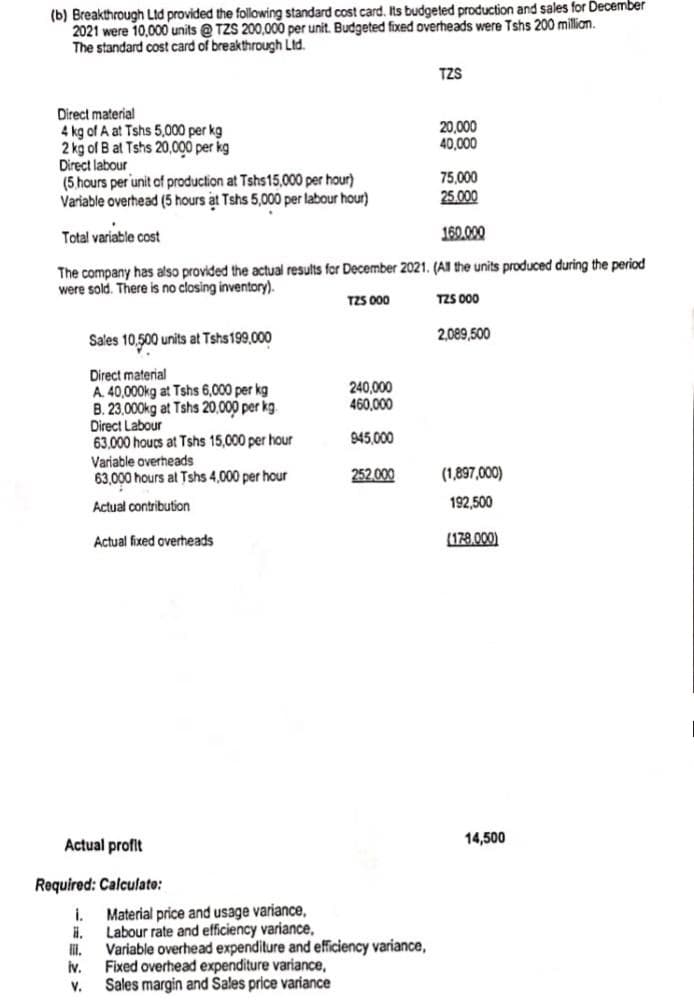

(b) Breakthrough Ltd provided the following standard cost card. Its budgeted production and sales for DecembeI 2021 were 10,000 units @ TZS 200,000 per unit. Budgeted fixed overheads were Tshs 200 million. The standard cost card of breakthrough Ltd. TZS Direct material 4 kg of A at Tshs 5,000 per kg 2 kg of B at Tshs 20,000 per kg Direct labour (5 hours per unit of production at Tshs15,000 per hour) Variable overhead (5 hours at Tshs 5,000 per labour hour) 20,000 40,000 75,000 25.000 Total variable cost 160.000 The company has also provided the actual results for December 2021. (Al the units produced during the period were sold. There is no closing inventory). TZS 000 TZS 000 2,089,500 Sales 10,500 units at Tshs199,000 Direct material A. 40,000kg at Tshs 6,000 per kg B. 23.000kg at Tshs 20,000 per kg Direct Labour 63,000 houcs at Tshs 15,000 per hour Variable overheads 63,000 hours at Tshs 4,000 per hour 240,000 460,000 945,000 252.000 (1,897,000) Actual contribution 192,500 Actual fixed overheads (178.000) Actual profit 14,500 Required: Calculato: i. Material price and usage variance, H. Labour rate and efficiency variance, lil. Variable overhead expenditure and efficiency variance, Fixed overhead expenditure variance, iv. Sales margin and Sales price variance V.

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Step by step

Solved in 4 steps