the end of 20x6, Jabba the Hutt's Hot Dog Hut had 350,000 shares of $1 par value common stock iss ddition, Jabba had 94,000 shares of $5 par value, 10% cumulative preferred stock as part of his shar of Jabba's stock, both common and preferred, has been outstanding since the company was incorpo 5. Da did not declare any dividends in 20x5, but he declares and pays a $140,000 cash dividend on De ermine the amount of cash that will be distributed to each class of Jabba's stockholders' equity for th ulation of preferred dividend: cash dividend eferred shareholders mmon shareholders Par Value per Preferred Share $ 0 Dividend Rate % Dividend per Preferred Share Number of Preferred Shares Preferred Dividend for two years

the end of 20x6, Jabba the Hutt's Hot Dog Hut had 350,000 shares of $1 par value common stock iss ddition, Jabba had 94,000 shares of $5 par value, 10% cumulative preferred stock as part of his shar of Jabba's stock, both common and preferred, has been outstanding since the company was incorpo 5. Da did not declare any dividends in 20x5, but he declares and pays a $140,000 cash dividend on De ermine the amount of cash that will be distributed to each class of Jabba's stockholders' equity for th ulation of preferred dividend: cash dividend eferred shareholders mmon shareholders Par Value per Preferred Share $ 0 Dividend Rate % Dividend per Preferred Share Number of Preferred Shares Preferred Dividend for two years

Chapter14: Corporation Accounting

Section: Chapter Questions

Problem 9PA: Aggregate Mining Corporation was incorporated five years ago. It is authorized to issue 500,000...

Related questions

Question

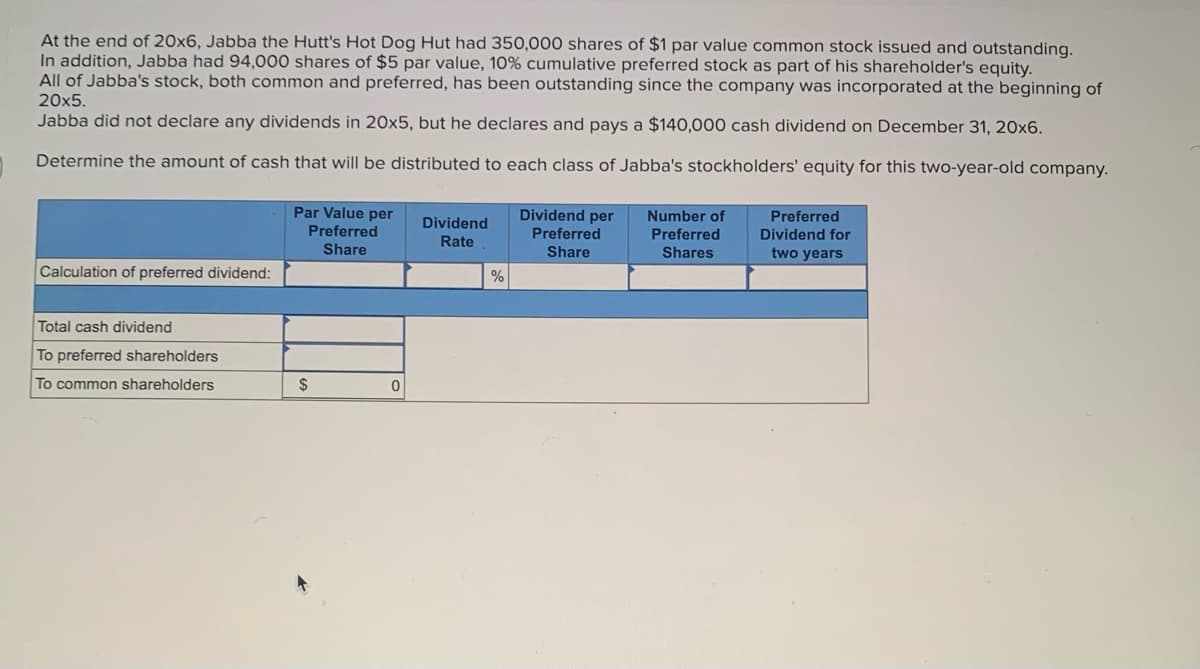

Transcribed Image Text:At the end of 20x6, Jabba the Hutt's Hot Dog Hut had 350,000 shares of $1 par value common stock issued and outstanding.

In addition, Jabba had 94,000 shares of $5 par value, 10% cumulative preferred stock as part of his shareholder's equity.

All of Jabba's stock, both common and preferred, has been outstanding since the company was incorporated at the beginning of

20x5.

Jabba did not declare any dividends in 20x5, but he declares and pays a $140,000 cash dividend on December 31, 20x6.

Determine the amount of cash that will be distributed to each class of Jabba's stockholders' equity for this two-year-old company.

Calculation of preferred dividend:

Total cash dividend

To preferred shareholders

To common shareholders

Par Value per

Preferred

Share

$

0

Dividend

Rate

%

Dividend per Number of

Preferred

Preferred

Share

Shares

Preferred

Dividend for

two years

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning