The equity section of Crane SA appears below as of December 31, 2022. Share capital-preference (6%preference shares, R$50 par value, authorized 82.000 shares, outstanding 72,000 shares) Share capital-ordinary (R$1 par, authorized and issued 10,000,000 shares) Share premium-ordinary Retained earnings Net income R$:07,200,000 26,400,000 R$3,600,000 10,000,000 16,400,000 133,600,000 R$163,600,000 Net income for 2022 reflects a total effective tax rate of 20%. Included in the ret income figure is a loss of R$9,600,000 (before tax) as a result of ciscontinued operations. Preference divicends of R$216.000were declared and paid in 2022 Dividends of R$800,000were ceclared and paid to ordinary shareholders in 2022 Compute earnings per share data as it should appear on the income statement of Crine SA. (Round answers to 2 decimal places, eg 148)

The equity section of Crane SA appears below as of December 31, 2022. Share capital-preference (6%preference shares, R$50 par value, authorized 82.000 shares, outstanding 72,000 shares) Share capital-ordinary (R$1 par, authorized and issued 10,000,000 shares) Share premium-ordinary Retained earnings Net income R$:07,200,000 26,400,000 R$3,600,000 10,000,000 16,400,000 133,600,000 R$163,600,000 Net income for 2022 reflects a total effective tax rate of 20%. Included in the ret income figure is a loss of R$9,600,000 (before tax) as a result of ciscontinued operations. Preference divicends of R$216.000were declared and paid in 2022 Dividends of R$800,000were ceclared and paid to ordinary shareholders in 2022 Compute earnings per share data as it should appear on the income statement of Crine SA. (Round answers to 2 decimal places, eg 148)

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 81PSB

Related questions

Question

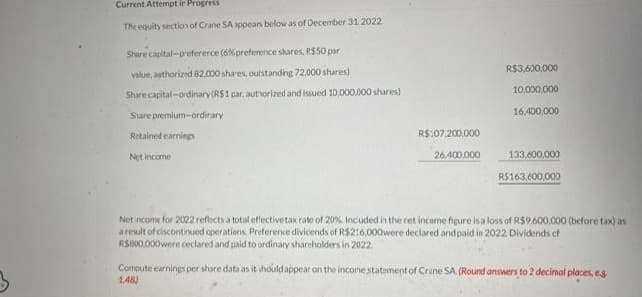

Transcribed Image Text:Current Attempt in Progress

The equity section of Crane SA appears below as of December 31, 2022

Share capital-preference (6%preference shares, R$50 par

value, authorized 82,000 shares, outstanding 72,000 shares)

Share capital-ordinary (R$1 par, authorized and issued 10,000,000 shares)

Share premium-ordinary

Retained earnings

Net income

R$:07,200,000

26,400,000

R$3,600,000

10,000,000

16,400,000

133,600,000

R$163,600,000

Net income for 2022 reflects a total effective tax rate of 20%. Included in the ret income figure is a loss of R$9,600,000 (before tax) as

a result of ciscontinued operations. Preference divicends of R$216,000were declared and paid in 2022 Dividends of

R$800,000were ceclared and paid to ordinary shareholders in 2022

Compute earnings per share data as it should appear on the income statement of Crane SA. (Round answers to 2 decimal places, eg

148)

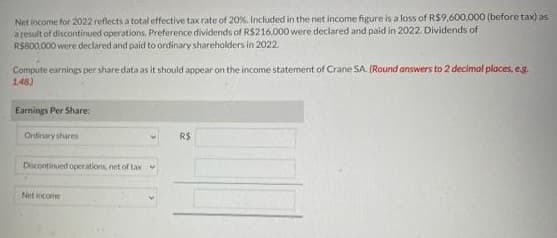

Transcribed Image Text:Net income for 2022 reflects a total effective tax rate of 20%. Included in the net income figure is a loss of R$9,600,000 (before tax) as

a result of discontinued operations. Preference dividends of R$216,000 were declared and paid in 2022. Dividends of

R$800,000 were declared and paid to ordinary shareholders in 2022.

Compute earnings per share data as it should appear on the income statement of Crane SA. (Round answers to 2 decimal places, e.g.

1.48)

Earnings Per Share:

Ordirury shares

Discontinued operations, net of tax V

Net income

R$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning