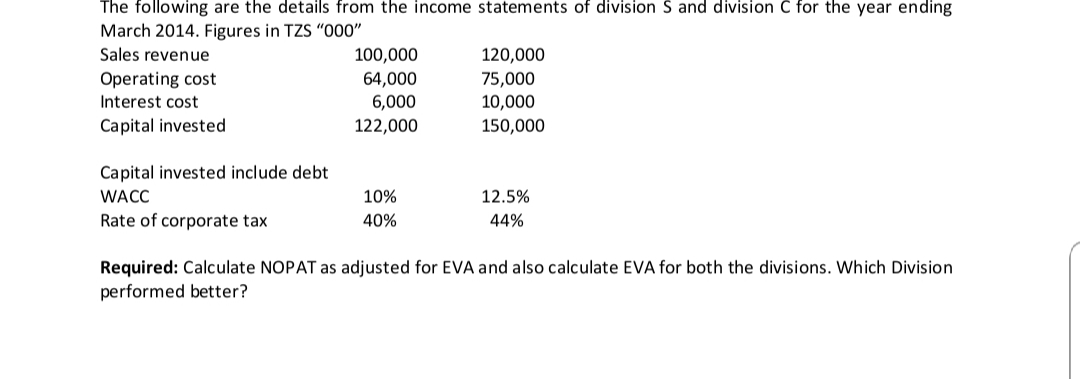

The following are the details from the income statements of division S and division C for the year ending March 2014. Figures in TZS "000" Sales revenue 100,000 120,000 Operating cost Interest cost 64,000 6,000 75,000 10,000 Capital invested 122,000 150,000 Capital invested include debt WACC 10% 12.5% Rate of corporate tax 40% 44% Required: Calculate NOPAT as adjusted for EVA and also calculate EVA for both the divisions. Which Division performed better?

The following are the details from the income statements of division S and division C for the year ending March 2014. Figures in TZS "000" Sales revenue 100,000 120,000 Operating cost Interest cost 64,000 6,000 75,000 10,000 Capital invested 122,000 150,000 Capital invested include debt WACC 10% 12.5% Rate of corporate tax 40% 44% Required: Calculate NOPAT as adjusted for EVA and also calculate EVA for both the divisions. Which Division performed better?

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.2.1P

Related questions

Question

100%

Transcribed Image Text:The following are the details from the income statements of division S and division C for the year ending

March 2014. Figures in TZS "000"

Sales revenue

100,000

64,000

6,000

120,000

75,000

10,000

150,000

Operating cost

Interest cost

Capital invested

122,000

Capital invested include debt

WACC

10%

12.5%

Rate of corporate tax

40%

44%

Required: Calculate NOPAT as adjusted for EVA and also calculate EVA for both the divisions. Which Division

performed better?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning