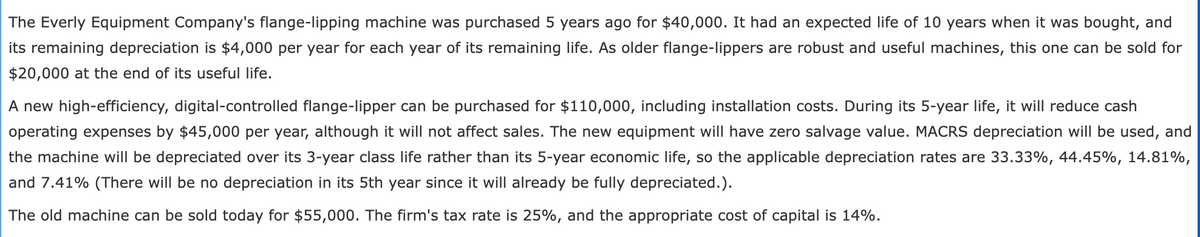

The Everly Equipment Company's flange-lipping machine was purchased 5 years ago for $40,000. It had an expected life of 10 years when it was bought, and its remaining depreciation is $4,000 per year for each year of its remaining life. As older flange-lippers are robust and useful machines, this one can be sold for $20,000 at the end of its useful life. A new high-efficiency, digital-controlled flange-lipper can be purchased for $110,000, including installation costs. During its 5-year life, it will reduce cash operating expenses by $45,000 per year, although it will not affect sales. The new equipment will have zero salvage value. MACRS depreciation will be used, and the machine will be depreciated over its 3-year class life rather than its 5-year economic life, so the applicable depreciation rates are 33.33%, 44.45%, 14.81%, and 7.41% (There will be no depreciation in its 5th year since it will already be fully depreciated.). The old machine can be sold today for $55,000. The firm's tax rate is 25%, and the appropriate cost of capital is 14%.

The Everly Equipment Company's flange-lipping machine was purchased 5 years ago for $40,000. It had an expected life of 10 years when it was bought, and its remaining depreciation is $4,000 per year for each year of its remaining life. As older flange-lippers are robust and useful machines, this one can be sold for $20,000 at the end of its useful life. A new high-efficiency, digital-controlled flange-lipper can be purchased for $110,000, including installation costs. During its 5-year life, it will reduce cash operating expenses by $45,000 per year, although it will not affect sales. The new equipment will have zero salvage value. MACRS depreciation will be used, and the machine will be depreciated over its 3-year class life rather than its 5-year economic life, so the applicable depreciation rates are 33.33%, 44.45%, 14.81%, and 7.41% (There will be no depreciation in its 5th year since it will already be fully depreciated.). The old machine can be sold today for $55,000. The firm's tax rate is 25%, and the appropriate cost of capital is 14%.

Chapter11: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 10P

Related questions

Question

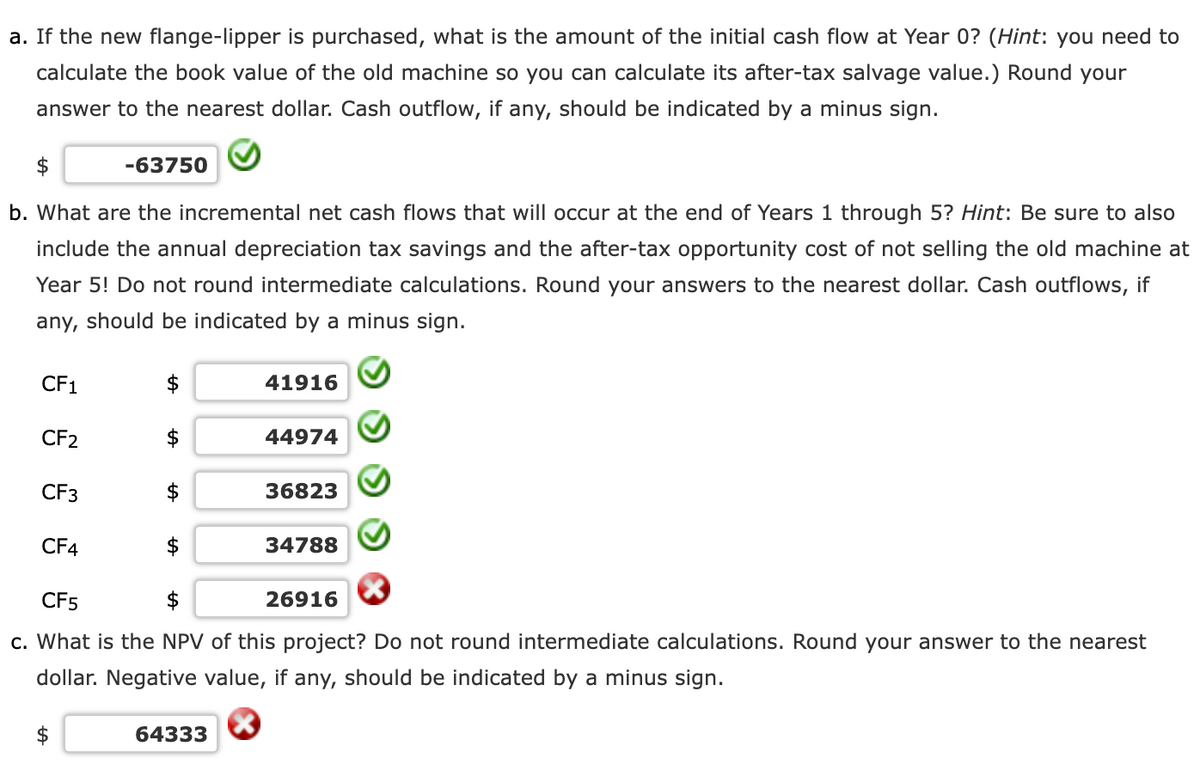

Transcribed Image Text:a. If the new flange-lipper is purchased, what is the amount of the initial cash flow at Year 0? (Hint: you need to

calculate the book value of the old machine so you can calculate its after-tax salvage value.) Round your

answer to the nearest dollar. Cash outflow, if any, should be indicated by a minus sign.

-63750

b. What are the incremental net cash flows that will occur at the end of Years 1 through 5? Hint: Be sure to also

include the annual depreciation tax savings and the after-tax opportunity cost of not selling the old machine at

Year 5! Do not round intermediate calculations. Round your answers to the nearest dollar. Cash outflows, if

any, should be indicated by a minus sign.

CF1

41916

CF2

44974

CF3

36823

CF4

34788

CF5

$

26916

c. What is the NPV of this project? Do not round intermediate calculations. Round your answer to the nearest

dollar. Negative value, if any, should be indicated by a minus sign.

$

64333

Transcribed Image Text:The Everly Equipment Company's flange-lipping machine was purchased 5 years ago for $40,000. It had an expected life of 10 years when it was bought, and

its remaining depreciation is $4,000 per year for each year of its remaining life. As older flange-lippers are robust and useful machines, this one can be sold for

$20,000 at the end of its useful life.

A new high-efficiency, digital-controlled flange-lipper can be purchased for $110,000, including installation costs. During its 5-year life, it will reduce cash

operating expenses by $45,000 per year, although it will not affect sales. The new equipment will have zero salvage value. MACRS depreciation will be used, and

the machine will be depreciated over its 3-year class life rather than its 5-year economic life, so the applicable depreciation rates are 33.33%, 44.45%, 14.81%,

and 7.41% (There will be no depreciation in its 5th year since it will already be fully depreciated.).

The old machine can be sold today for $55,000. The firm's tax rate is 25%, and the appropriate cost of capital is 14%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT