The following balances were extracted from the books of Pat Pet Shop on 31 December 2019: Amount (RM) 200,000 120,000 70,000 10,850 100,000 60,000 69,250 40,000 612,000 100,000 348,000 5,000 3,500 12,000 26,700 43,200 18,000 4,000 12,500 27,000 90,000 Accounts Building Motor vehicles Plant and machinery Profit as at 01.01.2019 Capital Acc depreciation as at 31.12.2019 : Building Acc depreciation as at 31.12.2019 : Motor vehicles Acc depreciation as at 31.12.2019 : Plant & machinery Sales Commission revenue Purchases Sales discounts Purchase discounts Opening inventory Trade receivables Trade payable Administrative expenses Staff training cost Bad debts Motor expenses Rental Bank overdraft Wages and salaries Interest Unearned commission for December 2019 13,400 115,000 6,000 2,000 Required:- Assuming all accounts are in normal balance, prepare the trial balance as at 31 December 2019. Question 5 After you have prepared the trial balance for Question 4, you notice the following information:- (i) Telephone bill for December amounting to RM200 has been received but not recorded. (ii) One day of casual wages amounting to RM125 remains unpaid and unrecorded at December 31; the amount will be included with the first Friday payment in January 2020. Included in rental expenses is rental paid for January 2020 amounting to RM2,000. Half of the commission revenue has been earned at December 31, 2019. (ii) (iv) Required:- (a) Prepare the adjusting journals. (b) Prepare the adjusted Trial Balance. Question 3 Jet is owner of Jet Cafe. At the end of each month, Jet prepares a bank reconciliation statement for his business bank account. At 31 December 2019 his ledger balance was RM1,869 (credit) and his bank statement showed that he had funds of RM210 at the bank. He has the following information: Jet has arranged for RM1,800 to be transferred from his personal bank account into the business bank account. The bank made the transfer on 30 December, but Jet has not made any entry for it in his records. On 21 December, Jet withdrew RM300 cash which he did not record. Cheque number 202018, which Jet issued to a supplier, appears on the bank statement as RM550. Jet incorrectly recorded the cheque as RM560. The bank debited Jet's account with charges of RM200 during December. Jet has not recorded these charges. On 31 December, Jet lodged RM450. On the bank statement, this amount is dated 3 January 2020. Jet was advised by the bank that he earned RM62 interest for the period in December that his account was in credit. Jet recorded this in December, but the ank did not (i) (ii) (iii) (iv) (v) (vi) ount until January 2020. (vii) Three of the cheques issued in December, with a total value of RM1,005, were dit not debited on the bank statement until after 31 December. (viii) A cheque for RM276, issued to a supplier, was cancelled but Jet has not recorded the cancellation of the cheque. Required: (a) Show the bank account in Jet's general ledger, including any adjusting entries required due to the information given in points (i) to (vii). Note: You MUST present your answer in a format which clearly indicates whether each entry is a debit or a credit. (b) Prepare a reconciliation of the bank statement balance to the corrected balance on the bank account in Jet's general ledger. (c) Indicate how the bank balance will be reported in Jet's final accounts and the amount to be reported.

The following balances were extracted from the books of Pat Pet Shop on 31 December 2019: Amount (RM) 200,000 120,000 70,000 10,850 100,000 60,000 69,250 40,000 612,000 100,000 348,000 5,000 3,500 12,000 26,700 43,200 18,000 4,000 12,500 27,000 90,000 Accounts Building Motor vehicles Plant and machinery Profit as at 01.01.2019 Capital Acc depreciation as at 31.12.2019 : Building Acc depreciation as at 31.12.2019 : Motor vehicles Acc depreciation as at 31.12.2019 : Plant & machinery Sales Commission revenue Purchases Sales discounts Purchase discounts Opening inventory Trade receivables Trade payable Administrative expenses Staff training cost Bad debts Motor expenses Rental Bank overdraft Wages and salaries Interest Unearned commission for December 2019 13,400 115,000 6,000 2,000 Required:- Assuming all accounts are in normal balance, prepare the trial balance as at 31 December 2019. Question 5 After you have prepared the trial balance for Question 4, you notice the following information:- (i) Telephone bill for December amounting to RM200 has been received but not recorded. (ii) One day of casual wages amounting to RM125 remains unpaid and unrecorded at December 31; the amount will be included with the first Friday payment in January 2020. Included in rental expenses is rental paid for January 2020 amounting to RM2,000. Half of the commission revenue has been earned at December 31, 2019. (ii) (iv) Required:- (a) Prepare the adjusting journals. (b) Prepare the adjusted Trial Balance. Question 3 Jet is owner of Jet Cafe. At the end of each month, Jet prepares a bank reconciliation statement for his business bank account. At 31 December 2019 his ledger balance was RM1,869 (credit) and his bank statement showed that he had funds of RM210 at the bank. He has the following information: Jet has arranged for RM1,800 to be transferred from his personal bank account into the business bank account. The bank made the transfer on 30 December, but Jet has not made any entry for it in his records. On 21 December, Jet withdrew RM300 cash which he did not record. Cheque number 202018, which Jet issued to a supplier, appears on the bank statement as RM550. Jet incorrectly recorded the cheque as RM560. The bank debited Jet's account with charges of RM200 during December. Jet has not recorded these charges. On 31 December, Jet lodged RM450. On the bank statement, this amount is dated 3 January 2020. Jet was advised by the bank that he earned RM62 interest for the period in December that his account was in credit. Jet recorded this in December, but the ank did not (i) (ii) (iii) (iv) (v) (vi) ount until January 2020. (vii) Three of the cheques issued in December, with a total value of RM1,005, were dit not debited on the bank statement until after 31 December. (viii) A cheque for RM276, issued to a supplier, was cancelled but Jet has not recorded the cancellation of the cheque. Required: (a) Show the bank account in Jet's general ledger, including any adjusting entries required due to the information given in points (i) to (vii). Note: You MUST present your answer in a format which clearly indicates whether each entry is a debit or a credit. (b) Prepare a reconciliation of the bank statement balance to the corrected balance on the bank account in Jet's general ledger. (c) Indicate how the bank balance will be reported in Jet's final accounts and the amount to be reported.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

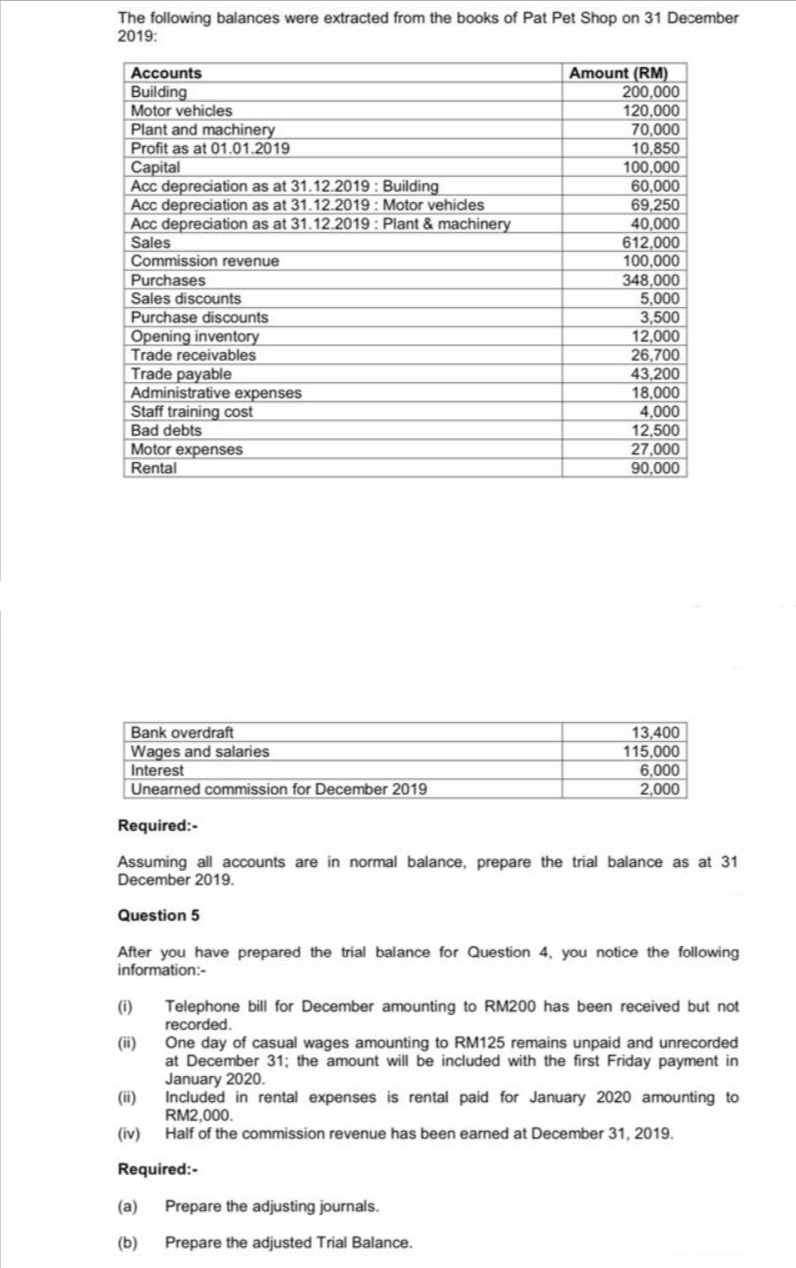

Transcribed Image Text:The following balances were extracted from the books of Pat Pet Shop on 31 December

2019:

Amount (RM)

200,000

120,000

70,000

10,850

100,000

60,000

69,250

40,000

612,000

100,000

348,000

5,000

3,500

12,000

26,700

43,200

18,000

4,000

12,500

27,000

90,000

Accounts

Building

Motor vehicles

Plant and machinery

Profit as at 01.01.2019

Capital

Acc depreciation as at 31.12.2019 : Building

Acc depreciation as at 31.12.2019 : Motor vehicles

Acc depreciation as at 31.12.2019 : Plant & machinery

Sales

Commission revenue

Purchases

Sales discounts

Purchase discounts

Opening inventory

Trade receivables

Trade payable

Administrative expenses

Staff training cost

Bad debts

Motor expenses

Rental

Bank overdraft

Wages and salaries

Interest

Unearned commission for December 2019

13,400

115,000

6,000

2,000

Required:-

Assuming all accounts are in normal balance, prepare the trial balance as at 31

December 2019.

Question 5

After you have prepared the trial balance for Question 4, you notice the following

information:-

(i)

Telephone bill for December amounting to RM200 has been received but not

recorded.

(ii)

One day of casual wages amounting to RM125 remains unpaid and unrecorded

at December 31; the amount will be included with the first Friday payment in

January 2020.

Included in rental expenses is rental paid for January 2020 amounting to

RM2,000.

Half of the commission revenue has been earned at December 31, 2019.

(ii)

(iv)

Required:-

(a)

Prepare the adjusting journals.

(b)

Prepare the adjusted Trial Balance.

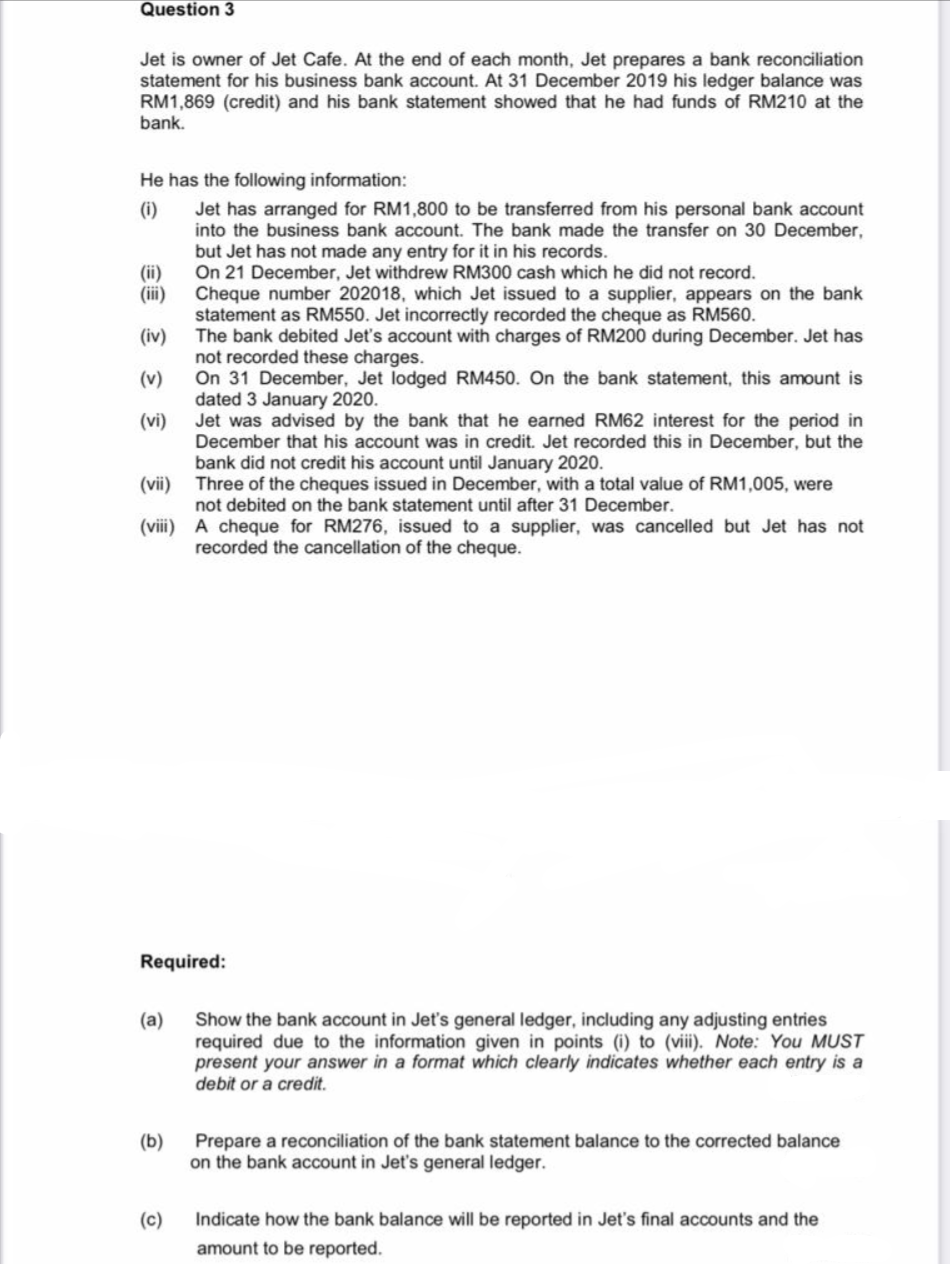

Transcribed Image Text:Question 3

Jet is owner of Jet Cafe. At the end of each month, Jet prepares a bank reconciliation

statement for his business bank account. At 31 December 2019 his ledger balance was

RM1,869 (credit) and his bank statement showed that he had funds of RM210 at the

bank.

He has the following information:

Jet has arranged for RM1,800 to be transferred from his personal bank account

into the business bank account. The bank made the transfer on 30 December,

but Jet has not made any entry for it in his records.

On 21 December, Jet withdrew RM300 cash which he did not record.

Cheque number 202018, which Jet issued to a supplier, appears on the bank

statement as RM550. Jet incorrectly recorded the cheque as RM560.

The bank debited Jet's account with charges of RM200 during December. Jet has

not recorded these charges.

On 31 December, Jet lodged RM450. On the bank statement, this amount is

dated 3 January 2020.

Jet was advised by the bank that he earned RM62 interest for the period in

December that his account was in credit. Jet recorded this in December, but the

ank did not

(i)

(ii)

(iii)

(iv)

(v)

(vi)

ount until January 2020.

(vii) Three of the cheques issued in December, with a total value of RM1,005, were

dit

not debited on the bank statement until after 31 December.

(viii) A cheque for RM276, issued to a supplier, was cancelled but Jet has not

recorded the cancellation of the cheque.

Required:

(a)

Show the bank account in Jet's general ledger, including any adjusting entries

required due to the information given in points (i) to (vii). Note: You MUST

present your answer in a format which clearly indicates whether each entry is a

debit or a credit.

(b)

Prepare a reconciliation of the bank statement balance to the corrected balance

on the bank account in Jet's general ledger.

(c)

Indicate how the bank balance will be reported in Jet's final accounts and the

amount to be reported.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education