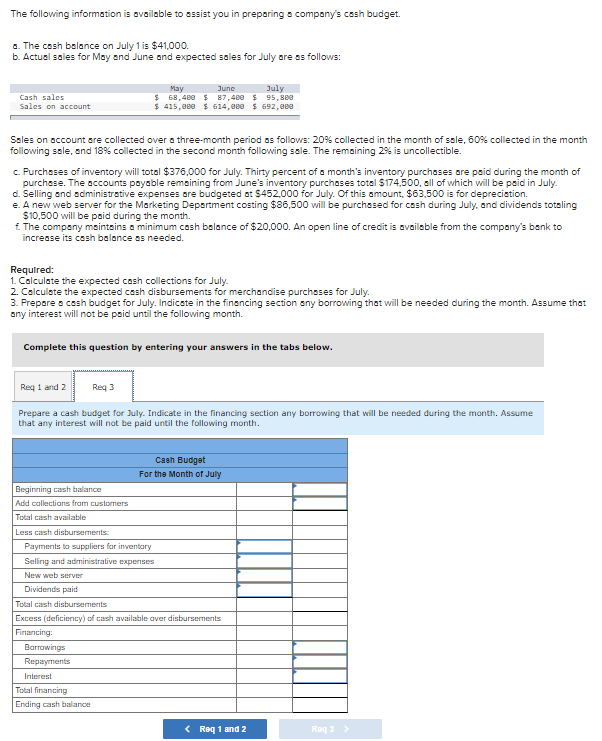

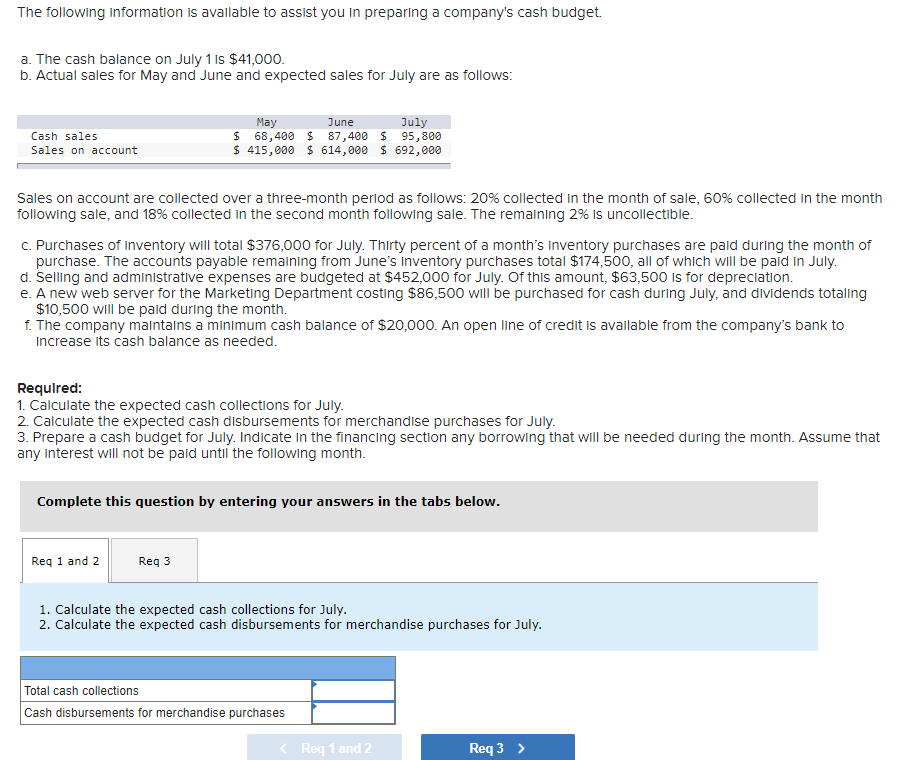

The following information is available to assist you In preparing a company's cash budget. a. The cash balance on July 1 is $41,000. b. Actual sales for May and June and expected sales for July are as follows: July May $ 68,400 $ 87,400 $ 95,800 $ 415,000 $ 614,000 $ 692,000 June Cash sales Sales on account Sales on account are collected over a three-month period as follows: 20% collected in the month of sale, 60% collected in the month following sale, and 18% collected in the second month following sale. The remaining 2% is uncollectible. C. Purchases of inventory will total $376,000 for July. Thirty percent of a month's Inventory purchases are paid during the month purchase. The accounts payable remaining from June's inventory purchases total $174,500, all of which will be paid in July. d. Selling and administrative expenses are budgeted at $452,000 for July. Of this amount, $63,500 Is for depreciation. e. A new web server for the Marketing Department costing $86,500 will be purchased for cash during July, and dividends totaling $10,500 will be paid during the month. f. The company malntalns a minimum cash balance of $20,000. An open line of credit is avallable from the company's bank to Increase its cash balance as needed. Requlred: 1. Calculate the expected cash collections for July. 2. Calculate the expected cash disbursements for merchandise purchases for July. 3. Prepare a cash budget for July. Indicate in the financing section any borrowing that will be needed during the month. Assume that any interest will not be pald until the following month.

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps