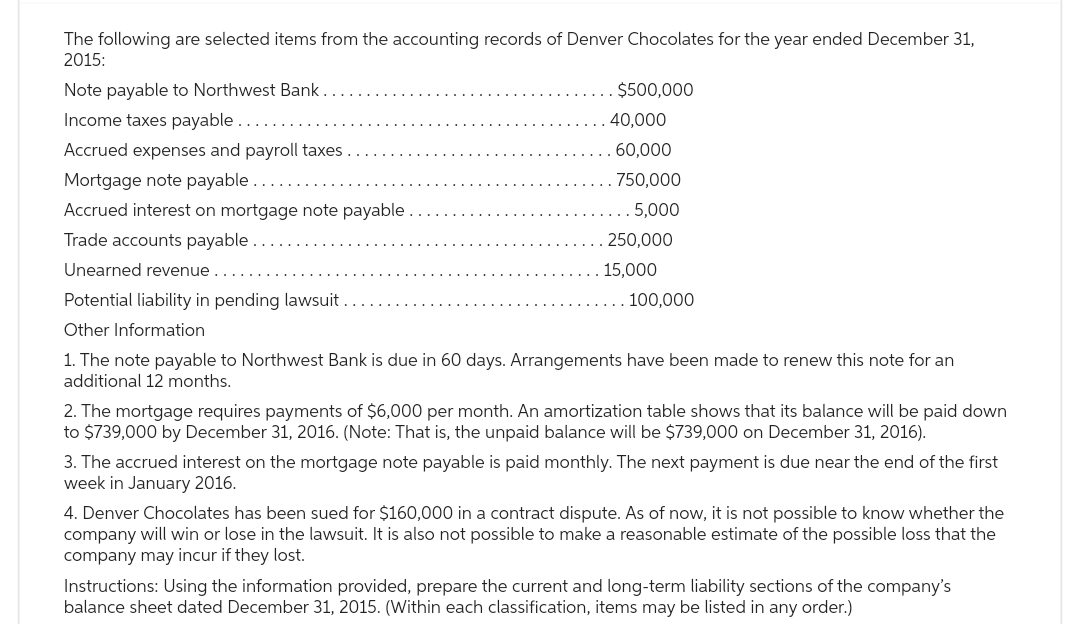

The following are selected items from the accounting records of Denver Chocolates for the year ended December 31, 2015: Note payable to Northwest Bank. Income taxes payable.. Accrued expenses and payroll taxes Mortgage note payable. Accrued interest on mortgage note payable. Trade accounts payable.. Unearned revenue Potential liability in pending lawsuit. Other Information $500,000 40,000 60,000 750,000 . 5,000 250,000 15,000 100,000 1. The note payable to Northwest Bank is due in 60 days. Arrangements have been made to renew this note for an additional 12 months. 2. The mortgage requires payments of $6,000 per month. An amortization table shows that its balance will be paid down to $739,000 by December 31, 2016. (Note: That is, the unpaid balance will be $739,000 on December 31, 2016). 3. The accrued interest on the mortgage payable is paid monthly. The next payment is due near the end of the first week in January 2016. 4. Denver Chocolates has been sued for $160,000 in a contract dispute. As of now, it is not possible to know whether the company will win or lose in the lawsuit. It is also not possible to make a reasonable estimate of the possible loss that the company may incur if they lost. Instructions: Using the information provided, prepare the current and long-term liability sections of the company's balance sheet dated December 31, 2015. (Within each classification, items may be listed in any order.)

The following are selected items from the accounting records of Denver Chocolates for the year ended December 31, 2015: Note payable to Northwest Bank. Income taxes payable.. Accrued expenses and payroll taxes Mortgage note payable. Accrued interest on mortgage note payable. Trade accounts payable.. Unearned revenue Potential liability in pending lawsuit. Other Information $500,000 40,000 60,000 750,000 . 5,000 250,000 15,000 100,000 1. The note payable to Northwest Bank is due in 60 days. Arrangements have been made to renew this note for an additional 12 months. 2. The mortgage requires payments of $6,000 per month. An amortization table shows that its balance will be paid down to $739,000 by December 31, 2016. (Note: That is, the unpaid balance will be $739,000 on December 31, 2016). 3. The accrued interest on the mortgage payable is paid monthly. The next payment is due near the end of the first week in January 2016. 4. Denver Chocolates has been sued for $160,000 in a contract dispute. As of now, it is not possible to know whether the company will win or lose in the lawsuit. It is also not possible to make a reasonable estimate of the possible loss that the company may incur if they lost. Instructions: Using the information provided, prepare the current and long-term liability sections of the company's balance sheet dated December 31, 2015. (Within each classification, items may be listed in any order.)

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter6: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 5PA: The following selected accounts and their current balances appear in the ledger of Clairemont Co....

Related questions

Question

Ll.135.

Transcribed Image Text:The following are selected items from the accounting records of Denver Chocolates for the year ended December 31,

2015:

Note payable to Northwest Bank.

Income taxes payable.

Accrued expenses and payroll taxes

Mortgage note payable.

Accrued interest on mortgage note payable

Trade accounts payable.

Unearned revenue..

Potential liability in pending lawsuit..

Other Information

$500,000

40,000

60,000

750,000

5,000

250,000

15,000

. 100,000

1. The note payable to Northwest Bank is due in 60 days. Arrangements have been made to renew this note for an

additional 12 months.

2. The mortgage requires payments of $6,000 per month. An amortization table shows that its balance will be paid down

to $739,000 by December 31, 2016. (Note: That is, the unpaid balance will be $739,000 on December 31, 2016).

3. The accrued interest on the mortgage note payable is paid monthly. The next payment is due near the end of the first

week in January 2016.

4. Denver Chocolates has been sued for $160,000 in a contract dispute. As of now, it is not possible to know whether the

company will win or lose in the lawsuit. It is also not possible to make a reasonable estimate of the possible loss that the

company may incur if they lost.

Instructions: Using the information provided, prepare the current and long-term liability sections of the company's

balance sheet dated December 31, 2015. (Within each classification, items may be listed in any order.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub