy many things that they had been hesitant to purchase in the past.

Given this scenario, insert your answers below each of the following questions.

- What kind of economic gap will start to occur (inflationary or recessionary)?

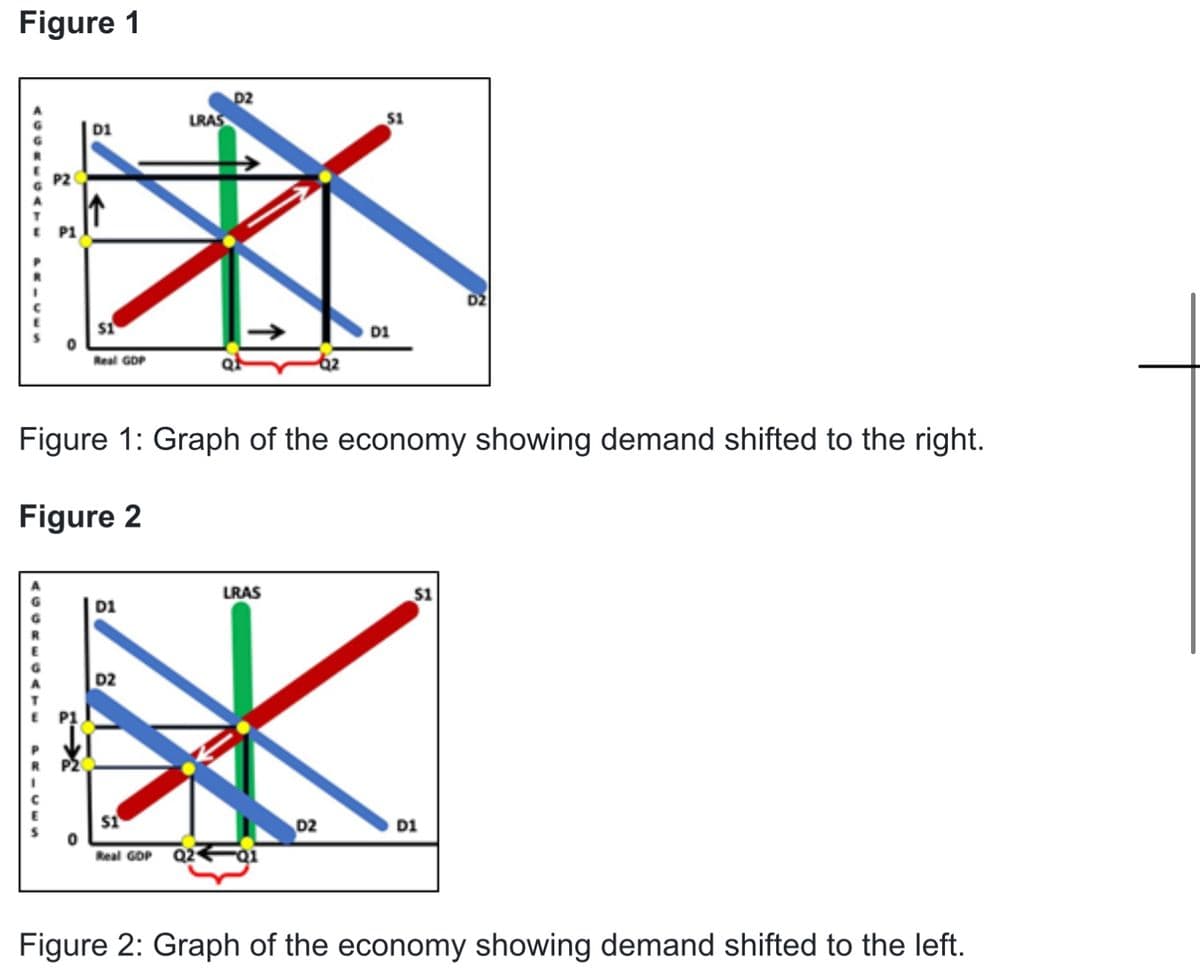

- Which of these graphs, Figure 1 or Figure 2, depicts this economic gap?

- What part of the Federal Reserve’s congressional mandate does this scenario trigger (

price stability and maximum sustainable employment)? - What kind of

monetary policy might be helpful to stabilize the economy (expansionary or contractionary)? - What specific monetary policy tools does the Federal Reserve have available to use in this scenario?

- Explain in detail, how should the Federal Reserve use each of these tools to maximize their effect in stabilizing the economy, what will be the likely effect of each monetary tool’s use on the money supply, and the resulting impact on the economy?

Transcribed Image Text:Figure 1

D2

LRAS

51

D1

P2

P1

D1

Real GDP

Figure 1: Graph of the economy showing demand shifted to the right.

Figure 2

LRAS

$1

D1

D2

P2

s1

D2

D1

Real GOP Q2 Fai

Figure 2: Graph of the economy showing demand shifted to the left.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you