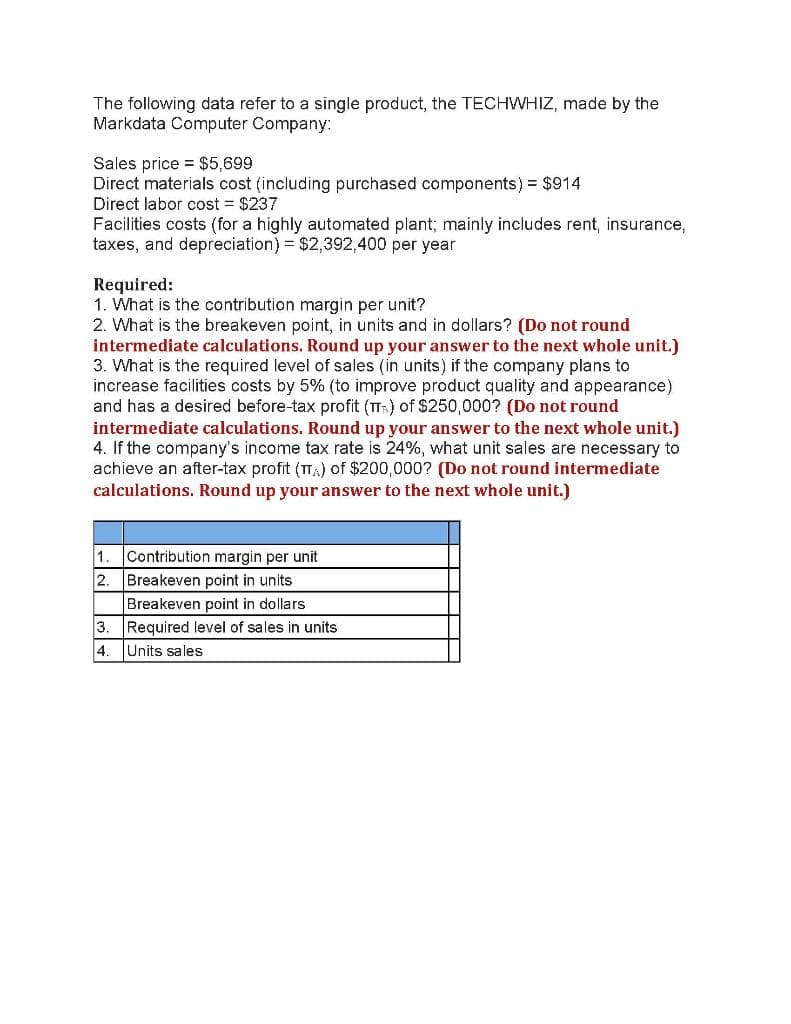

The following data refer to a single product, the TECHWHIZ, made by the Markdata Computer Company: Sales price = $5,699 Direct materials cost (including purchased components) = $914 Direct labor cost = $237 Facilities costs (for a highly automated plant; mainly includes rent, insurance, taxes, and depreciation) = $2,392,400 per year Required: 1. What is the contribution margin per unit? 2. What is the breakeven point, in units and in dollars? (Do not round intermediate calculations. Round up your answer to the next whole unit.) 3. What is the required level of sales (in units) if the company plans to increase facilities costs by 5% (to improve product quality and appearance) and has a desired before-tax profit (T) of $250,000? (Do not round intermediate calculations. Round up your answer to the next whole unit.)

The following data refer to a single product, the TECHWHIZ, made by the Markdata Computer Company: Sales price = $5,699 Direct materials cost (including purchased components) = $914 Direct labor cost = $237 Facilities costs (for a highly automated plant; mainly includes rent, insurance, taxes, and depreciation) = $2,392,400 per year Required: 1. What is the contribution margin per unit? 2. What is the breakeven point, in units and in dollars? (Do not round intermediate calculations. Round up your answer to the next whole unit.) 3. What is the required level of sales (in units) if the company plans to increase facilities costs by 5% (to improve product quality and appearance) and has a desired before-tax profit (T) of $250,000? (Do not round intermediate calculations. Round up your answer to the next whole unit.)

Chapter5: Process Costing

Section: Chapter Questions

Problem 2PB: The following product costs are available for Kellee Company on the production of eyeglass frames:...

Related questions

Question

Answer only first 3 subparts

Transcribed Image Text:The following data refer to a single product, the TECHWHIZ, made by the

Markdata Computer Company:

Sales price = $5,699

Direct materials cost (including purchased components) = $914

Direct labor cost $237

Facilities costs (for a highly automated plant; mainly includes rent, insurance,

taxes, and depreciation) = $2,392,400 per year

Required:

1. What is the contribution margin per unit?

2. What is the breakeven point, in units and in dollars? (Do not round

intermediate calculations. Round up your answer to the next whole unit.)

3. What is the required level of sales (in units) if the company plans to

increase facilities costs by 5% (to improve product quality and appearance)

and has a desired before-tax profit (T) of $250,000? (Do not round

intermediate calculations. Round up your answer to the next whole unit.)

4. If the company's income tax rate is 24%, what unit sales are necessary to

achieve an after-tax profit (TA) of $200,000? (Do not round intermediate

calculations. Round up your answer to the next whole unit.)

1.

Contribution margin per unit

2.

Breakeven point in units

Breakeven point in dollars

3. Required level of sales in units

4. Units sales

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,