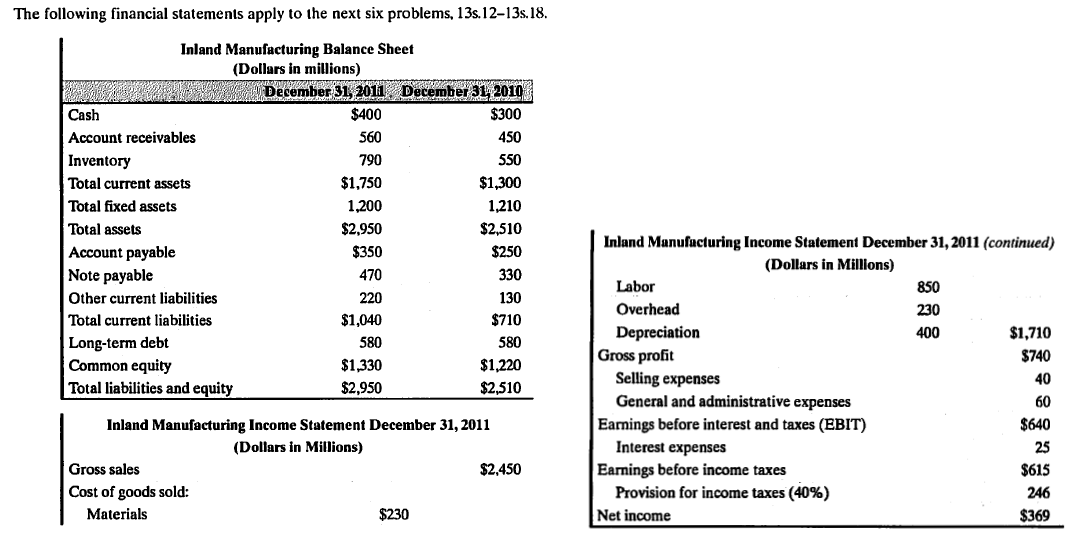

The following financial statements apply to the next six problems, 13s.12-13s.18. Inland Manufacturing Balance Sheet (Dollars in millions) December 31, 2011, December 31, 2010 Cash $400 $300 Account receivables 560 450 | Inventory 790 550 Total current assets $1,750 $1,300 Total fixed assets 1,200 1,210 Total assets $2,950 $2,510 Inland Manufacturing Income Statement December 31, 2011 (continued) Account payable Note payable $350 $250 (Dollars in Millions) 470 330 Labor 850 Other current liabilities 220 130 Overhead 230 Total current liabilities $1,040 $710 Depreciation Gross profit 400 $1,710 Long-term debt Common equity Total liabilities and equity 580 580 $740 $1,330 $1,220 Selling expenses General and administrative expenses 40 $2,950 $2,510 60 $640 Eanings before interest and taxes (EBIT) Interest expenses Inland Manufacturing Income Statement December 31, 2011 (Dollars in Millions) 25 Earnings before income taxes Provision for income taxes (40%) Gross sales $2,450 $615 Cost of goods sold: 246 Materials $230 Net income $369

The following financial statements apply to the next six problems, 13s.12-13s.18. Inland Manufacturing Balance Sheet (Dollars in millions) December 31, 2011, December 31, 2010 Cash $400 $300 Account receivables 560 450 | Inventory 790 550 Total current assets $1,750 $1,300 Total fixed assets 1,200 1,210 Total assets $2,950 $2,510 Inland Manufacturing Income Statement December 31, 2011 (continued) Account payable Note payable $350 $250 (Dollars in Millions) 470 330 Labor 850 Other current liabilities 220 130 Overhead 230 Total current liabilities $1,040 $710 Depreciation Gross profit 400 $1,710 Long-term debt Common equity Total liabilities and equity 580 580 $740 $1,330 $1,220 Selling expenses General and administrative expenses 40 $2,950 $2,510 60 $640 Eanings before interest and taxes (EBIT) Interest expenses Inland Manufacturing Income Statement December 31, 2011 (Dollars in Millions) 25 Earnings before income taxes Provision for income taxes (40%) Gross sales $2,450 $615 Cost of goods sold: 246 Materials $230 Net income $369

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 2E: Cost of Goods Sold and Income Statement Schuch Company presents you with the following account...

Related questions

Question

If Inland uses its $400 cash balance to pay off $400 of its long-term debt, what will be its new

(a) 1.68 (b) 2.03

(c) 1.35 (d) 3.12

Transcribed Image Text:The following financial statements apply to the next six problems, 13s.12-13s.18.

Inland Manufacturing Balance Sheet

(Dollars in millions)

December 31, 2011, December 31, 2010

Cash

$400

$300

Account receivables

560

450

| Inventory

790

550

Total current assets

$1,750

$1,300

Total fixed assets

1,200

1,210

Total assets

$2,950

$2,510

Inland Manufacturing Income Statement December 31, 2011 (continued)

Account payable

Note payable

$350

$250

(Dollars in Millions)

470

330

Labor

850

Other current liabilities

220

130

Overhead

230

Total current liabilities

$1,040

$710

Depreciation

Gross profit

400

$1,710

Long-term debt

Common equity

Total liabilities and equity

580

580

$740

$1,330

$1,220

Selling expenses

General and administrative expenses

40

$2,950

$2,510

60

$640

Eanings before interest and taxes (EBIT)

Interest expenses

Inland Manufacturing Income Statement December 31, 2011

(Dollars in Millions)

25

Earnings before income taxes

Provision for income taxes (40%)

Gross sales

$2,450

$615

Cost of goods sold:

246

Materials

$230

Net income

$369

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,