The following data are accumulated by Geddes Company in evaluating the purchase of $140,000 of equipment, having a four-year useful life: Net Income Net Cash Flow Year 1 $42,500 $77,500 Year 2 21,500 56,500 Year 3 15,500 50,500 Year 4 6,500 41,500 This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Assuming that the desired rate of return is 6%, determine the net present value for the proposal. If required, round to the nearest dollar. Net present value $fill in the blank 2 Would management be likely to look with favor on the proposal? , the net present value indicates that the return on the proposal is than the minimum desired rate of return of 6%

The following data are accumulated by Geddes Company in evaluating the purchase of $140,000 of equipment, having a four-year useful life: Net Income Net Cash Flow Year 1 $42,500 $77,500 Year 2 21,500 56,500 Year 3 15,500 50,500 Year 4 6,500 41,500 This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Assuming that the desired rate of return is 6%, determine the net present value for the proposal. If required, round to the nearest dollar. Net present value $fill in the blank 2 Would management be likely to look with favor on the proposal? , the net present value indicates that the return on the proposal is than the minimum desired rate of return of 6%

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 7E

Related questions

Question

The following data are accumulated by Geddes Company in evaluating the purchase of $140,000 of equipment, having a four-year useful life:

| Net Income | Net |

|||

| Year 1 | $42,500 | $77,500 | ||

| Year 2 | 21,500 | 56,500 | ||

| Year 3 | 15,500 | 50,500 | ||

| Year 4 | 6,500 | 41,500 |

This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below.

- Assuming that the desired

rate of return is 6%, determine the net present value for the proposal. If required, round to the nearest dollar.Net present value $fill in the blank 2 - Would management be likely to look with favor on the proposal?

, the net present value indicates that the return on the proposal is than the minimum desired rate of return of 6%.

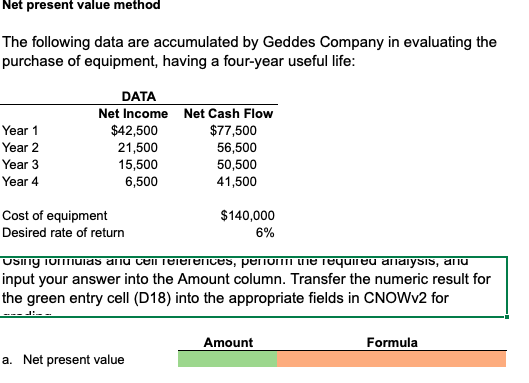

Transcribed Image Text:Net present value method

The following data are accumulated by Geddes Company in evaluating the

purchase of equipment, having a four-year useful life:

DATA

Net Income Net Cash Flow

$42,500

21,500

15,500

6,500

Year 1

$77,500

56,500

50,500

41,500

Year 2

Year 3

Year 4

Cost of equipment

$140,000

6%

Desired rate of return

USIng iomuias anu celiTelerences, penom he Tequileu anaiysis, anu

input your answer into the Amount column. Transfer the numeric result for

the green entry cell (D18) into the appropriate fields in CNOWV2 for

Amount

Formula

a. Net present value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning