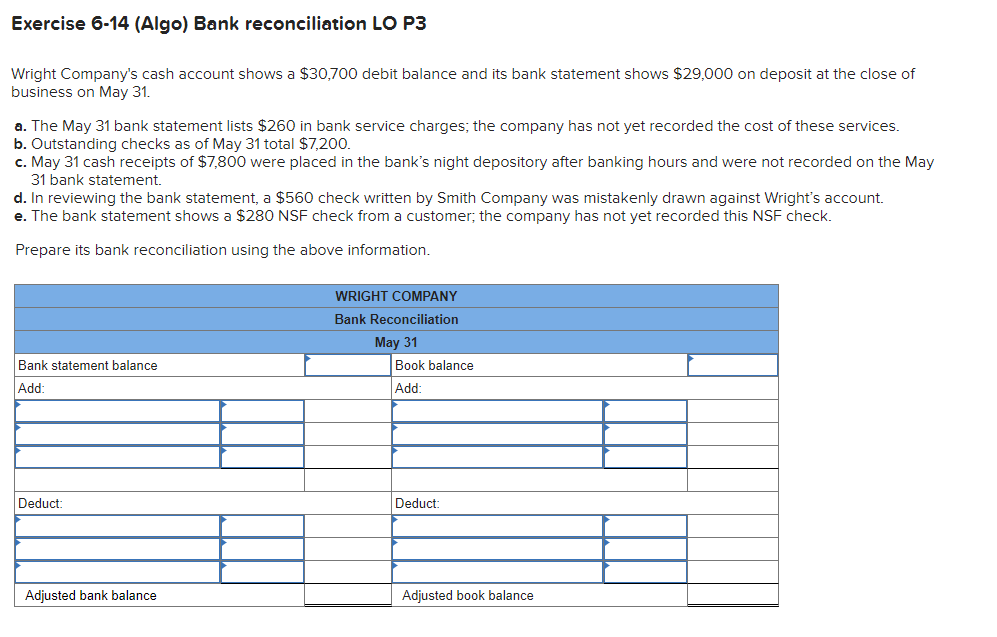

Wright Company's cash account shows a $30,700 debit balance and its bank statement shows $29,000 on deposit at the close of business on May 31. a. The May 31 bank statement lists $260 in bank service charges; the company has not yet recorded the cost of these services. b. Outstanding checks as of May 31 total $7,200. c. May 31 cash receipts of $7,800 were placed in the bank's night depository after banking hours and were not recorded on the May 31 bank statement. d. In reviewing the bank statement, a $560 check written by Smith Company was mistakenly drawn against Wright's account. e. The bank statement shows a $280 NSF check from a customer; the company has not yet recorded this NSF check. Prepare its bank reconciliation using the above information.

Wright Company's cash account shows a $30,700 debit balance and its bank statement shows $29,000 on deposit at the close of business on May 31. a. The May 31 bank statement lists $260 in bank service charges; the company has not yet recorded the cost of these services. b. Outstanding checks as of May 31 total $7,200. c. May 31 cash receipts of $7,800 were placed in the bank's night depository after banking hours and were not recorded on the May 31 bank statement. d. In reviewing the bank statement, a $560 check written by Smith Company was mistakenly drawn against Wright's account. e. The bank statement shows a $280 NSF check from a customer; the company has not yet recorded this NSF check. Prepare its bank reconciliation using the above information.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter4: Internal Control And Cash

Section: Chapter Questions

Problem 60BPSB

Related questions

Question

Transcribed Image Text:Exercise 6-14 (Algo) Bank reconciliation LO P3

Wright Company's cash account shows a $30,700 debit balance and its bank statement shows $29,000 on deposit at the close of

business on May 31.

a. The May 31 bank statement lists $260 in bank service charges; the company has not yet recorded the cost of these services.

b. Outstanding checks as of May 31 total $7,200.

c. May 31 cash receipts of $7,800 were placed in the bank's night depository after banking hours and were not recorded on the May

31 bank statement.

d. In reviewing the bank statement, a $560 check written by Smith Company was mistakenly drawn against Wright's account.

e. The bank statement shows a $280 NSF check from a customer; the company has not yet recorded this NSF check.

Prepare its bank reconciliation using the above information.

Bank statement balance

Add:

Deduct:

Adjusted bank balance

WRIGHT COMPANY

Bank Reconciliation

May 31

Book balance

Add:

Deduct:

Adjusted book balance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning