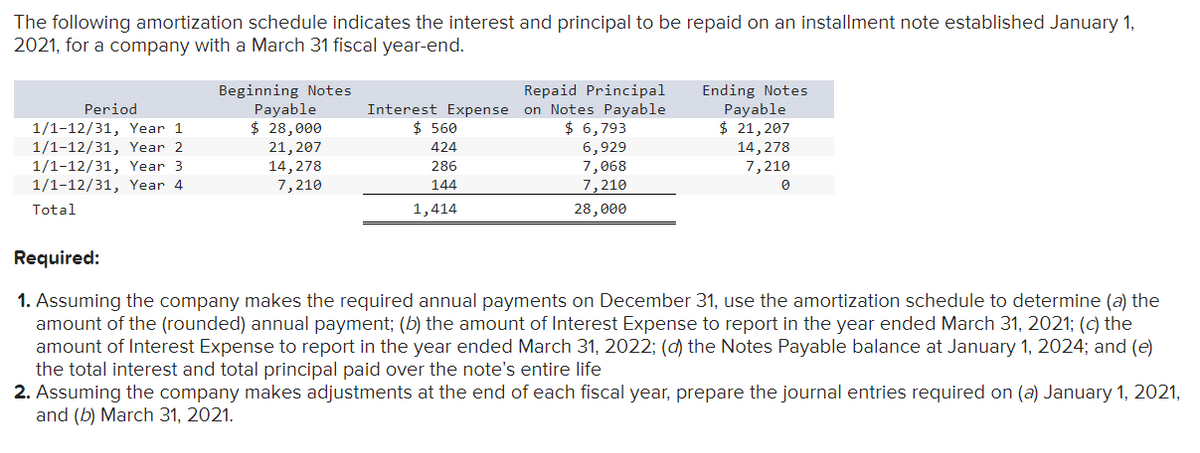

The following amortization schedule indicates the interest and principal to be repaid on an installment note established January 1, 2021, for a company with a March 31 fiscal year-end. Period 1/1-12/31, Year 1 1/1-12/31, Year 2 1/1-12/31, Year 3 1/1-12/31, Year 4 Total Beginning Notes Payable $ 28,000 21,207 14,278 7,210 Interest Expense $ 560 424 286 144 1,414 Repaid Principal on Notes Payable $ 6,793 6,929 7,068 7,210 28,000 Ending Notes Payable $ 21,207 14, 278 7,210 0 Required: 1. Assuming the company makes the required annual payments on December 31, use the amortization schedule to determine (a) the amount of the (rounded) annual payment; (b) the amount of Interest Expense to report in the year ended March 31, 2021; (c) the amount of Interest Expense to report in the year ended March 31, 2022; (d) the Notes Payable balance at January 1, 2024; and (e) the total interest and total principal paid over the note's entire life 2. Assuming the company makes adjustments at the end of each fiscal year, prepare the journal entries required on (a) January 1, 2021, and (b) March 31, 2021.

The following amortization schedule indicates the interest and principal to be repaid on an installment note established January 1, 2021, for a company with a March 31 fiscal year-end. Period 1/1-12/31, Year 1 1/1-12/31, Year 2 1/1-12/31, Year 3 1/1-12/31, Year 4 Total Beginning Notes Payable $ 28,000 21,207 14,278 7,210 Interest Expense $ 560 424 286 144 1,414 Repaid Principal on Notes Payable $ 6,793 6,929 7,068 7,210 28,000 Ending Notes Payable $ 21,207 14, 278 7,210 0 Required: 1. Assuming the company makes the required annual payments on December 31, use the amortization schedule to determine (a) the amount of the (rounded) annual payment; (b) the amount of Interest Expense to report in the year ended March 31, 2021; (c) the amount of Interest Expense to report in the year ended March 31, 2022; (d) the Notes Payable balance at January 1, 2024; and (e) the total interest and total principal paid over the note's entire life 2. Assuming the company makes adjustments at the end of each fiscal year, prepare the journal entries required on (a) January 1, 2021, and (b) March 31, 2021.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 17E: Interest-Bearing and Non-Interest-Bearing Notes On December 11, 2019, Hooper Inc. made a credit sale...

Related questions

Question

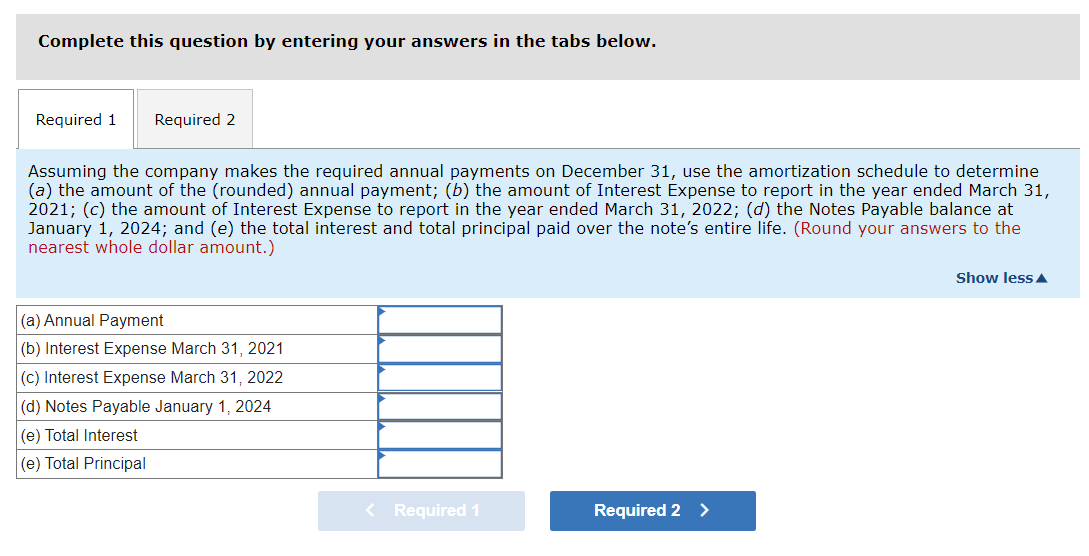

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Assuming the company makes the required annual payments on December 31, use the amortization schedule to determine

(a) the amount of the (rounded) annual payment; (b) the amount of Interest Expense to report in the year ended March 31,

2021; (c) the amount of Interest Expense to report in the year ended March 31, 2022; (d) the Notes Payable balance at

January 1, 2024; and (e) the total interest and total principal paid over the note's entire life. (Round your answers to the

nearest whole dollar amount.)

(a) Annual Payment

(b) Interest Expense March 31, 2021

(c) Interest Expense March 31, 2022

(d) Notes Payable January 1, 2024

(e) Total Interest

(e) Total Principal

< Required 1

Required 2 >

Show less

Transcribed Image Text:The following amortization schedule indicates the interest and principal to be repaid on an installment note established January 1,

2021, for a company with a March 31 fiscal year-end.

Period

1/1-12/31, Year 1

Interest Expense on Notes Payable

$ 560

424

#TITT

286

144

1,414

1/1-12/31, Year 2

1/1-12/31, Year 3

1/1-12/31, Year 4

Total

Beginning Notes

Payable

$ 28,000

21, 207

14, 278

Repaid Principal Ending Notes

7,210

$ 6,793

6,929

7,068

7,210

28,000

Payable

$ 21,207

14,278

7,210

Required:

1. Assuming the company makes the required annual payments on December 31, use the amortization schedule to determine (a) the

amount of the (rounded) annual payment; (b) the amount of Interest Expense to report in the year ended March 31, 2021; (c) the

amount of Interest Expense to report in the year ended March 31, 2022; (d) the Notes Payable balance at January 1, 2024; and (e)

the total interest and total principal paid over the note's entire life

2. Assuming the company makes adjustments at the end of each fiscal year, prepare the journal entries required on (a) January 1, 2021,

and (b) March 31, 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning