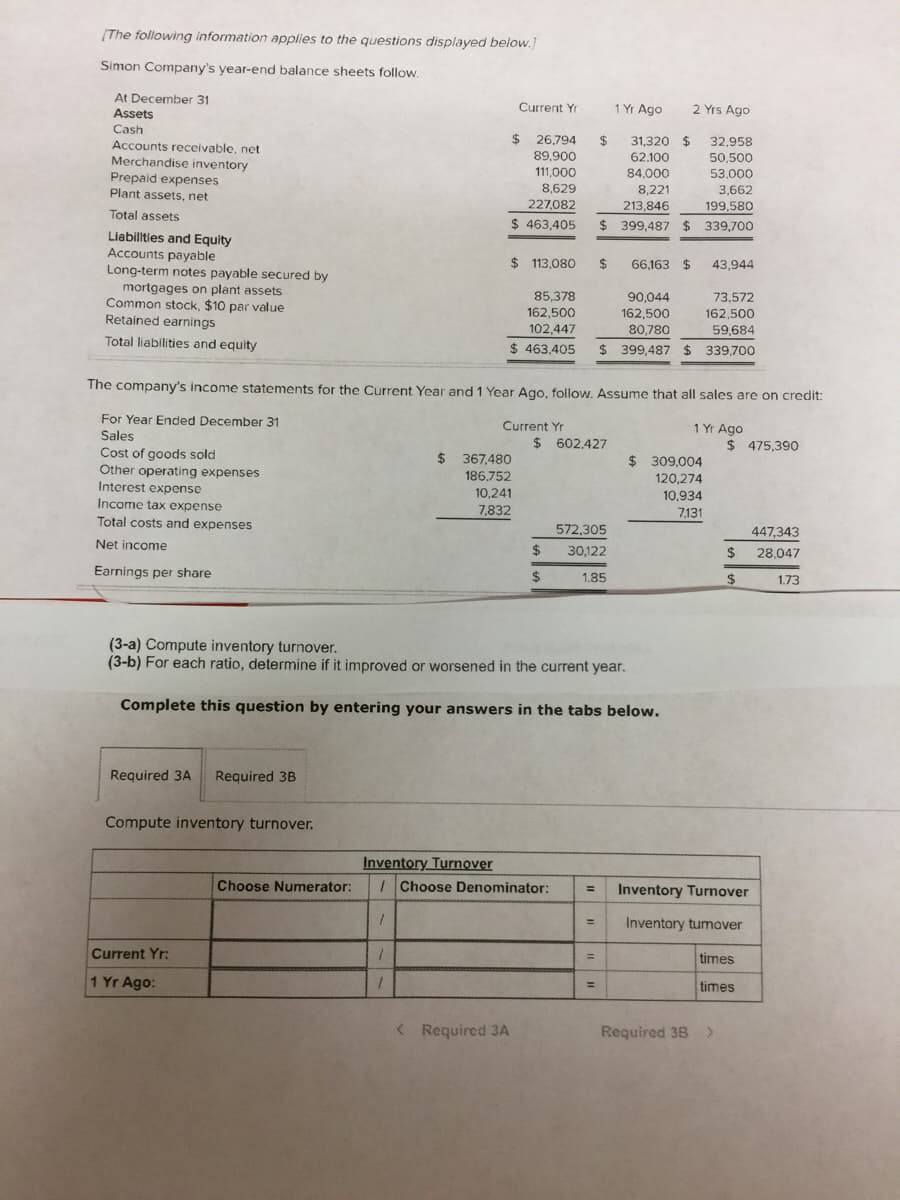

[The following information applies to the questions displayed below.) Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets. net Current Yr 1 Yr Ago 2 Yrs Ago $ 26,794 89,900 111,000 31,320 $ 62.100 32,958 50,500 84,000 53.000 8,629 8,221 3,662 199,580 227,082 213,846 Total assets $ 463,405 $ 399,487 $ 339,700 Llabillties and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings $ 113,080 2$ 66,163 $ 43,944 85,378 90,044 162,500 80,780 73,572 162,500 102,447 162,500 59,684 Total liabilities and equity $ 463,405 $ 399,487 $ 339,700 The company's income statements for the Current Year and 1 Year Ago, follow. Assume that all sales are on credit: For Year Ended December 31 Sales Current Yr 1 Yr Ago $ 602,427 $ 475,390 Cost of goods sold Other operating expenses Interest expense $ 367,480 $ 309.004 186.752 10,241 120,274 10,934 Income tax expense Total costs and expenses 7,832 7,131 572,305 447,343 Net income %24 30,122 24 28.047 Earnings per share %24 1.85 %24 1.73 (3-a) Compute inventory turnover. (3-b) For each ratio, determine if it improved or worsened in the current year. Complete this question by entering your answers in the tabs below. Required 3A Required 3B Compute inventory turnover. Inventory Turnover IChoose Denominator: Choose Numerator: Inventory Turnover %3D Inventory tumover %3D Current Yr: %3D times 1 Yr Ago: %3D times ( Required 3A Required 38 >

[The following information applies to the questions displayed below.) Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets. net Current Yr 1 Yr Ago 2 Yrs Ago $ 26,794 89,900 111,000 31,320 $ 62.100 32,958 50,500 84,000 53.000 8,629 8,221 3,662 199,580 227,082 213,846 Total assets $ 463,405 $ 399,487 $ 339,700 Llabillties and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings $ 113,080 2$ 66,163 $ 43,944 85,378 90,044 162,500 80,780 73,572 162,500 102,447 162,500 59,684 Total liabilities and equity $ 463,405 $ 399,487 $ 339,700 The company's income statements for the Current Year and 1 Year Ago, follow. Assume that all sales are on credit: For Year Ended December 31 Sales Current Yr 1 Yr Ago $ 602,427 $ 475,390 Cost of goods sold Other operating expenses Interest expense $ 367,480 $ 309.004 186.752 10,241 120,274 10,934 Income tax expense Total costs and expenses 7,832 7,131 572,305 447,343 Net income %24 30,122 24 28.047 Earnings per share %24 1.85 %24 1.73 (3-a) Compute inventory turnover. (3-b) For each ratio, determine if it improved or worsened in the current year. Complete this question by entering your answers in the tabs below. Required 3A Required 3B Compute inventory turnover. Inventory Turnover IChoose Denominator: Choose Numerator: Inventory Turnover %3D Inventory tumover %3D Current Yr: %3D times 1 Yr Ago: %3D times ( Required 3A Required 38 >

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 56P: The following selected information is taken from the financial statements of Arnn Company for its...

Related questions

Question

Transcribed Image Text:[The following information applies to the questions displayed below.

Simon Company's year-end balance sheets follow.

At December 31

Assets

1 Yr Ago

Current Yr

2 Yrs Ago

Cash

$ 26,794

$

31,320 $

62.100

32,958

Accounts receivable, net

Merchandise inventory

89,900

50,500

111,000

8,629

84,000

53,000

Prepaid expenses

Plant assets, net

3,662

199,580

8,221

227,082

213.846

Total assets

$ 463,405

$ 399,487 $ 339,700

Liabilitles and Equity

Accounts payable

Long-term notes payable secured by

mortgages on plant assets

Common stock, $10 par value

Retained earnings

$ 113,080

$

66,163 $

43,944

85,378

90,044

162,500

80,780

73,572

162,500

102,447

162,500

59,684

Total liabilities and equity

$ 463,405

$ 399,487 $ 339,700

The company's income statements for the Current Year and 1 Year Ago, follow. Assume that all sales are on credit:

For Year Ended December 31

Current Yr

1 Yr Ago

Sales

$ 602,427

$ 475,390

Cost of goods sold

Other operating expenses

Interest expense

Income tax expense

$ 367,480

$ 309,004

186.752

120.274

10,241

10,934

7,832

7,131

Total costs and expenses

572.305

447,343

Net income

$

30,122

28.047

2$

Earnings per share

%24

1.85

$

1.73

(3-a) Compute inventory turnover.

(3-b) For each ratio, determine if it improved or worsened in the current year.

Complete this question by entering your answers in the tabs below.

Required 3A

Required 3B

Compute inventory turnover.

Inventory Turnover

IChoose Denominator:

Choose Numerator:

Inventory Turnover

%3D

%3D

Inventory tumover

Current Yr:

times

%3D

1 Yr Ago:

times

%3D

< Required 3A

Required 38 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning