(1) Debt and equity ratios. Debt Ratio Choose Numerator: Choose Denominator: Debt Ratio Total liabilities I Total equity Debt ratio 246,306 Is 324,692 = 75.9 % Current Year: 1 Year Ago: 0 % Equity Ratio Choose Numerator: Choose Denominator: Equity Ratio Equity ratio Current Year: 0 % 1 Year Ago:

(1) Debt and equity ratios. Debt Ratio Choose Numerator: Choose Denominator: Debt Ratio Total liabilities I Total equity Debt ratio 246,306 Is 324,692 = 75.9 % Current Year: 1 Year Ago: 0 % Equity Ratio Choose Numerator: Choose Denominator: Equity Ratio Equity ratio Current Year: 0 % 1 Year Ago:

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter17: Financial Statement Analysis

Section: Chapter Questions

Problem 4E

Related questions

Question

Simon Company’s year-end balance sheets follow.

| At December 31 | Current Yr | 1 Yr Ago | 2 Yrs Ago | ||||||||

| Assets | |||||||||||

| Cash | $ | 34,026 | $ | 39,379 | $ | 39,798 | |||||

| 98,617 | 68,224 | 53,063 | |||||||||

| Merchandise inventory | 120,309 | 91,975 | 57,666 | ||||||||

| Prepaid expenses | 10,957 | 10,544 | 4,602 | ||||||||

| Plant assets, net | 307,089 | 282,118 | 255,071 | ||||||||

| Total assets | $ | 570,998 | $ | 492,240 | $ | 410,200 | |||||

| Liabilities and Equity | |||||||||||

| Accounts payable | $ | 142,179 | $ | 81,525 | $ | 53,063 | |||||

| Long-term notes payable secured by mortgages on plant assets |

104,127 | 112,083 | 88,841 | ||||||||

| Common stock, $10 par value | 162,500 | 162,500 | 162,500 | ||||||||

| 162,192 | 136,132 | 105,796 | |||||||||

| Total liabilities and equity | $ | 570,998 | $ | 492,240 | $ | 410,200 | |||||

The company’s income statements for the Current Year and 1 Year Ago, follow.

| For Year Ended December 31 | Current Yr | 1 Yr Ago | ||||||||||

| Sales | $ | 742,297 | $ | 585,766 | ||||||||

| Cost of goods sold | $ | 452,801 | $ | 380,748 | ||||||||

| Other operating expenses | 230,112 | 148,199 | ||||||||||

| Interest expense | 12,619 | 13,473 | ||||||||||

| Income tax expense | 9,650 | 8,786 | ||||||||||

| Total costs and expenses | 705,182 | 551,206 | ||||||||||

| Net income | $ | 37,115 | $ | 34,560 | ||||||||

| Earnings per share | $ | 2.28 | $ | 2.13 | ||||||||

For both the Current Year and 1 Year Ago, compute the following ratios:

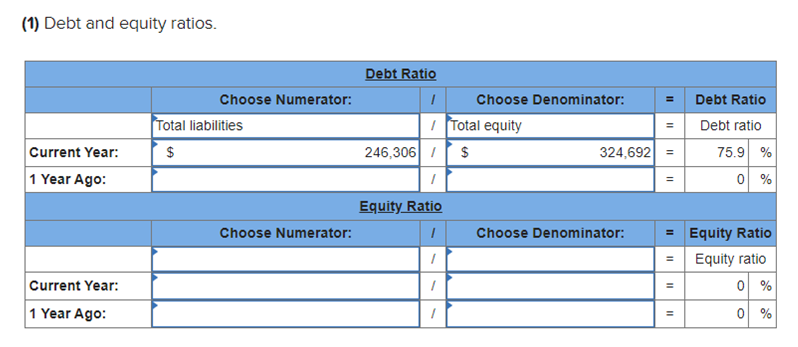

(1) Debt and equity ratios.

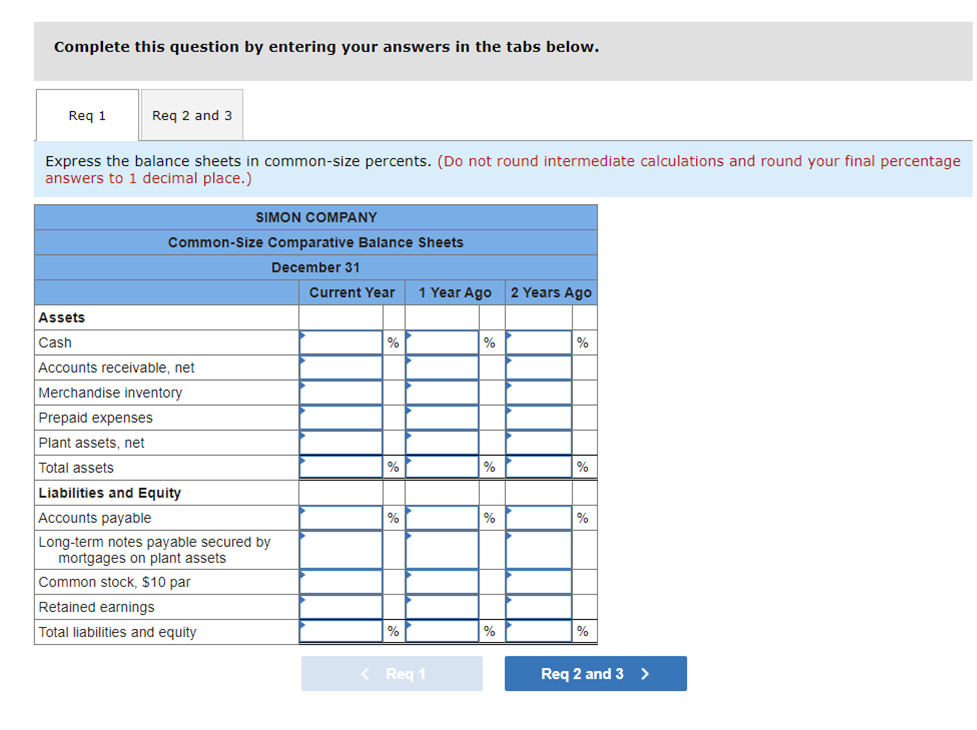

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Req 1

Reg 2 and 3

Express the balance sheets in common-size percents. (Do not round intermediate calculations and round your final percentage

answers to 1 decimal place.)

SIMON COMPANY

Common-Size Comparative Balance Sheets

December 31

Current Year

1 Year Ago

2 Years Ago

Assets

Cash

%

%

%

Accounts receivable, net

Merchandise inventory

Prepaid expenses

Plant assets, net

Total assets

%

%

Liabilities and Equity

Accounts payable

%

%

%

Long-term notes payable secured by

mortgages on plant assets

Common stock, $10 par

Retained earnings

Total liabilities and equity

%

%

< Req 1

Req 2 and 3 >

Transcribed Image Text:(1) Debt and equity ratios.

Debt Ratio

Choose Numerator:

Choose Denominator:

Debt Ratio

Total liabilities

I Total equity

246,306 Is

Debt ratio

Current Year:

$

324,692 =

75.9 %

1 Year Ago:

0 %

Equity Ratio

Choose Numerator:

Choose Denominator:

= Equity Ratio

Equity ratio

Current Year:

0 %

1 Year Ago:

이 %

%3D

II

II

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning