Rizzo Goal Inc. produces and sells hockey equipment, often custom made for online orders. The company has the following performance metrics on its balanced scorecard: days from ordered to delivered, number of shipping errors, customer retention rate, and market share. A measure map illustrates that the days from ordered to delivered and the number of shipping errors are both expected to directly affect the customer retention rate, which affects market share. Additional internal analysis finds that: Every shipping error over 2 shipping errors per month reduces the customer retention rate by 1.5%. On average, each day above 2 days from ordered to delivered yields a reduction in the customer retention rate of 1%. Each day before 2 days from order to delivery yields an increase in the customer retention rate of 1%, on average. Rizzo Goal Inc.’s current customer retention rate is 75%. The company estimates that for every 1% increase or decrease in the customer retention rate, market share changes 0.5 in the same direction. Rizzo Goal Inc.’s current market share is 21.4%. Ignoring any other factors, if the company has 4 shipping errors this month and an average of 2.5 days from ordered to delivered. a. Determine the new customer retention rate. Round your answer to one decimal place. b. Determine the new market share that Rizzo Goal Inc. expects to have. Round your answer to one decimal place.

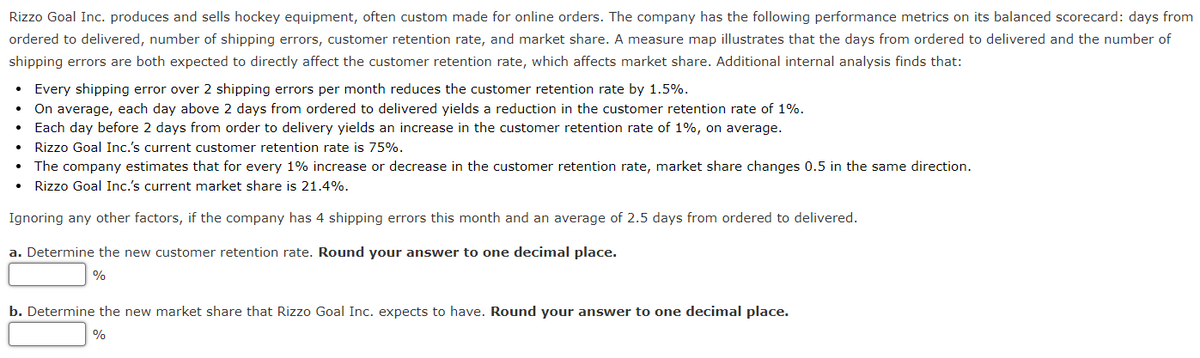

Rizzo Goal Inc. produces and sells hockey equipment, often custom made for online orders. The company has the following performance metrics on its balanced scorecard: days from ordered to delivered, number of shipping errors, customer retention rate, and market share. A measure map illustrates that the days from ordered to delivered and the number of shipping errors are both expected to directly affect the customer retention rate, which affects market share. Additional internal analysis finds that:

- Every shipping error over 2 shipping errors per month reduces the customer retention rate by 1.5%.

- On average, each day above 2 days from ordered to delivered yields a reduction in the customer retention rate of 1%.

- Each day before 2 days from order to delivery yields an increase in the customer retention rate of 1%, on average.

- Rizzo Goal Inc.’s current customer retention rate is 75%.

- The company estimates that for every 1% increase or decrease in the customer retention rate, market share changes 0.5 in the same direction.

- Rizzo Goal Inc.’s current market share is 21.4%.

Ignoring any other factors, if the company has 4 shipping errors this month and an average of 2.5 days from ordered to delivered.

a. Determine the new customer retention rate. Round your answer to one decimal place.

b. Determine the new market share that Rizzo Goal Inc. expects to have. Round your answer to one decimal place.

Step by step

Solved in 4 steps