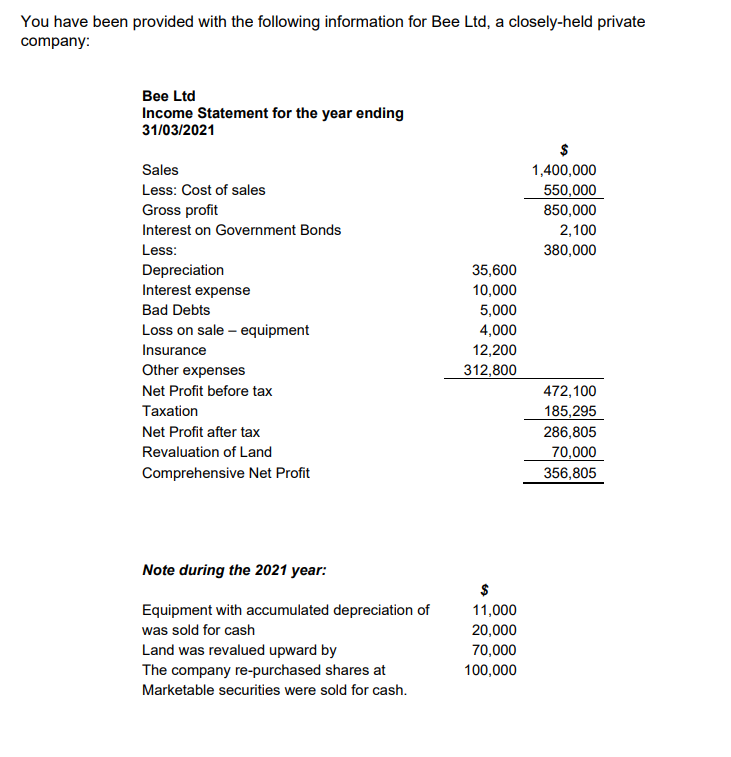

You have been provided with the following information for Bee Ltd, a cIosely-neld priIvate company: Bee Ltd Income Statement for the year ending 31/03/2021 Sales 1,400,000 Less: Cost of sales 550,000 850,000 Gross profit Interest on Government Bonds 2,100 Less: 380,000 35,600 Depreciation Interest expense 10,000 Bad Debts 5,000 4,000 12,200 312,800 Loss on sale – equipment Insurance Other expenses Net Profit before tax 472,100 Taxation 185,295 Net Profit after tax 286,805 Revaluation of Land 70,000 Comprehensive Net Profit 356,805 Note during the 2021 year: $ Equipment with accumulated depreciation of 11,000 was sold for cash 20,000 Land was revalued upward by The company re-purchased shares at 70,000 100,000 Marketable securities were sold for cash.

You have been provided with the following information for Bee Ltd, a cIosely-neld priIvate company: Bee Ltd Income Statement for the year ending 31/03/2021 Sales 1,400,000 Less: Cost of sales 550,000 850,000 Gross profit Interest on Government Bonds 2,100 Less: 380,000 35,600 Depreciation Interest expense 10,000 Bad Debts 5,000 4,000 12,200 312,800 Loss on sale – equipment Insurance Other expenses Net Profit before tax 472,100 Taxation 185,295 Net Profit after tax 286,805 Revaluation of Land 70,000 Comprehensive Net Profit 356,805 Note during the 2021 year: $ Equipment with accumulated depreciation of 11,000 was sold for cash 20,000 Land was revalued upward by The company re-purchased shares at 70,000 100,000 Marketable securities were sold for cash.

Chapter17: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 47P

Related questions

Question

Transcribed Image Text:You have been provided with the following information for Bee Ltd, a closely-held private

company:

Bee Ltd

Income Statement for the year ending

31/03/2021

$

Sales

1,400,000

Less: Cost of sales

550,000

Gross profit

850,000

Interest on Government Bonds

2,100

Less:

380,000

Depreciation

Interest expense

35,600

10,000

Bad Debts

5,000

Loss on sale – equipment

4,000

Insurance

12,200

Other expenses

312,800

472,100

185,295

286,805

70,000

Net Profit before tax

Taxation

Net Profit after tax

Revaluation of Land

Comprehensive Net Profit

356,805

Note during the 2021 year:

$

Equipment with accumulated depreciation of

11,000

was sold for cash

20,000

Land was revalued upward by

The company re-purchased shares at

70,000

100,000

Marketable securities were sold for cash.

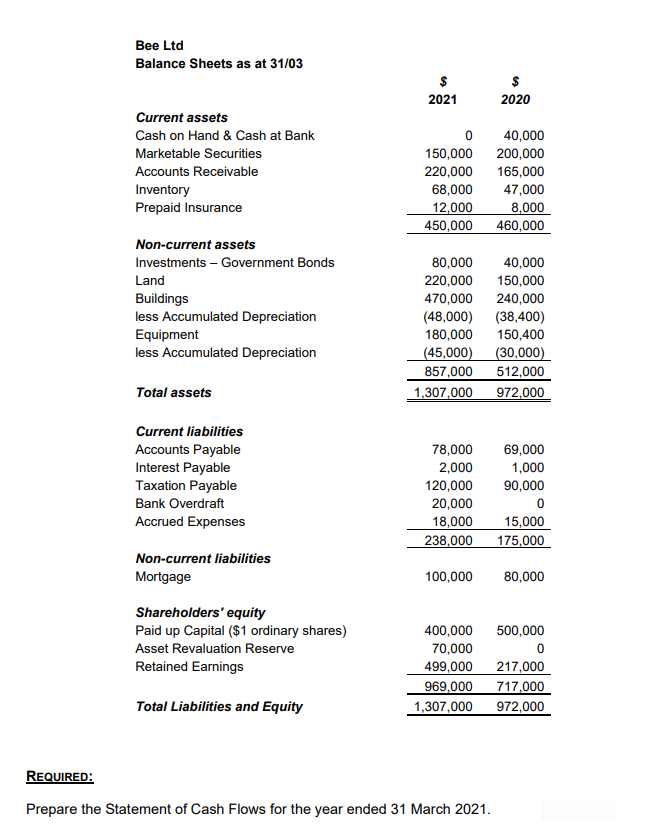

Transcribed Image Text:Вee Ltd

Balance Sheets as at 31/03

$

$

2021

2020

Current assets

Cash on Hand & Cash at Bank

40,000

200,000

165,000

47,000

8,000

460,000

Marketable Securities

150,000

220,000

Accounts Receivable

Inventory

Prepaid Insurance

68,000

12,000

450,000

Non-current assets

Investments – Government Bonds

80,000

220,000

470,000

(48,000)

180,000

(45,000)

857,000

40,000

150,000

240,000

(38,400)

150,400

Land

Buildings

less Accumulated Depreciation

Equipment

less Accumulated Depreciation

(30,000)

512,000

Total assets

1,307,000

972,000

Current liabilities

Accounts Payable

Interest Payable

Taxation Payable

78,000

2,000

120,000

20,000

69,000

1,000

90,000

Bank Overdraft

18,000

238,000

Accrued Expenses

15,000

175,000

Non-current liabilities

Mortgage

100,000

80,000

Shareholders' equity

Paid up Capital ($1 ordinary shares)

400,000

70,000

500,000

Asset Revaluation Reserve

Retained Earnings

499,000

969,000

1,307,000

217,000

717,000

Total Liabilities and Equity

972,000

REQUIRED:

Prepare the Statement of Cash Flows for the year ended 31 March 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning