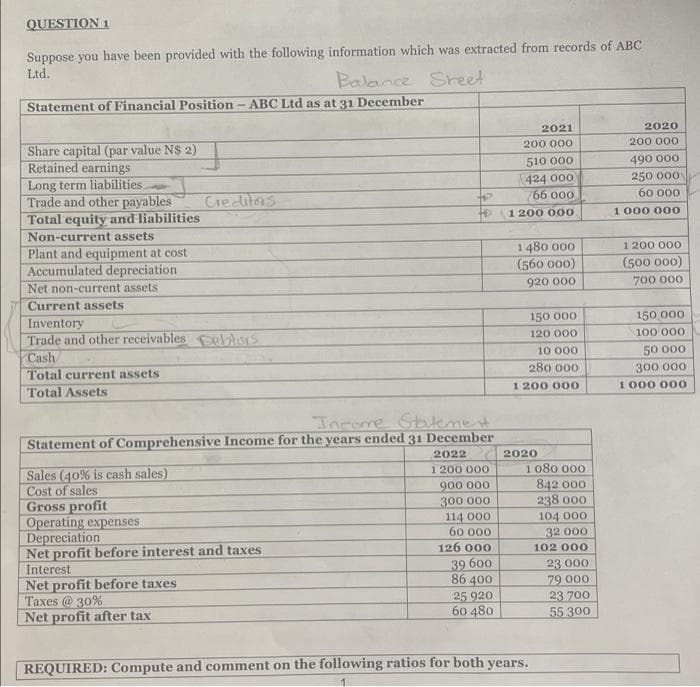

Suppose you have been provided with the following information which was extracted from records of ABC Ltd. Balance Sheet Statement of Financial Position - ABC Ltd as at 31 December 2021 2020 200 000 200 000 Share capital (par value N$ 2) Retained earnings Long term liabilities. 510 000 490 000 424 000 250 000 Creditas Trade and other payables Total equity and liabilities 66 000 1200 000. 60 000 1 000 000 Non-current assets 1480 000 1 200 000 Plant and equipment at cost Accumulat depreciation (560 000) (500 000) Net non-current assets 920 000 700 000 Current assets Inventory 150 000 150 000 Trade and other receivables obs 120.000 100 000 Cash 10 000 50.000 300 000 Total current assets 280 000 Total Assets 1 200 000 1 000 000 Income Statement Statement of Comprehensive Income for the years ended 31 December 2022 2020 Sales (40% is cash sales) 1 200 000 1080 000 Cost of sales 900 000 842.000 Gross profit 300 000 238 000 Operating expenses 114 000 104 000 Depreciation 60 000 32 000 Net profit before interest and taxes 126 000 102 000 Interest 39 600 23 000 Net profit before taxes 86 400 79 000 Taxes @ 30% 25 920 23 700 Net profit after tax 60 480 55 300 REQUIRED: Compute and comment on the following ratios for both years. to H

Suppose you have been provided with the following information which was extracted from records of ABC Ltd. Balance Sheet Statement of Financial Position - ABC Ltd as at 31 December 2021 2020 200 000 200 000 Share capital (par value N$ 2) Retained earnings Long term liabilities. 510 000 490 000 424 000 250 000 Creditas Trade and other payables Total equity and liabilities 66 000 1200 000. 60 000 1 000 000 Non-current assets 1480 000 1 200 000 Plant and equipment at cost Accumulat depreciation (560 000) (500 000) Net non-current assets 920 000 700 000 Current assets Inventory 150 000 150 000 Trade and other receivables obs 120.000 100 000 Cash 10 000 50.000 300 000 Total current assets 280 000 Total Assets 1 200 000 1 000 000 Income Statement Statement of Comprehensive Income for the years ended 31 December 2022 2020 Sales (40% is cash sales) 1 200 000 1080 000 Cost of sales 900 000 842.000 Gross profit 300 000 238 000 Operating expenses 114 000 104 000 Depreciation 60 000 32 000 Net profit before interest and taxes 126 000 102 000 Interest 39 600 23 000 Net profit before taxes 86 400 79 000 Taxes @ 30% 25 920 23 700 Net profit after tax 60 480 55 300 REQUIRED: Compute and comment on the following ratios for both years. to H

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter14: Financial Statement Analysis

Section: Chapter Questions

Problem 14.6BE

Related questions

Question

Plz help me

I give ????

Transcribed Image Text:QUESTION 1

Suppose you have been provided with the following information which was extracted from records of ABC

Ltd.

Balance Sheet

Statement of Financial Position - ABC Ltd as at 31 December

2021

2020

200 000

200 000

Share capital (par value N$ 2)

Retained earnings

510 000

490 000

Long term liabilities.

424 000

250 000

Creditors

66 000

Trade and other payables

Total equity and liabilities

60 000

1 000 000

1 200 000.

Non-current assets

1480 000

Plant and equipment at cost

Accumulated depreciation

Net non-current assets.

1 200 000

(500 000)

(560 000)

920 000

700 000

Current assets

Inventory

150 000

150 000

Trade and other receivables oblisys.

120.000

Cash

10 000

280 000

100 000

50.000

300 000

Total current assets

Total Assets

1 200 000

1 000 000

Income Statement

Statement of Comprehensive Income for the years ended 31 December

2022

2020

Sales (40% is cash sales)

1 200 000

Cost of sales

1080 000

842 000

900 000

Gross profit

300 000

238 000

Operating expenses

114 000

104 000

Depreciation

60 000

32 000

Net profit before interest and taxes

126 000

102 000

Interest

39 600

23 000

Net profit before taxes

79 000

86 400

25 920

Taxes @ 30%

23 700

Net profit after tax

60 480

55 300

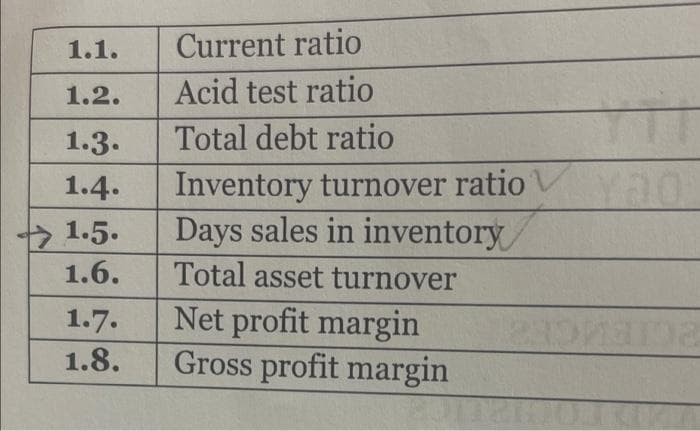

REQUIRED: Compute and comment on the following ratios for both years.

1

HP

Ho

Transcribed Image Text:1.1.

1.2.

1.3.

1.4.

1.5.

1.6.

1.7.

1.8.

Current ratio

Acid test ratio

Total debt ratio

Inventory turnover ratio

Days sales in inventory

Total asset turnover

Net profit margin

Gross profit margin

20

para

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning