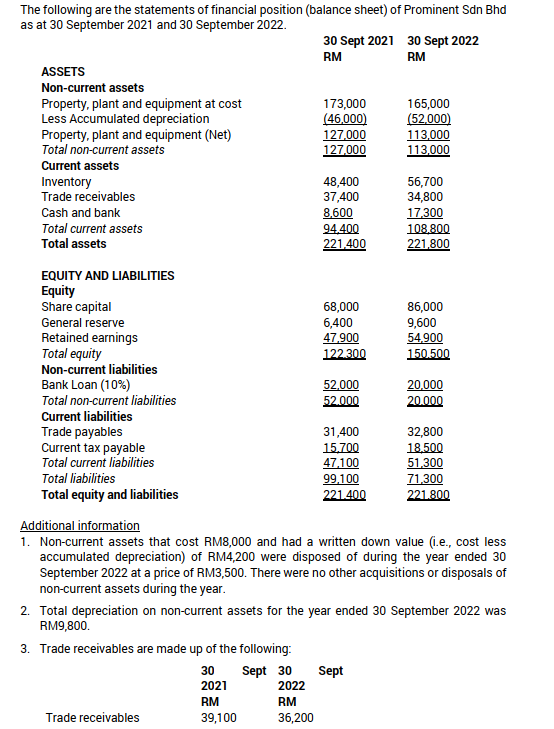

The following are the statements of financial position (balance sheet) of Prominent Sdn Bhd as at 30 September 2021 and 30 September 2022. ASSETS Non-current assets Property, plant and equipment at cost Less Accumulated depreciation Property, plant and equipment (Net) Total non-current assets Current assets Inventory Trade receivables Cash and bank Total current assets Total assets EQUITY AND LIABILITIES Equity Share capital General reserve Retained earnings Total equity Non-current liabilities Bank Loan (10%) Total non-current liabilities Current liabilities Trade payables Current tax payable Total current liabilities Total liabilities Total equity and liabilities 3. Trade receivables are made up of the following: 30 2021 RM 39,100 Trade receivables 30 Sept 2021 30 Sept 2022 RM RM Sept 30 173,000 (46,000) 2022 RM 36,200 127,000 127,000 48,400 37,400 8.600 94,400 221,400 68,000 6,400 47,900 122.300 52,000 52.000 31,400 15.700 47,100 99.100 221.400 165,000 (52,000) 113,000 113,000 56,700 34,800 Additional information 1. Non-current assets that cost RM8,000 and had a written down value (i.e., cost less accumulated depreciation) of RM4,200 were disposed of during the year ended 30 September 2022 at a price of RM3,500. There were no other acquisitions or disposals of non-current assets during the year. Sept 17,300 108,800 221,800 2. Total depreciation on non-current assets for the year ended 30 September 2022 was RM9,800. 86,000 9,600 54,900 150.500 20,000 20.000 32,800 18,500 51,300 71,300 221.800

The following are the statements of financial position (balance sheet) of Prominent Sdn Bhd as at 30 September 2021 and 30 September 2022. ASSETS Non-current assets Property, plant and equipment at cost Less Accumulated depreciation Property, plant and equipment (Net) Total non-current assets Current assets Inventory Trade receivables Cash and bank Total current assets Total assets EQUITY AND LIABILITIES Equity Share capital General reserve Retained earnings Total equity Non-current liabilities Bank Loan (10%) Total non-current liabilities Current liabilities Trade payables Current tax payable Total current liabilities Total liabilities Total equity and liabilities 3. Trade receivables are made up of the following: 30 2021 RM 39,100 Trade receivables 30 Sept 2021 30 Sept 2022 RM RM Sept 30 173,000 (46,000) 2022 RM 36,200 127,000 127,000 48,400 37,400 8.600 94,400 221,400 68,000 6,400 47,900 122.300 52,000 52.000 31,400 15.700 47,100 99.100 221.400 165,000 (52,000) 113,000 113,000 56,700 34,800 Additional information 1. Non-current assets that cost RM8,000 and had a written down value (i.e., cost less accumulated depreciation) of RM4,200 were disposed of during the year ended 30 September 2022 at a price of RM3,500. There were no other acquisitions or disposals of non-current assets during the year. Sept 17,300 108,800 221,800 2. Total depreciation on non-current assets for the year ended 30 September 2022 was RM9,800. 86,000 9,600 54,900 150.500 20,000 20.000 32,800 18,500 51,300 71,300 221.800

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter21: The Statement Of Cash Flows

Section: Chapter Questions

Problem 17E: Investing Activities and Depreciable Assets Verlando Company had the following account balances and...

Related questions

Question

How do you respond to this situation?

Transcribed Image Text:The following are the statements of financial position (balance sheet) of Prominent Sdn Bhd

as at 30 September 2021 and 30 September 2022.

ASSETS

Non-current assets

Property, plant and equipment at cost

Less Accumulated depreciation

Property, plant and equipment (Net)

Total non-current assets

Current assets

Inventory

Trade receivables

Cash and bank

Total current assets

Total assets

EQUITY AND LIABILITIES

Equity

Share capital

General reserve

Retained earnings

Total equity

Non-current liabilities

Bank Loan (10%)

Total non-current liabilities

Current liabilities

Trade payables

Current tax payable

Total current liabilities

Total liabilities

Total equity and liabilities

3. Trade receivables are made up of the following:

30

Sept 30

2021

RM

39,100

30 Sept 2021 30 Sept 2022

RM

RM

Trade receivables

173,000

(46,000)

127,000

127,000

2022

RM

36,200

48,400

37,400

8,600

94.400

221,400

68,000

6,400

47,900

122.300

52,000

52.000

31,400

15.700

47,100

99,100

221.400

165,000

(52,000)

113,000

113,000

Sept

56,700

34,800

17,300

108,800

221,800

86,000

9,600

54,900

150.500

Additional information

1. Non-current assets that cost RM8,000 and had a written down value (i.e., cost less

accumulated depreciation) of RM4,200 were disposed of during the year ended 30

September 2022 at a price of RM3,500. There were no other acquisitions or disposals of

non-current assets during the year.

20,000

20.000

2. Total depreciation on non-current assets for the year ended 30 September 2022 was

RM9,800.

32,800

18,500

51,300

71,300

221.800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning