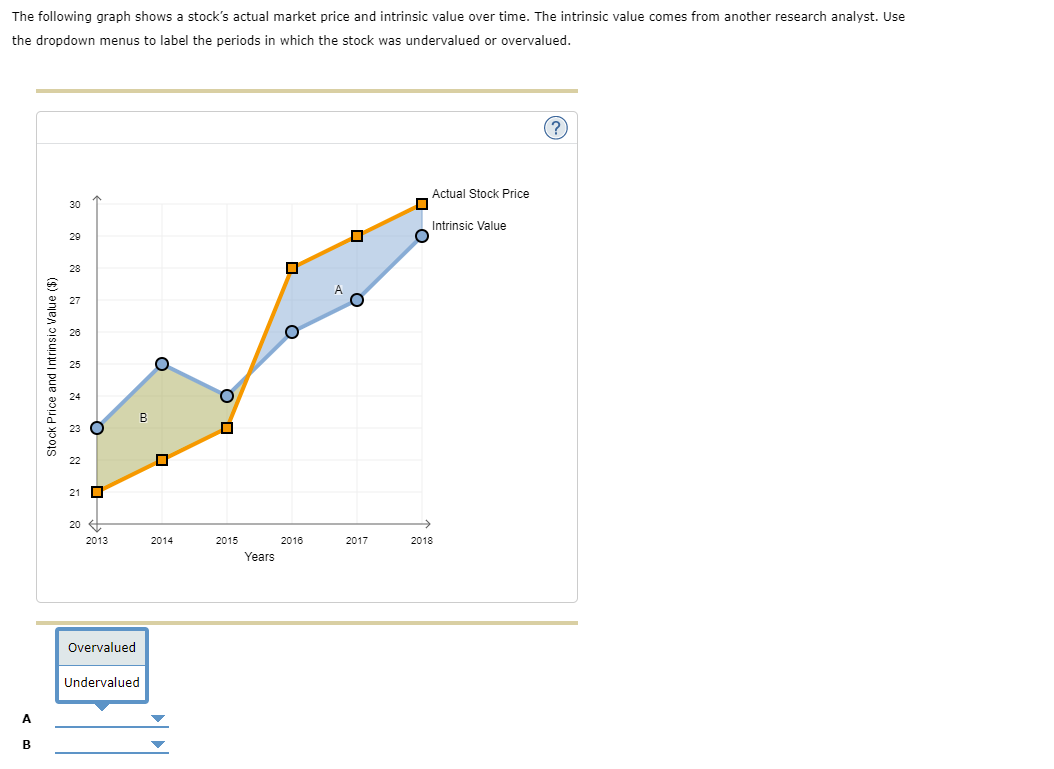

The following graph shows a stock's actual market price and intrinsic value over time. The intrinsic value comes from another research analyst. Use the dropdown menus to label the periods in which the stock was undervalued or overvalued. (? Actual Stock Price 30 Intrinsic Value 29 28 B 23 O 22 21 O 20 2013 2014 2015 2018 2017 2018 Years Overvalued Undervalued A B Stock Price and Intrinsic Value ($)

The following graph shows a stock's actual market price and intrinsic value over time. The intrinsic value comes from another research analyst. Use the dropdown menus to label the periods in which the stock was undervalued or overvalued. (? Actual Stock Price 30 Intrinsic Value 29 28 B 23 O 22 21 O 20 2013 2014 2015 2018 2017 2018 Years Overvalued Undervalued A B Stock Price and Intrinsic Value ($)

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter11: Determining The Cost Of Capital

Section: Chapter Questions

Problem 3MC

Related questions

Question

Transcribed Image Text:The following graph shows a stock's actual market price and intrinsic value over time. The intrinsic value comes from another research analyst. Use

the dropdown menus to label the periods in which the stock was undervalued or overvalued.

Actual Stock Price

30

Intrinsic Value

29

28

22

21 O

20 4

2013

2014

2015

2016

2017

2018

Years

Overvalued

Undervalued

A

В

Stock Price and Intrinsic Value ($)

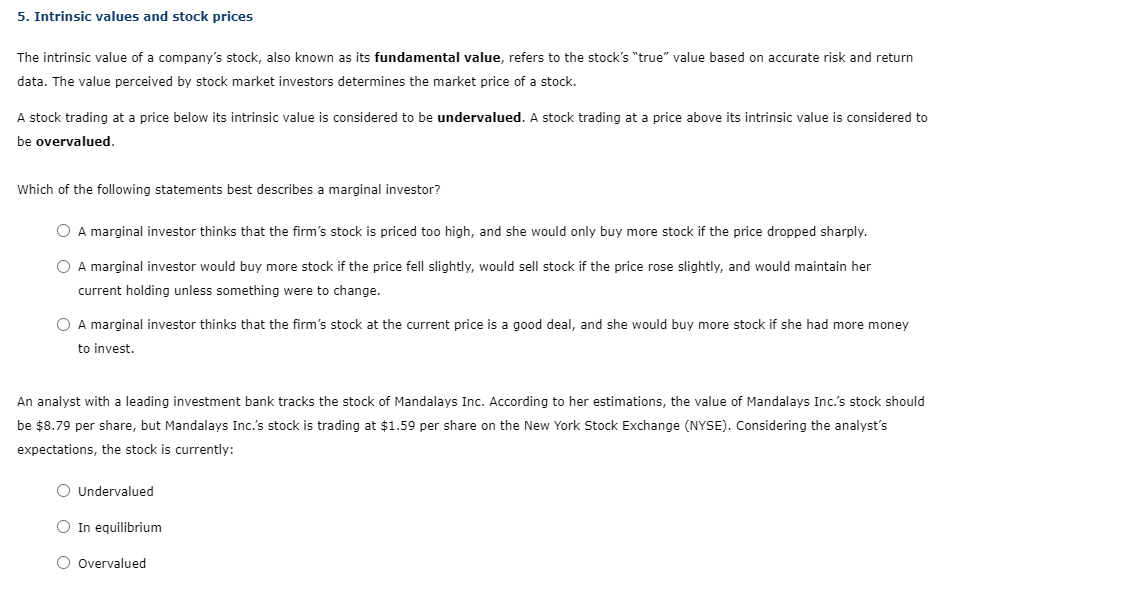

Transcribed Image Text:5. Intrinsic values and stock prices

The intrinsic value of a company's stock, also known as its fundamental value, refers to the stock's "true" value based on accurate risk and return

data. The value perceived by stock market investors determines the market price of a stock.

A stock trading at a price below its intrinsic value is considered to be undervalued. A stock trading at a price above its intrinsic value is considered to

be overvalued.

Which of the following statements best describes a marginal investor?

O A marginal investor thinks that the firm's stock is priced too high, and she would only buy more stock if the price dropped sharply.

O A marginal investor would buy more stock if the price fell slightly, would sell stock if the price rose slightly, and would maintain her

current holding unless something were to change.

O A marginal investor thinks that the firm's stock at the current price is a good deal, and she would buy more stock if she had more money

to invest.

An analyst with a leading investment bank tracks the stock of Mandalays Inc. According to her estimations, the value of Mandalays Inc.'s stock should

be $8.79 per share, but Mandalays Inc.'s stock is trading at $1.59 per share on the New York Stock Exchange (NYSE). Considering the analyst's

expectations, the stock is currently:

O Undervalued

O In equilibrium

O Overvalued

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning