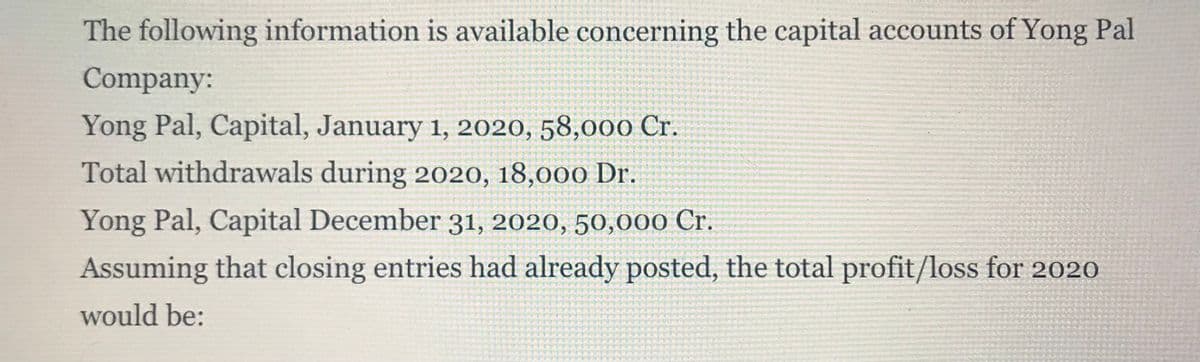

The following information is available concerning the capital accounts of Yong Pal Company: Yong Pal, Capital, January 1, 2020, 58,000 Cr. Total withdrawals during 2020, 18,000 Dr. Yong Pal, Capital December 31, 2020, 50,000 Cr. Assuming that closing entries had already posted, the total profit/loss for 2020 would be:

Q: On January 1, 2021, total assets for Liftoff Technologies were $425,000; on December 31, 2021, total…

A: Accounting Equation; Total Assets=Total liabilities + Total Stockholders Equity

Q: The owner’s capital of FDNACCT was P100,000 on October 1, 2020, the beginning of its fiscal year.…

A: Owner's Capital September 30, 2021 = Owner's Capital October 1, 2020 + Investment - Withdrawals +…

Q: During 2020, Campbell Company entered into the following transactions. Purchased equipment for…

A: The accounting equation refers to the equation of the balance sheet. It is based on the method of…

Q: Teller Corporation's post-closing trial balance at December 31, 2020, was as follows. Teller…

A: The total stockholders’ equity represents the owner’s capital or claim in the company. The total…

Q: Neptune Corporation is preparing its December 31, 2018, balance sheet. The following items may be…

A: Balance sheet: It refers to a financial statement that shows all the liabilities, assets, and…

Q: During 2022, the company had service revenue of $175,100 and interest revenue of $84,80 amount of…

A: A closing entry is a journal entry that is made at the end of the fiscal period. It entails…

Q: The hypothetical company XYZ Inc started its operations in 2020. On December 31 2020, it had the…

A: Since,Accrual basis of accounting is generally followed .Here,it is assumed that a particular amount…

Q: What is the owner's equity for the BlueDragon company for accounting period 2020? note: write the…

A: Solution:- Owner’s equity means the amount of funds contributed by the owners of the entity. In case…

Q: During 2019, Canton Company's assets increased $95,700 and the liabilities decreased $19,300. Canton…

A: Accounting equation also known as the balance sheet equation is a representation of the relationship…

Q: The hypothetical company XYZ Inc started its operations in 2020. On December 31 2020, it had the…

A: Balance sheet is an important part of accounting.It shows the company's current status whether it is…

Q: Following are selected balance sheet accounts of Blossom Bros. Corp. at December 31, 2020 and 2019,…

A: Determine the category (operating, investing, or financing) and the amount that should be reported…

Q: Presented below is income statement and dividend information of the Nebraska Corporation for the…

A: Solution:- Preparation of the necessary closing entries at December 31, 2021 as follows:- working…

Q: As of December 31, 2019, the capital of Sweet & Spicy Company are equal to two-thirds of the total…

A: Total assets = Capital - liabilities Capital = total assets x 2/3

Q: Here are the 2018 and 2019 (incomplete) balance sheets for Newble Oil Corp. .1)What was the…

A: Solution: Introduction: A balance sheet is a summary of financial balances of an individual or…

Q: A list of account balances for “Amara Inc” as at the 30th June 2020 is shown below. Account name $…

A:

Q: Following are selected balance sheet accounts of Monty Bros. Corp. at December 31, 2020 and 2019,…

A: Operating activities: Operating activity is the main business activity of any organization. The…

Q: Engr. Jeon Bassett is the owner of JBA Engineering and Design Firm. At the end of its accounting…

A: The balance sheet represents the financial position of the business with assets and liabilities on a…

Q: X Company is preparing its closing entries for 2020,following accounts at the end of 2020: Servw…

A: Ans. While calculating income summary all the operating income and operating expenses should be…

Q: Use the following information for the next three (3) questions: The ledger of Kara Company in 2021…

A: Current assets are realizable within one year, So it includes account receivable cash, prepaid, and…

Q: FINALE INC. operates a service business. Total equity amounted to P5,000,000 at the end of 2020.…

A: Cost of goods sold means the cost incurred on the production of the goods that have been sold by the…

Q: Prepare the Statement of Financial Position as at 29 February 2020. The notes to the financial…

A: Balance sheet: Balance sheet can be defined as the financial statement that records the items that…

Q: The income and expense accounts of Rosie Corp. for the year ended 2019 are listed below. Sales…

A: Total Profit = Total Revenue - Total Expenses

Q: The income and expense accounts of Rosie Corp. for the year ended 2019 are listed below. Sales…

A: Statement of owner's equity gives information about the changes in the owner's capital account.…

Q: Rotweiler Obedience School's December 31, 2018, balance sheet showed net fixed assets of $1,800,000,…

A: Capital expenditures are those expenses which are made for the purchase of capital assets or fixed…

Q: The capital, withdrawal and income summary accounts for Christopher Biore Trave Agency are shown in…

A: Solution: Statement of changes in equity for Christopher Biore Travel Agency is as under:

Q: Nash Corporation's adjusted trial balance contained the following asset accounts at December 31,…

A: Current Assets are those assets from which the organisation expects to derive economic benefits…

Q: The firm's statement of retained earnings indicates that a $10,000 cash dividend was declared and…

A: Given are the closing entries as on Dec 31, 2020:

Q: Conrad Air, Inc., reported net income of $1,360,000 for the year ended December 31, 2020. Show…

A: Increase in the value of marketable securities by $ 13,60,000 Thus the total marketable securities…

Q: Rica Company was establish on January 1, 2019, with P5,000,000 from the owner and borrowed funds of…

A: Introduction: Balance sheet: All Assets and liabilities are shown in Balance sheet. It tells the net…

Q: the records of abc trading for the current year show the following: december 31, 2020 january 1,…

A: Net worth at the end of the taxable year(December 31, 2020):…

Q: After all revenue and expense accounts have been closed at the end of the fiscal year on 31 March…

A: Net Income (loss) = Credit of Income summary - Debit of Income summary = RO 302600 - 240400 = RO…

Q: During the year ended june 30, 2020, a ceramic manufaturing unit earned $439,000. After paying out…

A: After incurring all the expenses including dividends paid, the balance amount which was retained by…

Q: The income statement for the month of June 2020 of Muscat Company contains the following…

A: Definition: Statement of Retained Earnings: The statement of retained earnings shows, the changes in…

Q: ring the year, Feather reported net income of $700,000 and declared and paid d e investment's fair…

A: Statement of financial position refers to the statement which is prepared by company in order to…

Q: The shareholders’ equity of Chernasky Company at the beginning and end of 2020 totalled $15,000 and…

A:

Q: Sheffield Corporation’s adjusted trial balance contained the following asset accounts at December…

A: Current assets: The assets which could be converted into cash within one year like accounts…

Q: The records of ABC Trading for the current year show the following: December 31, 2020 January 1,…

A: The net asset approach is used in order to determine the taxable income of an individual. Under this…

Q: The following trial balance was extracted from the books of Big Bamboo Limited on December 31, 2020…

A: Formulas:

Q: Eme Rald Architects is owned by Arch. Eme Rald. During 2019, Arh. Rald invested additional drafting…

A: Net Income: It tells the profitability of the company. All the revenues and expenses of company are…

Q: As at Dec. 31, 2020, the accounting records for Marcus Aurelius Outdoor Ad Concepts contained the…

A: Note: Since you have posted a question with multiple sub-parts, we will solve first three subparts…

Q: Accounting information from the records of the Sarah Jane's Clothing Corporation at the end of 2020…

A: Cash flows from operating activities: It is a section of Statement of cash flow that explains the…

Q: n January 2020, Ali Company’s assets valued at MYR 350,000, and its owner’s equity was MYR 150,000.…

A: Answer) Calculation of Ending balance of Equity Ending Balance of Equity = Ending Balance of Assets…

Q: The records of ABC Trading for the current year show the following: January 1, 2020 500,000 150,000…

A: Capital = Assets - Liabilities

Q: The following balance sheet has been produced for Litz Corporation as of August 8, 2020, the date on…

A: Corporate liquidation: It is a process in which the entity is shut down, as it is unable to settle…

Q: On December 31, 2020, the balance sheet of Legend Corporation shows a total equity of P1,260,000.…

A: The ending balance of retained earing can be calculated by adding up net income and deducting…

Q: During 2021, Burlington Company incurred operating expenses amounting to $600,000, of which $550,000…

A:

Q: The following is extracted from the books of White Co as at 31 December 2019: Net current assets 6…

A: Formula: Capital = Assets - Liabilities. Deduction of liabilities from Assets derives the capital.

Q: The hypothetical company XYZ Inc started its operations in 2020. On December 31 2020, it had the…

A: Accounting balance sheet is very important aspect as it gives clear cut picture of the company's…

Q: Rotweiler Obedience School's December 31, 2018, balance sheet showed net fixed assets of $1,730,000,…

A: Net capital spending is the amount of money invested in fixed assets during a particular period.…

Q: At the end of the year of 2019, Red Barney Inc. has a total assets of P 10, 556,964 and total…

A: Accounting equation: Accounting equation is an accounting tool expressed in the form of equation, by…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Reinhardt Company reported revenues of $122,000 and expenses of $83,000 on its 2019 income statement. In addition, Reinhardt paid of dividends during 2019. On December 31, 2019, Reinhardt prepared closing entries. The net effect of the closing entries on retained earnings was a(n): a. decrease of $4,000. b. increase of $35,000. c. increase of $39,000. d. decrease of $87,000.Refer to the information for Cox Inc. above. What amount would Cox record as depreciation expense at December 31, 2020, if the double-declining-balance method were used? a. $187,200 b. $192,000 c. $195,200 d. $312, 000Prince Corporations accounts provided the following information at December 31, 2019: What should be the current balance of retained earnings? a. 520,000 b. 580,000 c. 610,000 d. 670,000

- Balance Sheet Calculations Cornerstone Development Companys balance sheet information at the end of 2019 and 2020 is provided in random order, as follows: Additional information: At the end of 2019, (a) the amount of long-term liabilities is twice the amount of current liabilities and (b) there are 2,900 shares of common stock outstanding. During 2020, the company (a) issued 100 shares of common stock for 25 per share, (b) earned net income of 20,600, and (c) paid dividends of 1 per share on the common stock outstanding at year-end. Required: Next Level Fill in the blanks lettered (a) through (p). All of the necessary information is provided. (Hint: It is not necessary to calculate your answers in alphabetical order.)Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1, 000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50, 000 to retire bonds with a face value (and book value) of 50, 000. e. On July 2, 2019, Farrell purchased equipment for 63, 000 cash. f. On December 31, 2019, land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows. (Appendix 21.1) Spreadsheet and Statement Refer to the information for Farrell Corporation in P21-13. Required: 1. Using the direct method for operating cash flows, prepare a spreadsheet to support a 2019 statement of cash flows. (Hint: Combine the income statement and December 31, 2019, balance sheet items for the adjusted trial balance. Use a retained earnings balance of 291,000 in this adjusted trial balance.) 2. Prepare the statement of cash flows. (A separate schedule reconciling net income to cash provided by operating activities is not necessary.)Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1,000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50,000 to retire bonds with a face value (and book value) of 50,000. e. On July 2, 2019, Farrell purchased equipment for 63,000 cash. f. On December 31, 2019. land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows.

- Income Statement and Retained Earnings Huff Company presents the following items derived from its December 31, 2019, adjusted trial balance: The following information is also available for 2019 and is not reflected in the preceding accounts: 1. The common stock has been outstanding all year. A cash dividend of 1.28 per share was declared and paid. 2. Land was sold at a pretax gain of 6,300. 3. Division X (a major component of the company) was sold at a pretax gain of 4,700. It had incurred a 9,500 pretax operating loss during 2019. 4. A tornado, which is an unusual event in the area, caused a 5,400 pretax loss. 5. The income tax rate on all items of income is 30%. 6. The average shareholders equity is 90,000. Required: 1. Prepare a 2019 multiple-step income statement for Huff. 2. Prepare a 2019 retained earnings statement. 3. Compute the 2019 return on common equity (Net Income 4 Average Shareholders Equity).Refer to the information in RE13-11. Assume that on December 31, 2019, the investment in Cornett Company stock has a market value of 10,500. Prepare the year-end journal entry to record the unrealized gain or loss.Athenian Venues Inc. just reported the following selected portion of its financial statements for the end of 2020. Your assistant has already calculated the 2020 end-of-year net operating working capital (NOWC) from the full set of financial statements (not shown here), which is 13 million. The total net operating capital for 2019 was 50 million. What was the 2020 net investment in operating capital? Athenian Venues Inc.: Selected Balance Sheet Information as of December 31 (Millions of Dollars)

- AFN EQUATION Refer to Problem 16-1 and assume that the company had 3 million in assets at the end of 2019. However, now assume that the company pays no dividends. Under these assumptions, what additional funds would be needed for the coming year? Why is this AFN different from the one you found in Problem 16-1?Net Income and Comprehensive Income At the beginning of 2019, JR Companys shareholders equity was as follows: During 2019, the following events and transactions occurred: 1. JR recognized sales revenues of 108,000. It incurred cost of goods sold of 62,000 and operating expenses of 12,000, 2. JR issued 1,000 shares of its 5 par common stock for 14 per share. 3. JR invested 30,000 in available-for-sale securities. At the end of the year, the securities had a fair value of 35,000. 4. JR paid dividends of 6,000. The income tax rate on all items of income is 30%. Required: 1. Prepare a 2019 income statement for JR which includes net income and comprehensive income ignore earnings per share). 2. For 2016 prepare a separate (a) income statement (ignore earnings per share) and (b) statement of comprehensive income.Fisafolia Corporation has gross income from operations of $210,000 and operating expenses of $160,000 for 2019. The corporation also has $30,000 in dividends from publicly traded domestic corporations in which the ownership percentage was 45 percent. Calculate the corporation's dividends received deduction for 2019. $_____________ Assume that instead of $210,000, Fisafolia Corporation has gross income from operations of $135,000. Calculate the corporation's dividends received deduction for 2019. $___________ Assume that instead of $210,000, Fisafolia Corporation has gross income from operations of $158,000. Calculate the corporation's dividends received deduction for 2019. $_____________