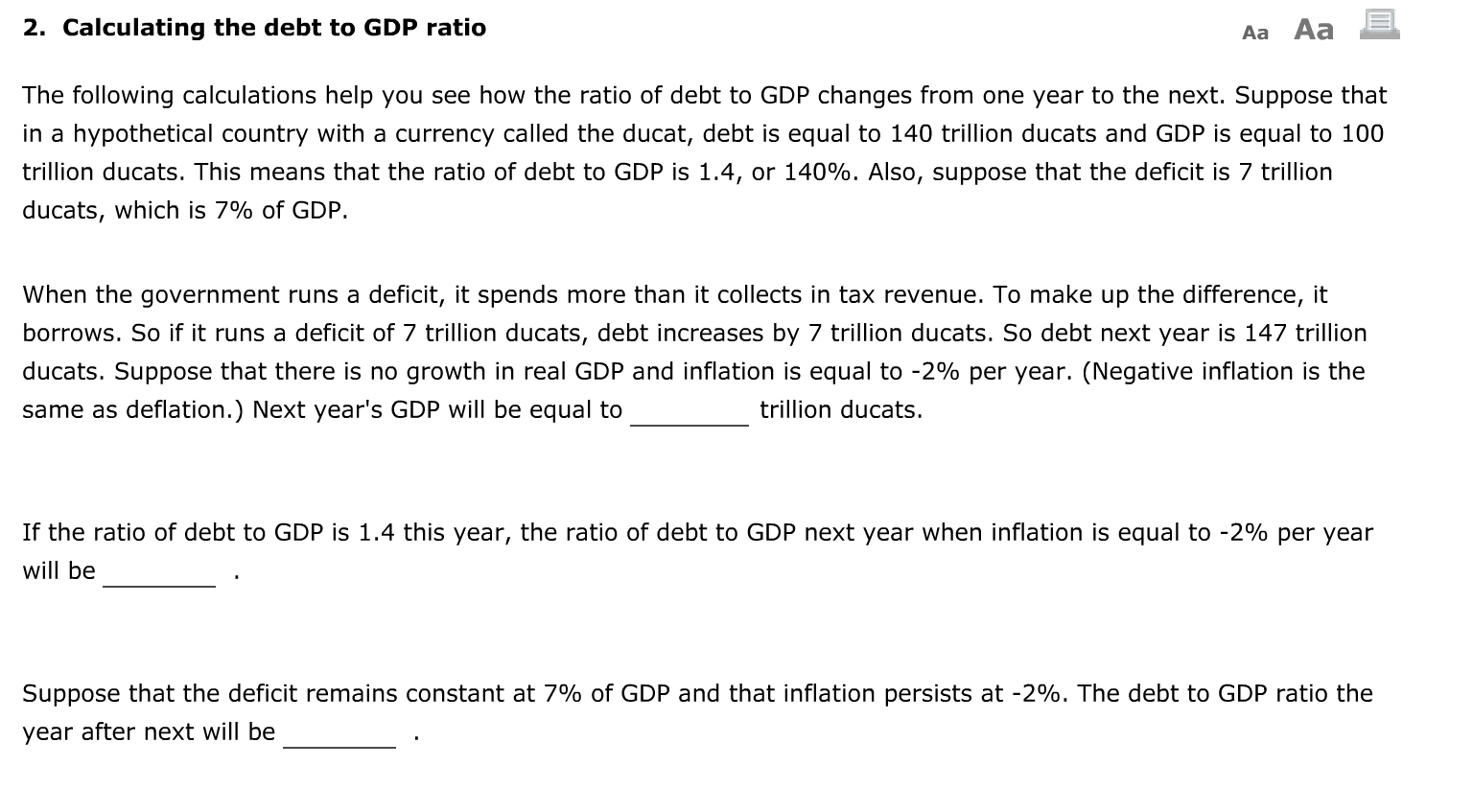

The following calculations help you see how the ratio of debt to GDP changes from one year to the next. Suppose that in a hypothetical country with a currency called the ducat, debt is equal to 140 trillion ducats and GDP is equal to 100 trillion ducats. This means that the ratio of debt to GDP is 1.4, or 140%. Also, suppose that the deficit is 7 trillion ducats, which is 7% of GDP. When the government runs a deficit, it spends more than it collects in tax revenue. To make up the difference, it borrows. So if it runs a deficit of 7 trillion ducats, debt increases by 7 trillion ducats. So debt next year is 147 trillion ducats. Suppose that there is no growth in real GDP and inflation is equal to -2% per year. (Negative inflation is the same as deflation.) Next year's GDP will be equal to trillion ducats. If the ratio of debt to GDP is 1.4 this year, the ratio of debt to GDP next year when inflation is equal to -2% per year will be Suppose that the deficit remains constant at 7% of GDP and that inflation persists at -2%. The debt to GDP ratio the year after next will be

The following calculations help you see how the ratio of debt to GDP changes from one year to the next. Suppose that in a hypothetical country with a currency called the ducat, debt is equal to 140 trillion ducats and GDP is equal to 100 trillion ducats. This means that the ratio of debt to GDP is 1.4, or 140%. Also, suppose that the deficit is 7 trillion ducats, which is 7% of GDP. When the government runs a deficit, it spends more than it collects in tax revenue. To make up the difference, it borrows. So if it runs a deficit of 7 trillion ducats, debt increases by 7 trillion ducats. So debt next year is 147 trillion ducats. Suppose that there is no growth in real GDP and inflation is equal to -2% per year. (Negative inflation is the same as deflation.) Next year's GDP will be equal to trillion ducats. If the ratio of debt to GDP is 1.4 this year, the ratio of debt to GDP next year when inflation is equal to -2% per year will be Suppose that the deficit remains constant at 7% of GDP and that inflation persists at -2%. The debt to GDP ratio the year after next will be

Chapter12: Federal Budgets And Public Policy

Section: Chapter Questions

Problem 3.8P

Related questions

Question

100%

2. calculating the debt to GDP ratio

Transcribed Image Text:The following calculations help you see how the ratio of debt to GDP changes from one year to the next. Suppose that

in a hypothetical country with a currency called the ducat, debt is equal to 140 trillion ducats and GDP is equal to 100

trillion ducats. This means that the ratio of debt to GDP is 1.4, or 140%. Also, suppose that the deficit is 7 trillion

ducats, which is 7% of GDP.

When the government runs a deficit, it spends more than it collects in tax revenue. To make up the difference, it

borrows. So if it runs a deficit of 7 trillion ducats, debt increases by 7 trillion ducats. So debt next year is 147 trillion

ducats. Suppose that there is no growth in real GDP and inflation is equal to -2% per year. (Negative inflation is the

same as deflation.) Next year's GDP will be equal to

trillion ducats.

If the ratio of debt to GDP is 1.4 this year, the ratio of debt to GDP next year when inflation is equal to -2% per year

will be

Suppose that the deficit remains constant at 7% of GDP and that inflation persists at -2%. The debt to GDP ratio the

year after next will be

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning