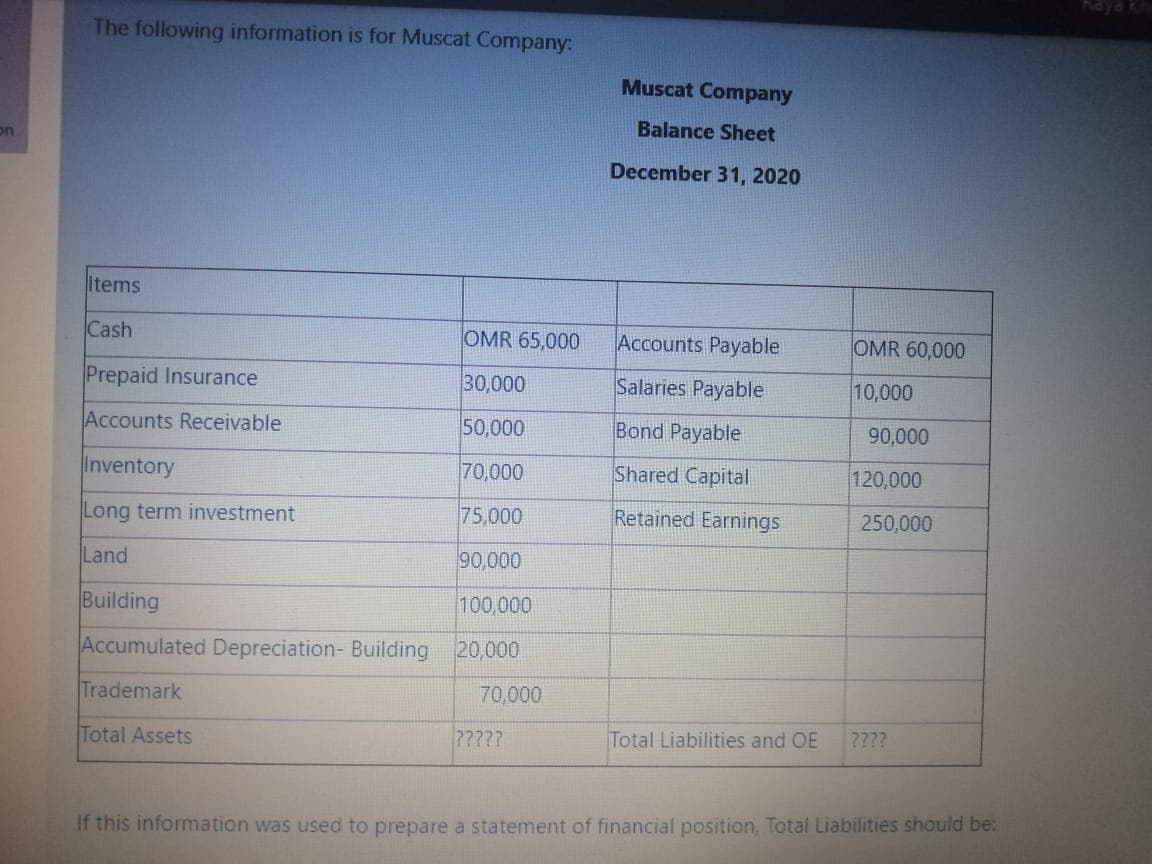

The following information is for Muscat Company: Muscat Company Balance Sheet December 31, 2020 Items Cash OMR 65,000 Accounts Payable OMR 60,000 Prepaid Insurance 30,000 Salaries Payable 10,000 Accounts Receivable 50,000 Bond Payable 90,000 Inventory 70,000 Shared Capital 120,000 Long term investment 75,000 Retained Earnings 250,000 Land 90,000 Building 100,000 Accumulated Depreciation- Building 20,000 Trademark 70,000 Total Assets 7???? Total Liabilities and OE 7??? If this information was used to prepare a statement of financial position, Total Liabilities should be:

Q: The following are the statement of financial position of Abok Ltd. As at 31 December 2019 and 2020…

A: Cash Flow Statement - It refers to the statement that shows inflows and outflows of cash in concern…

Q: AGT Inc., had the following condensed Statement of Financial Position (Balance Sheet) at the end of…

A: New Capital=Capital 2019+Addition=$75,000+$10,000=$85,000

Q: ncome tax payable 9,000 Work in process 36,000 Share Capital 500,000 Raw materials 52,000 Retained…

A: As per rule, allowed to answer three subparts and post the remaining in the next submission.

Q: Prepare the balance sheet of UCLA Ltd. ( the figures are in $ and as on 31 December 2019.) General…

A: Balance sheet of the business shows all assets, liabilities and equity of the business as on…

Q: The following is the summarized statement of financial position Malover Ltd at 31 December 2019 and…

A: In financial accounting, a cash flow statement is a statement that shows the amount of cash and cash…

Q: The information below was taken from the records of the Piper Company for the year ended December…

A: Statement of cash flows is a statement which shows all cash inflows and cash outflows of the…

Q: resented below is the balance sheet for HHD, Inc., at December 31, 2021. Current assets $…

A: Financial statements are the set of records of the financial transactions and position of a business…

Q: The following is the summarized statement of financial position Malover Ltd at 31 December 2019 and…

A: There are 2 methods to calculate cash flow from operating activities:- Direct method; Indirect…

Q: Required Prepare the statement of comprehensive income for the year ended 31 October 2020 for…

A: Comprehensive income: Comprehensive income can be defined as the change in the assets of the…

Q: The following balances were taken from the books of Pronghorn Limited on December 31, 2020:…

A: The question is based on the concept of Financial Accounting.

Q: Balance Sheet December 31, 2020 LIABILITIES AND SHAREHOLDER'S ASSETS EQUITY Current assets Current…

A: Ratio analysis is the analysis made on the basis of balance sheet and income statements of the…

Q: amison Corp.'s balance sheet accounts as of December 31, 2021 and 2020 and information relating to…

A: Cash Flow from Financing Activities includes all transactions involving raising of funds to finance…

Q: The 2021 balance sheet for Hallbrook Industries, Inc., is shown below. HALLBROOK INDUSTRIES, INC.…

A: Particulars Amount Cash $200 Short-term investments 150 Accounts receivable 200 Quick Assets…

Q: The following balance sheet for the Hubbard Corporation was prepared by the company: HUBBARD…

A: Balance Sheet includes: Assets accounts Liabilities accounts Shareholder's equity accounts As per…

Q: 1.Positivity Company provided the following information on December 31, 2020 ( in their normal…

A: Assets section of balance sheet can be categorized in two parts, current assets or non-current…

Q: The income and expense accounts of Rosie Corp. for the year ended 2019 are listed below. Sales…

A: Total Profit = Total Revenue - Total Expenses

Q: Positivity Company provided the following information on December 31, 2020 ( in their normal…

A: Current assets: These include all the assets of the business that can be converted into cash within…

Q: The income and expense accounts of Rosie Corp. for the year ended 2019 are listed below. Sales…

A: Statement of owner's equity gives information about the changes in the owner's capital account.…

Q: On December 31, 2019, Clean and White Linen Supplies Ltd. had the following account balances: Cash…

A: Cash Account Particulars Amount Particulars Amount Balance b/d $90,000 Insurance Premium…

Q: Prepare The Statement of Financial Position for 2020

A: Statement of financial position shows the assets and liabilities of the business as on a particular…

Q: The following balances were taken from the books of Schimank Corp. on December 31, 2020:…

A: The income statement is a financial statement that represents the financial performance of the…

Q: What is the total current assets? *

A: The current assets are all those assets that are either in the form of cash or can be converted into…

Q: Prepare a 2018 balance sheet for Rogers Corp. based on the following information: Cash $490,000;…

A: Common Stock - Common Stock is the shares issued to the shareholders. There are two types of stock…

Q: Grant Wood Corporation’s balance sheet at the end of 2019 included the following items. Current…

A: a.

Q: The balance sheets for Cosmic Company showed the following information. Additional information…

A: The cash flow statement is prepared to adjust the cash inflow and outflow during the period.

Q: The comparative balance sheets for Crane Company as of December 31 are presented below. Crane…

A: A cash flow statement is a monetary statement that shows how much cash and cash equivalents are…

Q: Sheffield Corp.’s statement of financial position at the end of 2019 included the following items:…

A: Cash Flow Statement is an account prepared in the end of financial year to calculate the amount of…

Q: The balance sheet of Simpson Ltd at 30 June 2021 was as follows: Simpson Ltd Balance Sheet as at 30…

A: The total shareholders equity section is prepared in the balance sheet of a company. Under this…

Q: The following accounts are extracted from the books of X Inc. on December 31, 2020: Account…

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: The current asset section of Guardian Consultant’s balance sheet consists of cash, accounts…

A:

Q: AGT Inc., had the following condensed Statement of Financial Position (Balance Sheet) at the end of…

A: In the above question we have given closing balance of balance sheet items as on December 31,2019…

Q: The following information is from Best Ltd's Statement of Financial Position as at 30 June 2020:…

A: Cash Receipts from customers is the cash received from the sales to the customers. This calculated…

Q: Bonita Corporation’s balance sheet at the end of 2019 included the following items. Current assets…

A: Balance sheet is one of the financial statement that is being prepared by business for the purpose…

Q: ACcouRing information from the records of the Sarah Jane's Clothing Corporation at the end of 2020…

A: Cash Flow from operating activities is $98,500 refer step 2 for calculation and format

Q: Prepare a classified balance sheet in good form. Common stock authorized was 400,000 shares, and…

A: Balance Sheet: Balance Sheet summarizes the assets, the liabilities, and the Shareholder's equity…

Q: Gold Company provided the following trial balance on December 31, 2019: Cash overdraft P100,000…

A: Current liabilities: Liabilities that have to be paid within one year or one operating cycle,…

Q: Given below are the balances of accounts of Kriss Bhd as at 31 December 2019 and 31 December 2020.…

A: Kriss Bhd…

Q: Presented below are the financial statements of Swifty Corporation. Swifty Corporation Comparative…

A: An financial gain clarification could be a business report that proides ttal information with regrd…

Q: Prepare the balance sheet of UCLA Ltd. ( the figures are in $ and as on 31 December 2019. General…

A: The financial statement is an organized and summarized detailed information about the financial…

Q: On July 1, 2020, Flounder Corporation purchased Young Company by paying $261,000 cash and issuing a…

A: Amortization expense = (Fair Value of Trademarks - Residual Value) / 4 * (6/12) Amortization expense…

Q: The balance sheet of San Juanico Company as of December 31, 2022 is as follows: Assets…

A: Consolidated goodwill: According to IFRS 3, the computation of goodwill or gain on acquisition at…

Q: Presented below are a number of balance sheet items for Montoya, Inc. for the current year, 2020.…

A: Classified balance sheet: A balance sheet in which assets, liabilities, and shareholders’ equity is…

Q: The January 31, 2020 balance sheet of Miko Corporation shows the following information: P8,000 Cash…

A: A Cash Budget depicts the cash receipts and cash payments for the period. It helps the company to…

Q: The balance sheet of Kishwaukee Corporation as of December 31, 2020, is as follows. Kishwaukee…

A: Balance sheet: This financial statement reports a company’s resources (assets) and claims of…

Q: Presented below are a number of balance sheet items for Montoya, Inc. for the current year, 2020.…

A: Balance Sheet: Balance Sheet is one of the financial statements which summarize the assets, the…

Q: Positivity Company provided the following information on December 31, 2020 ( in their normal…

A: Current asset are the assets which can be easily converted into liquidity within one year. Such…

Q: The balance sheet of Evergreen Company at June 30, 2012 contains the following items: Assets…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: The following balances were taken from the books of Alonzo Corp. on December 31, 2020. Interest…

A: The income statement is one of the essential part of the financial statements used for reporting the…

Step by step

Solved in 2 steps with 2 images

- Leverage Cook Corporation issued financial statements at December 31, 2019, that include the following information: Balance sheet at December 31,2019 Assets $8,000,000 Liabilities $1,200,000 Stockholders' equity (300,000 shares) $6,800,000 Income statement for 2019: Income from operations $1,200,000 Less: Interest expense (100,000) Income before taxes $1,100,000 Less: Income taxes expense (0,30) (330,000) Net income $ 770,000 The levels of assets, liabilities, stockholders' equity, and operating income have been stable in recent years; however, Cook Corporation is planning a 51,800,000 expansion program that will increase income from operations by $350,000 to $1,550,000, Cook is planning to sell 8.5% notes at par to finance the expansion. Required: What earnings per share does Cook report before the expansion?Begin with the partial model in the file Ch02 P21 Build a Model.xlsx on the textbooks Web site. a. Using the financial statements shown here for Lan Chen Technologies, calculate net operating working capital, total net operating capital, net operating profit after taxes, free cash flow, and return on invested capital for 2020. The federal-plus-state tax rate is 25%. b. Assume there were 15 million shares outstanding at the end of 2019, the year-end closing stock price was 65 per share, and the after-tax cost of capital was 10%. Calculate EVA and MVA for 2020. Lan Chen Technologies: Income Statements for Year Ending December 31 (Millions of Dollars) Lan Chen Technologies: December 31 Balance Sheets (Thousands of Dollars)From the following forecast the Balance sheet for the year 2021Balance sheet as of 31/12/2020Liabilities& Equity AmountAssetsAmountEquity33,000 Plant and machinery 10,000Retained earnings 10,000 Land Property20.000Accounts payable 7,000 Accounts receivables 3.000Inventories10.000Cash in hand2000Cash at Bank5.00050,00050,0001. It is expected that the company will make a net income of10% of forecasted sales2. The company will purchase additional 5000 OMR worthmachines by taking an additional loan of 5000 OMR3. Forecasted sales OMR 100,0004. Dividend payout will be 50%5. The following estimates are also given;Accounts payable 10,000Accounts receivable 6,000Inventories 15,000Cash in hand 6.000Cash at bank 1,000

- The comparative balance sheets for Metlock Corporation show the following information. December 312020 2019Cash $33,500 $12,900Accounts receivable 12,400 10,000Inventory 12,100 9,000Available-for-sale debt investments –0– 3,000Buildings –0– 29,800Equipment 44,800 19,900Patents 5,000 6,300 $107,800 $90,900Allowance for doubtful accounts $3,100 $4,500Accumulated depreciation—equipment 2,000 4,500Accumulated depreciation—building –0– 6,000Accounts payable 5,000 3,000Dividends payable –0– 4,900Notes payable, short-term (nontrade) 3,000 4,100Long-term notes payable 31,000 25,000Common stock 43,000 33,000Retained earnings 20,700 5,900 $107,800 $90,900 Additional data related to 2020 are as follows. 1. Equipment that had cost $11,000 and was 40% depreciated at time of disposal was sold for $2,500.2. $10,000 of the long-term note payable was paid by issuing common stock.3. Cash dividends paid were $4,900.4. On January…A comparative balance sheet for Gena Company appears below:GENA COMPANYComparative Balance SheetDec. 31, 2021 Dec. 31, 2020AssetsCash $ 34,000 $11,000Accounts receivable 21,000 13,000Inventory 35,000 17,000Prepaid expenses 6,000 9,000Long-term investments -0- 17,000Equipment 60,000 33,000Accumulated depreciation—equipment (20,000) (15,000)Total assets $136,000 $85,000Liabilities and Stockholders' EquityAccounts payable $ 17,000 $ 7,000Bonds payable 36,000 45,000Common stock 53,000 23,000Retained earnings 30,000 10,000Total liabilities and stockholders' equity $136,000 $85,000Additional information:1. Net income for the year ending December 31, 2021 was $35,000.2. Cash dividends of $15,000 were declared and paid during the year.3. Long-term investments that had a cost of $17,000 were sold for $14,000.4. Depreciation expense for the year was $5,000.InstructionsPrepare a full statement of cash flows for the year ended December 31, 2021, using the indirectmethod.Some selected financial statement items belonging to MNO Company are given in the table below. According to this information, which of the following is Return on Assets (ROA) in 2021? Inventory 12,500Total Assets in 2021 110,000Current Liabilities 40,000Total Assets in 2020 90,000Net Profit 12,000Shareholders' Equity 65,000 Select one:a. 0.12b. 0.10c. 0.18d. 0.13

- Pharoah Corporation’s comparative balance sheet is presented below. PHAROAH CORPORATIONBalance SheetDecember 31 Assets 2021 2020 Cash $12,010 $8,980 Accounts receivable 17,810 19,660 Land 16,800 21,840 Buildings 58,800 58,800 Accumulated depreciation—buildings (12,600 ) (8,400 ) Total $92,820 $100,880 Liabilities and Shareholders’ Equity Accounts payable $10,390 $26,120 Common shares 63,000 57,960 Retained earnings 19,430 16,800 Total $92,820 $100,880 Additional information: 1. Profit was $19,010. Dividends declared and paid were $16,380. 2. No noncash investing and financing activities occurred during 2021. 3. The land was sold for cash of $4,120 resulting in a loss of $920 on the sale of the land. Prepare a cash flow statement for 2021 using the indirect method. Lu…Here is comparative balance sheet for 2021 and 2022, stating each asset as a percent of total assests and each liability and stockholders' equity item as a percent of the total liabilities and stockholders' equity. 2020 (%) 2021 (%) Assets Cash 43,500 8.84 55,000 14.25 Inventory 22,000 4.47 23,500 6.09 Equipment and fixures 380,000 77.24 255,000 66.08 Supplies 3,800 0.77 4,100 1.06 Prepaid expenses 9,200 1.87 12,500 3.24 Store design/Buildout 27,000 5.49 27,000 7.00 Loan Fee 4,000 0.81 5,500 1.42 Advertising and Marketing 2,500 0.51 3,300 0.86 Total assets 492,000 100.00 385,900 100.00 Bank Loan 150,000 30.49 170,000 44.05 Other liability (Balancing figure) 292,000 59.35 170,900 44.29 Owner contribution 50,000 10.16 45,000 11.66 Total equity and liability 492,000 100.00 385,900 100.00 Please explain or make an assumption of the figureUsing the information provided below:Rubialac PaintsSelected Income Statement Items, 2020Cash Sales $2,500,000Credit Sales $9,500,000Total Sales $12,000,000COGS 7,000,000 Rubialac PaintsSelected Balance Sheet Accounts12/31/2020 12/31/19 ChangeAccounts Receivable $550,000 $400,000 $150,000Inventory $275,000 $250,000 $25,000Accounts Payable $150,000 $110,000 $40,000 What is the inventory turnover for Rubialac Paints? What is the average production cycle for the firm? What is the average collection cycle? What could Eagle Paints do to reduce the average collection cycle?

- The 2018 balance sheet for Hallbrook Industries, Inc., is shown below.HALLBROOK INDUSTRIES, INC.Balance SheetDecember 31, 2018($ in thousands)AssetsCash $ 200Short-term investments 150Accounts receivable 200Inventories 350Property, plant, and equipment (net) 1,000Total assets $1,900Liabilities and Shareholders’ EquityCurrent liabilities $ 400Long-term liabilities 350Paid-in capital 750Retained earnings 400Total liabilities and shareholders’ equity $1,900The company’s 2018 income statement reported the following amounts ($ in thousands):Net sales $4,600Interest expense 40Income tax expense 100Net income 160Required:Determine the following ratios for 2018:1. Current ratio2. Acid-test ratio3. Debt to equity ratio4. Times interest earned ratioOn May 2, 2022, the separate statement of financial position of Peter Corporation and Simon Company are as follows: Peter Simon Cash 145,700 15,000 Accounts receivable 120,500 35,800 Inventories 42,500 10,200 Plant assets 185,800 78,000 Total assets 494,500 139,000 Liabilities 110,400 28,800 Capital stock, P100 par 200,000 50,000 Additional paid-in capita l 50,000 0Retained earnings 134,100 60,700 Total liabilities and equity 494,500 139,500 On May 2, 2022 Peter acquired 90% of Simon's outstanding voting shares for P108,000. Peter incurred additional P32,000 in acquisition- related costs. All the assets of Simon are fairly valued except the plant assets with a fair value of P90,000 on…Jamison Corp.'s balance sheet accounts as of December 31, 2021 and 2020 and information relating to 2021 activities are presented below. December 31, 2021 2020 AssetsCash $ 440,000 $ 200,000Short-term investments 600,000 —Accounts receivable (net) 1,020,000 1,020,000Inventory 1,380,000 1,200,000Long-term investments 400,000 600,000Plant assets 3,400,000 2,000,000Accumulated depreciation (900,000)…