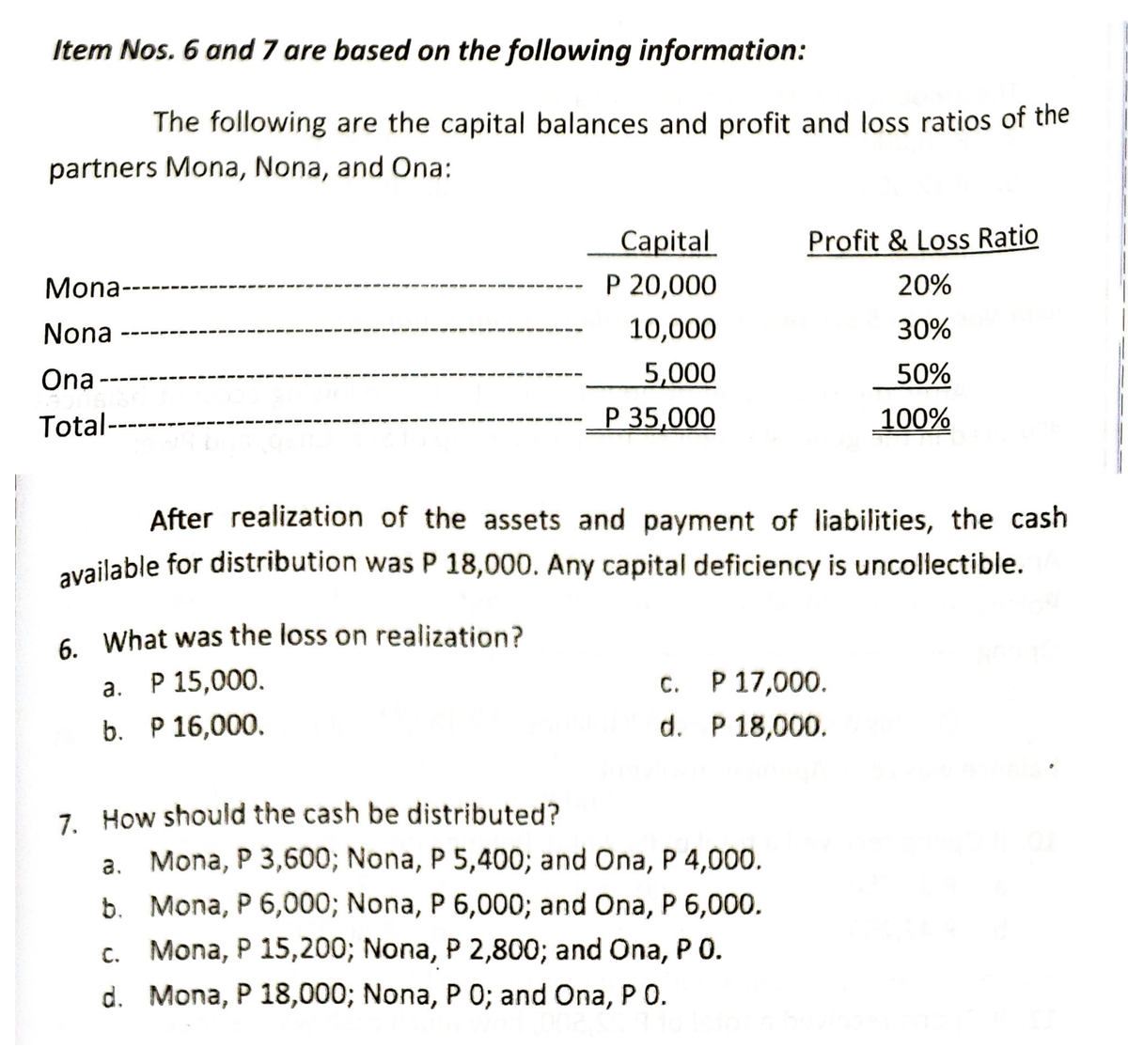

The following are the capital balances and profit and loss ratios of the partners Mona, Nona, and Ona: Capital Profit & Loss Ratio Mona- P 20,000 20% Nona 10,000 30% Ona- 5,000 50% Total- P 35,000 100% After realization of the assets and payment of liabilities, the cash available for distribution was P 18,000. Any capital deficiency is uncollectible. 6. What was the loss on realization? a. P 15,000. C. P 17,000. b. P 16,000. d. P 18,000. 7. How should the cash be distributed? a. Mona, P 3,600; Nona, P 5,400; and Ona, P 4,000. b. Mona, P 6,000; Nona, P 6,000; and Ona, P 6,000. c. Mona, P 15,200; Nona, P 2,800; and Ona, P 0. d. Mona, P 18,000; Nona, P 0; and Ona, P 0.

The following are the capital balances and profit and loss ratios of the partners Mona, Nona, and Ona: Capital Profit & Loss Ratio Mona- P 20,000 20% Nona 10,000 30% Ona- 5,000 50% Total- P 35,000 100% After realization of the assets and payment of liabilities, the cash available for distribution was P 18,000. Any capital deficiency is uncollectible. 6. What was the loss on realization? a. P 15,000. C. P 17,000. b. P 16,000. d. P 18,000. 7. How should the cash be distributed? a. Mona, P 3,600; Nona, P 5,400; and Ona, P 4,000. b. Mona, P 6,000; Nona, P 6,000; and Ona, P 6,000. c. Mona, P 15,200; Nona, P 2,800; and Ona, P 0. d. Mona, P 18,000; Nona, P 0; and Ona, P 0.

Chapter14: Property Transactions: Capital Gains And Losses, § 1231, And Recapture Provisions

Section: Chapter Questions

Problem 30CE

Related questions

Question

Transcribed Image Text:Item Nos. 6 and 7 are based on the following information:

The following are the capital balances and profit and loss ratios of the

partners Mona, Nona, and Ona:

Capital

Profit & Loss Ratio

Mona-

P 20,000

20%

Nona

10,000

30%

Ona-

5,000

50%

Total--

P 35,000

100%

After realization of the assets and payment of liabilities, the cash

available for distribution was P 18,000. Any capital deficiency is uncollectible.

6. What was the loss on realization?

a. P 15,000.

C.

P 17,000.

b. P 16,000.

d. P 18,000.

7. How should the cash be distributed?

b.

a. Mona, P 3,600; Nona, P 5,400; and Ona, P 4,000.

Mona, P 6,000; Nona, P 6,000; and Ona, P 6,000.

c. Mona, P 15,200; Nona, P 2,800; and Ona, P O.

d. Mona, P 18,000; Nona, P 0; and Ona, PO.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning