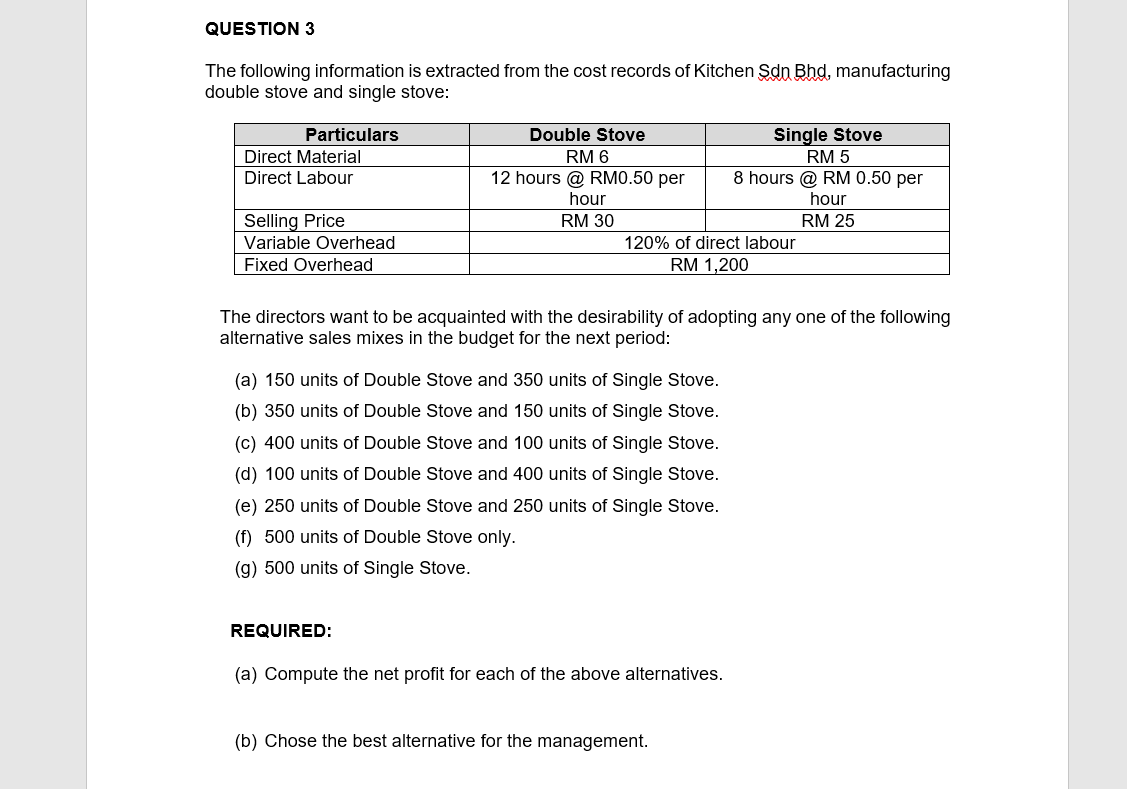

The following information is extracted from the cost records of Kitchen Sdn Bhd, manufacturing double stove and single stove: Particulars Double Stove Single Stove Direct Material RM 6 RM 5 Direct Labour 12 hours @ RMO.50 per 8 hours @ RM 0.50 per hour RM 25 hour Selling Price RM 30 Variable Overhead 120% of direct labour Fixed Overhead RM 1,200 The directors want to be acquainted with the desirability of adopting any one of the following alternative sales mixes in the budget for the next period: (a) 150 units of Double Stove and 350 units of Single Stove. (b) 350 units of Double Stove and 150 units of Single Stove. (c) 400 units of Double Stove and 100 units of Single Stove. (d) 100 units of Double Stove and 400 units of Single Stove. (e) 250 units of Double Stove and 250 units of Single Stove. (f) 500 units of Double Stove only. (g) 500 units of Single Stove. REQUIRED: (a) Compute the net profit for each of the above alternatives. (b) Chose the best alternative for the management.

The following information is extracted from the cost records of Kitchen Sdn Bhd, manufacturing double stove and single stove: Particulars Double Stove Single Stove Direct Material RM 6 RM 5 Direct Labour 12 hours @ RMO.50 per 8 hours @ RM 0.50 per hour RM 25 hour Selling Price RM 30 Variable Overhead 120% of direct labour Fixed Overhead RM 1,200 The directors want to be acquainted with the desirability of adopting any one of the following alternative sales mixes in the budget for the next period: (a) 150 units of Double Stove and 350 units of Single Stove. (b) 350 units of Double Stove and 150 units of Single Stove. (c) 400 units of Double Stove and 100 units of Single Stove. (d) 100 units of Double Stove and 400 units of Single Stove. (e) 250 units of Double Stove and 250 units of Single Stove. (f) 500 units of Double Stove only. (g) 500 units of Single Stove. REQUIRED: (a) Compute the net profit for each of the above alternatives. (b) Chose the best alternative for the management.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter3: Cost Behavior And Cost Forecasting

Section: Chapter Questions

Problem 69P: (Appendix 3A) Separating Fixed and Variable Costs, Service Setting Louise McDermott, controller for...

Related questions

Question

Transcribed Image Text:QUESTION 3

The following information is extracted from the cost records of Kitchen Sdn Bhd, manufacturing

double stove and single stove:

Particulars

Double Stove

Single Stove

Direct Material

Direct Labour

RM 6

RM 5

12 hours @ RMO.50 per

8 hours @ RM 0.50 per

hour

hour

Selling Price

RM 30

RM 25

Variable Overhead

120% of direct labour

Fixed Overhead

RM 1,200

The directors want to be acquainted with the desirability of adopting any one of the following

alternative sales mixes in the budget for the next period:

(a) 150 units of Double Stove and 350 units of Single Stove.

(b) 350 units of Double Stove and 150 units of Single Stove.

(c) 400 units of Double Stove and 100 units of Single Stove.

(d) 100 units of Double Stove and 400 units of Single Stove.

(e) 250 units of Double Stove and 250 units of Single Stove.

(f) 500 units of Double Stove only.

(g) 500 units of Single Stove.

REQUIRED:

(a) Compute the net profit for each of the above alternatives.

(b) Chose the best alternative for the management.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning