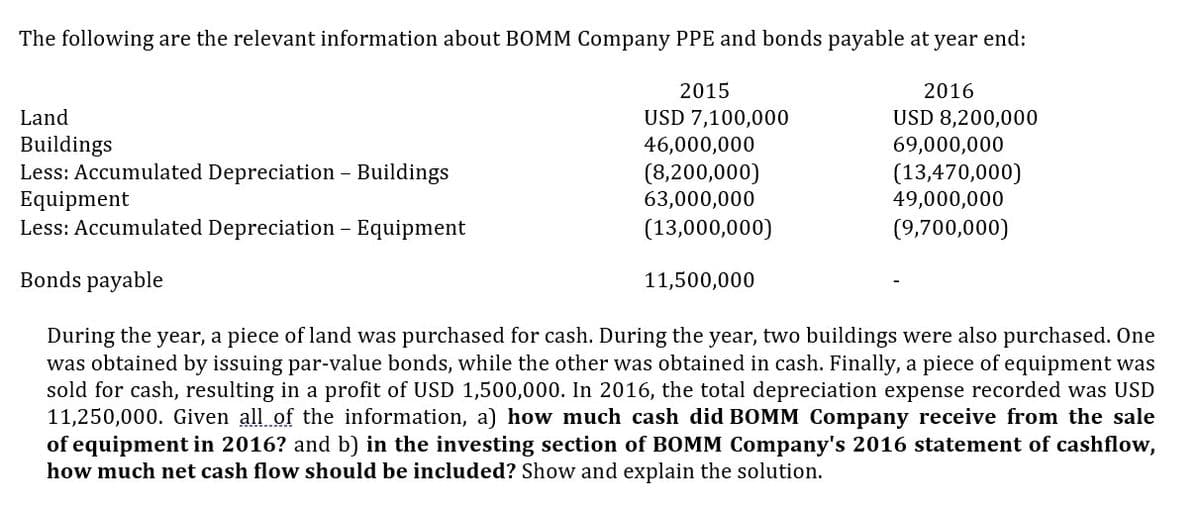

The following are the relevant information about BOMM Company PPE and bonds payable at year end: 2015 2016 Land USD 7,100,000 46,000,000 USD 8,200,000 69,000,000 Buildings Less: Accumulated Depreciation - Buildings (8,200,000) (13,470,000) Equipment 63,000,000 49,000,000 Less: Accumulated Depreciation - Equipment (13,000,000) (9,700,000) Bonds payable 11,500,000 During the year, a piece of land was purchased for cash. During the year, two buildings were also purchased. One was obtained by issuing par-value bonds, while the other was obtained in cash. Finally, a piece of equipment was sold for cash, resulting in a profit of USD 1,500,000. In 2016, the total depreciation expense recorded was USD 11,250,000. Given all of the information, a) how much cash did BOMM Company receive from the sale of equipment in 2016? and b) in the investing section of BOMM Company's 2016 statement of cashflow, how much net cash flow should be included? Show and explain the solution.

The following are the relevant information about BOMM Company PPE and bonds payable at year end: 2015 2016 Land USD 7,100,000 46,000,000 USD 8,200,000 69,000,000 Buildings Less: Accumulated Depreciation - Buildings (8,200,000) (13,470,000) Equipment 63,000,000 49,000,000 Less: Accumulated Depreciation - Equipment (13,000,000) (9,700,000) Bonds payable 11,500,000 During the year, a piece of land was purchased for cash. During the year, two buildings were also purchased. One was obtained by issuing par-value bonds, while the other was obtained in cash. Finally, a piece of equipment was sold for cash, resulting in a profit of USD 1,500,000. In 2016, the total depreciation expense recorded was USD 11,250,000. Given all of the information, a) how much cash did BOMM Company receive from the sale of equipment in 2016? and b) in the investing section of BOMM Company's 2016 statement of cashflow, how much net cash flow should be included? Show and explain the solution.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 1MC

Related questions

Question

Show solution and explanation.

Transcribed Image Text:The following are the relevant information about BOMM Company PPE and bonds payable at year end:

2015

2016

Land

USD 7,100,000

46,000,000

USD 8,200,000

69,000,000

Buildings

Less: Accumulated Depreciation - Buildings

(8,200,000)

(13,470,000)

Equipment

63,000,000

49,000,000

Less: Accumulated Depreciation - Equipment

(13,000,000)

(9,700,000)

Bonds payable

11,500,000

During the year, a piece of land was purchased for cash. During the year, two buildings were also purchased. One

was obtained by issuing par-value bonds, while the other was obtained in cash. Finally, a piece of equipment was

sold for cash, resulting in a profit of USD 1,500,000. In 2016, the total depreciation expense recorded was USD

11,250,000. Given all of the information, a) how much cash did BOMM Company receive from the sale

of equipment in 2016? and b) in the investing section of BOMM Company's 2016 statement of cashflow,

how much net cash flow should be included? Show and explain the solution.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning