The following graph shows the economy in long-run equilibrium at an expected price level of 120 and potential output of $300 billion. Suppose the government implements a large investment tax credit, causing investment spending to increase. Shift the short-run aggregate supply (SRAS) curve or the aggregate demand (AD) curve to show the short-run impact of the investment tax credit on the graph. Note: Select and drag one or both of the curves to the desired position. Curves will snap into position, so if you try to move a curve and it snaps back to its original position, just drag it a little farther. PRICE LEVEL 240 200 160 120 80 40 O 0 100 SRAS, SRAS 200 300 400 REAL GDP (Billions of dollars) AD₂ 500 600 AD SRAS ? In the short run, the increase in investment spending due to the new tax credit shifts the aggregate demand the price level to rise above the price level people expected, and the quantity of output to fall below credit will cause the unemployment rate to the natural rate of unemployment in the short run. curve to the right , causing potential output. The investment tax

The following graph shows the economy in long-run equilibrium at an expected price level of 120 and potential output of $300 billion. Suppose the government implements a large investment tax credit, causing investment spending to increase. Shift the short-run aggregate supply (SRAS) curve or the aggregate demand (AD) curve to show the short-run impact of the investment tax credit on the graph. Note: Select and drag one or both of the curves to the desired position. Curves will snap into position, so if you try to move a curve and it snaps back to its original position, just drag it a little farther. PRICE LEVEL 240 200 160 120 80 40 O 0 100 SRAS, SRAS 200 300 400 REAL GDP (Billions of dollars) AD₂ 500 600 AD SRAS ? In the short run, the increase in investment spending due to the new tax credit shifts the aggregate demand the price level to rise above the price level people expected, and the quantity of output to fall below credit will cause the unemployment rate to the natural rate of unemployment in the short run. curve to the right , causing potential output. The investment tax

Macroeconomics: Principles and Policy (MindTap Course List)

13th Edition

ISBN:9781305280601

Author:William J. Baumol, Alan S. Blinder

Publisher:William J. Baumol, Alan S. Blinder

Chapter10: Bringing In The Supply Side: Unemployment And Inflation?

Section: Chapter Questions

Problem 3TY

Related questions

Question

6

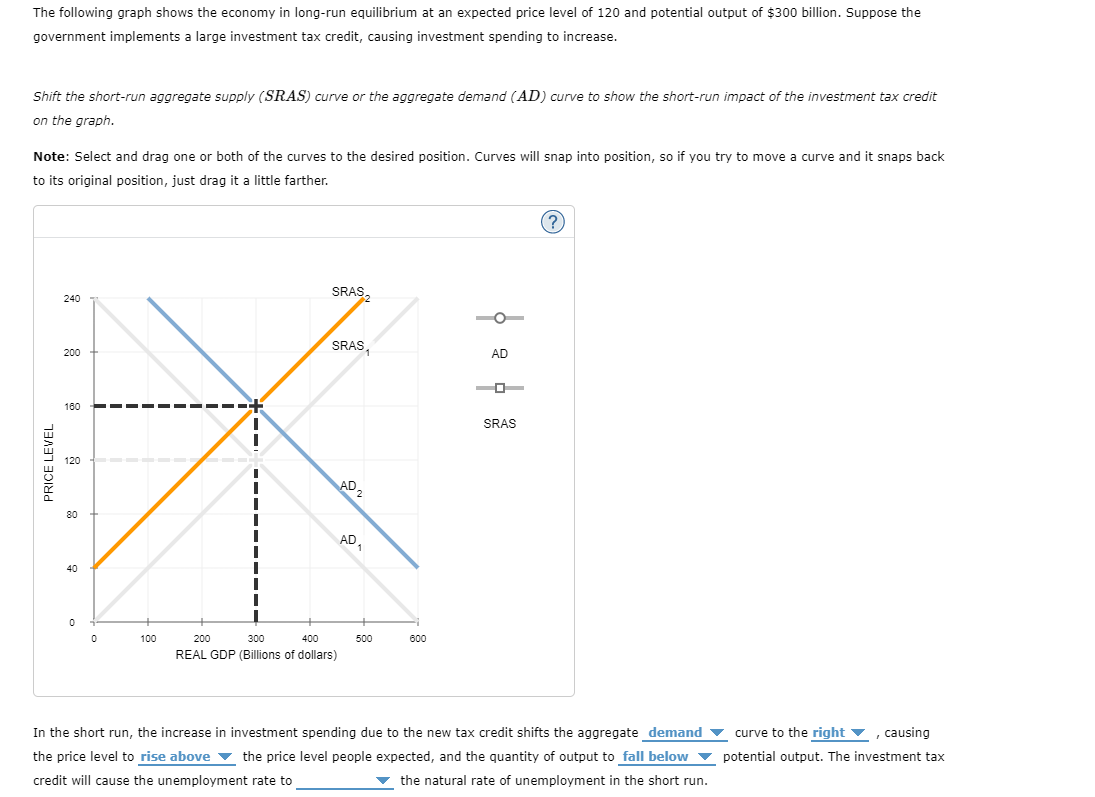

Transcribed Image Text:The following graph shows the economy in long-run equilibrium at an expected price level of 120 and potential output of $300 billion. Suppose the

government implements a large investment tax credit, causing investment spending to increase.

Shift the short-run aggregate supply (SRAS) curve or the aggregate demand (AD) curve to show the short-run impact of the investment tax credit

on the graph.

Note: Select and drag one or both of the curves to the desired position. Curves will snap into position, so if you try to move a curve and it snaps back

to its original position, just drag it a little farther.

PRICE LEVEL

240

200

160

8

40

0

0

100

SRAS,

SRAS,

200

300

400

REAL GDP (Billions of dollars)

AD 2

AD₁

500

600

AD

SRAS

(?)

In the short run, the increase in investment spending due to the new tax credit shifts the aggregate demand

the price level to rise above the price level people expected, and the quantity of output to fall below

credit will cause the unemployment rate to

the natural rate of unemployment in the short run.

curve to the right ▼, causing

potential output. The investment tax

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Macroeconomics: Principles and Policy (MindTap Co…

Economics

ISBN:

9781305280601

Author:

William J. Baumol, Alan S. Blinder

Publisher:

Cengage Learning

Macroeconomics: Principles and Policy (MindTap Co…

Economics

ISBN:

9781305280601

Author:

William J. Baumol, Alan S. Blinder

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning