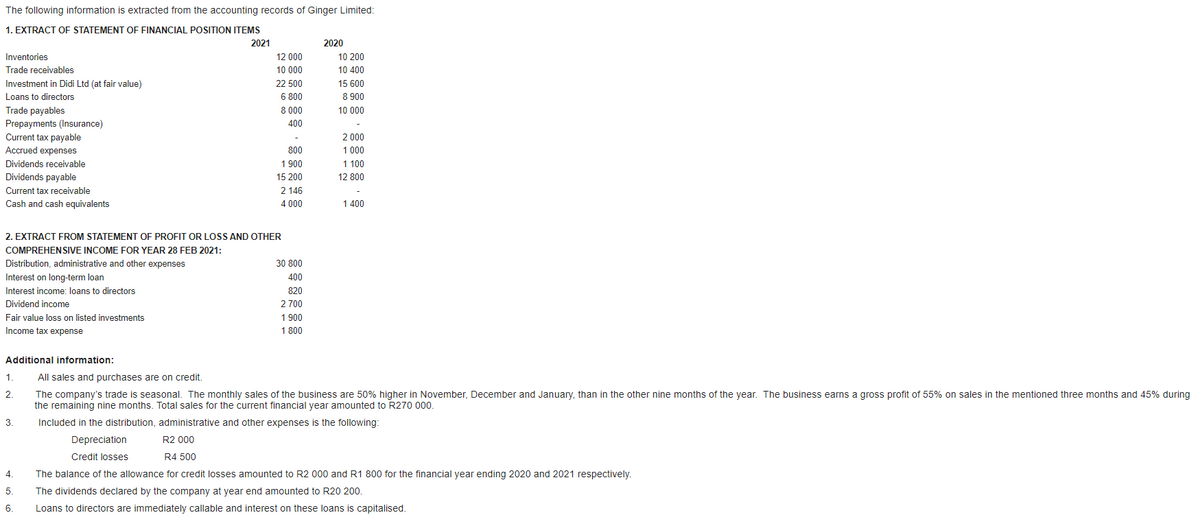

The following information is extracted from the accounting records of Ginger Limited: 1. EXTRACT OF STATEMENT OF FINANCIAL POSITION ITEMS 2021 2020 Inventories Trade receivables Investment in Didi Ltd (at fair value) Loans to directors Trade payables Prepayments (Insurance) Current tax payable Accrued expenses Dividends receivable Dividends payable 12 000 10 200 10 000 10 400 22 500 15 600 6 800 8 900 8 000 10 000 400 2 000 800 1 000 1 900 1 100 15 200 12 800 Current tax receivable 2 146 Cash and cash equivalents 4 000 1 400 2. EXTRACT FROM STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR YEAR 28 FEB 2021: Distribution, administrative and other expenses Interest on long-term loan Interest income: loans to directors Dividend income 30 800 400 820 2 700 Fair value loss on listed investments 1900 Income tax expense 1 800 Additional information: 1. All sales and purchases are on credit. The company's trade is seasonal. The monthly sales of the business are 50% higher in November, December and January, than in the other nine months of the year. The business earns a gross profit of 55% on sales in the mentioned three months and 45% during g nine months. Total sales for the current financial year amounted to R270 000. 3. Included in the distribution, administrative and other expenses is the following: Depreciation R2 000 Credit losses R4 500 4. The balance of the allowance for credit losses amounted to R2 000 and R1 800 for the financial year ending 2020 and 2021 respectively. 5. The dividends declared by the company at year end amounted to R20 200. 5. Loans to directors are immediately callable and interest on these loans is capitalised.

The following information is extracted from the accounting records of Ginger Limited: 1. EXTRACT OF STATEMENT OF FINANCIAL POSITION ITEMS 2021 2020 Inventories Trade receivables Investment in Didi Ltd (at fair value) Loans to directors Trade payables Prepayments (Insurance) Current tax payable Accrued expenses Dividends receivable Dividends payable 12 000 10 200 10 000 10 400 22 500 15 600 6 800 8 900 8 000 10 000 400 2 000 800 1 000 1 900 1 100 15 200 12 800 Current tax receivable 2 146 Cash and cash equivalents 4 000 1 400 2. EXTRACT FROM STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR YEAR 28 FEB 2021: Distribution, administrative and other expenses Interest on long-term loan Interest income: loans to directors Dividend income 30 800 400 820 2 700 Fair value loss on listed investments 1900 Income tax expense 1 800 Additional information: 1. All sales and purchases are on credit. The company's trade is seasonal. The monthly sales of the business are 50% higher in November, December and January, than in the other nine months of the year. The business earns a gross profit of 55% on sales in the mentioned three months and 45% during g nine months. Total sales for the current financial year amounted to R270 000. 3. Included in the distribution, administrative and other expenses is the following: Depreciation R2 000 Credit losses R4 500 4. The balance of the allowance for credit losses amounted to R2 000 and R1 800 for the financial year ending 2020 and 2021 respectively. 5. The dividends declared by the company at year end amounted to R20 200. 5. Loans to directors are immediately callable and interest on these loans is capitalised.

Chapter17: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 47P

Related questions

Question

Transcribed Image Text:The following information is extracted from the accounting records of Ginger Limited:

1. EXTRACT OF STATEMENT OFE FINANCIAL POSITION ITEMS

2021

2020

Inventories

12 000

10 200

Trade receivables

10 000

10 400

Investment in Didi Ltd (at fair value)

22 500

15 600

Loans to directors

6 800

8 900

8 000

Trade payables

Prepayments (Insurance)

Current tax payable

Accrued expenses

10 000

400

2 000

800

1 000

Dividends receivable

1 900

1 100

Dividends payable

15 200

12 800

Current tax receivable

2 146

Cash and cash equivalents

4 000

1 400

2. EXTRACT FROM STATEMENT OF PROFIT OR LOSS AND OTHER

COMPREHENSIVE INCOME FOR YEAR 28 FEB 2021:

Distribution, administrative and other expenses

30 800

Interest on long-term loan

400

Interest income: loans to directors

820

Dividend income

2 700

Fair value loss on listed investments

1 900

Income tax expense

1 800

Additional information:

1

All sales and purchases are on credit.

The company's trade is seasonal. The monthly sales of the business are 50% higher in November, December and January, than in the other nine months of the year. The business earns a gross profit of 55% on sales in the mentioned three months and 45% during

the remaining nine months. Total sales for the current financial year amounted to R270 000.

2.

3.

Included in the distribution, administrative and other expenses is the following:

Depreciation

R2 000

Credit losses

R4 500

4

The balance of the allowance for credit losses amounted to R2 000 and R1 800 for the financial year ending 2020 and 2021 respectively.

5.

The dividends declared by the company at year end amounted to R20 200.

6.

Loans to directors are immediately callable and interest on these loans is capitalised.

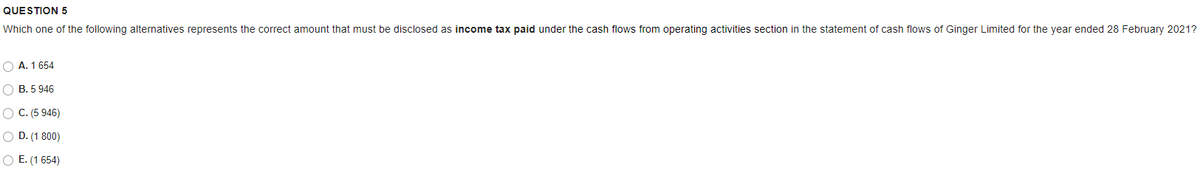

Transcribed Image Text:QUESTION 5

Which one of the following alternatives represents the correct amount that must be disclosed as income tax paid under the cash flows from operating activities section in the statement of cash flows of Ginger Limited for the year ended 28 February 2021?

O A. 1 654

O B. 5 946

O C. (5 946)

O D. (1 800)

O E. (1 654)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT