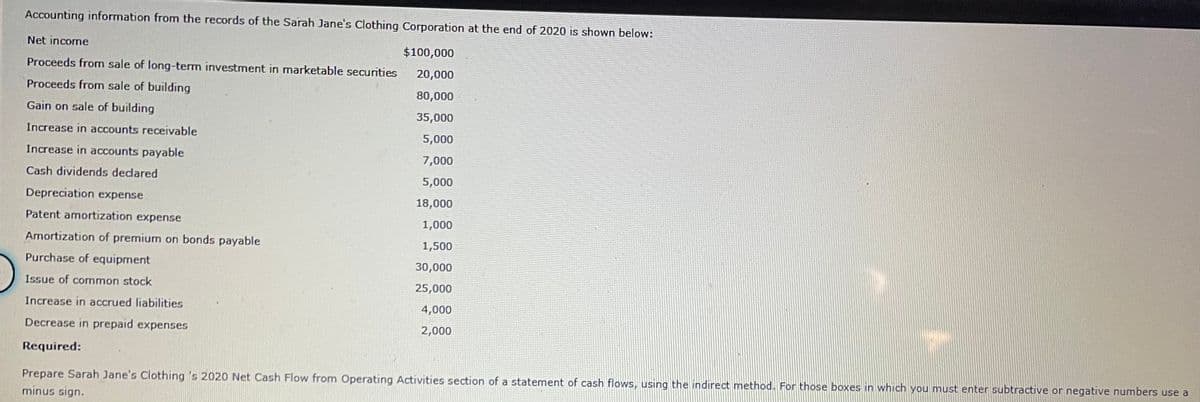

ACcouRing information from the records of the Sarah Jane's Clothing Corporation at the end of 2020 is shown below: Net income $100,000 Proceeds from sale of long-term investment in marketable securities 20,000 Proceeds from sale of building 80,000 Gain on sale of building 35,000 Increase in accounts receivable 5,000 Increase in accounts payable 7,000 Cash dividends dedared 5,000 Depreciation expense 18,000 Patent amortization expense 1,000 Amortization of premium on bonds payable 1,500 Purchase of equipment 30,000 Issue of common stock 25,000 Increase in accrued liabilities 4,000 Decrease in prepaid expenses 2,000 Required: Prepare Sarah Jane's Clothing 's 2020 Net Cash Flow from Operating Activities section of a statement of cash flows, using the indirect method. For those boxes in which you must enter subtractive or negative numbers use a minus sign.

ACcouRing information from the records of the Sarah Jane's Clothing Corporation at the end of 2020 is shown below: Net income $100,000 Proceeds from sale of long-term investment in marketable securities 20,000 Proceeds from sale of building 80,000 Gain on sale of building 35,000 Increase in accounts receivable 5,000 Increase in accounts payable 7,000 Cash dividends dedared 5,000 Depreciation expense 18,000 Patent amortization expense 1,000 Amortization of premium on bonds payable 1,500 Purchase of equipment 30,000 Issue of common stock 25,000 Increase in accrued liabilities 4,000 Decrease in prepaid expenses 2,000 Required: Prepare Sarah Jane's Clothing 's 2020 Net Cash Flow from Operating Activities section of a statement of cash flows, using the indirect method. For those boxes in which you must enter subtractive or negative numbers use a minus sign.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 2MC: During 2021, Anthony Company purchased debt securities as a long-term investment and classified them...

Related questions

Question

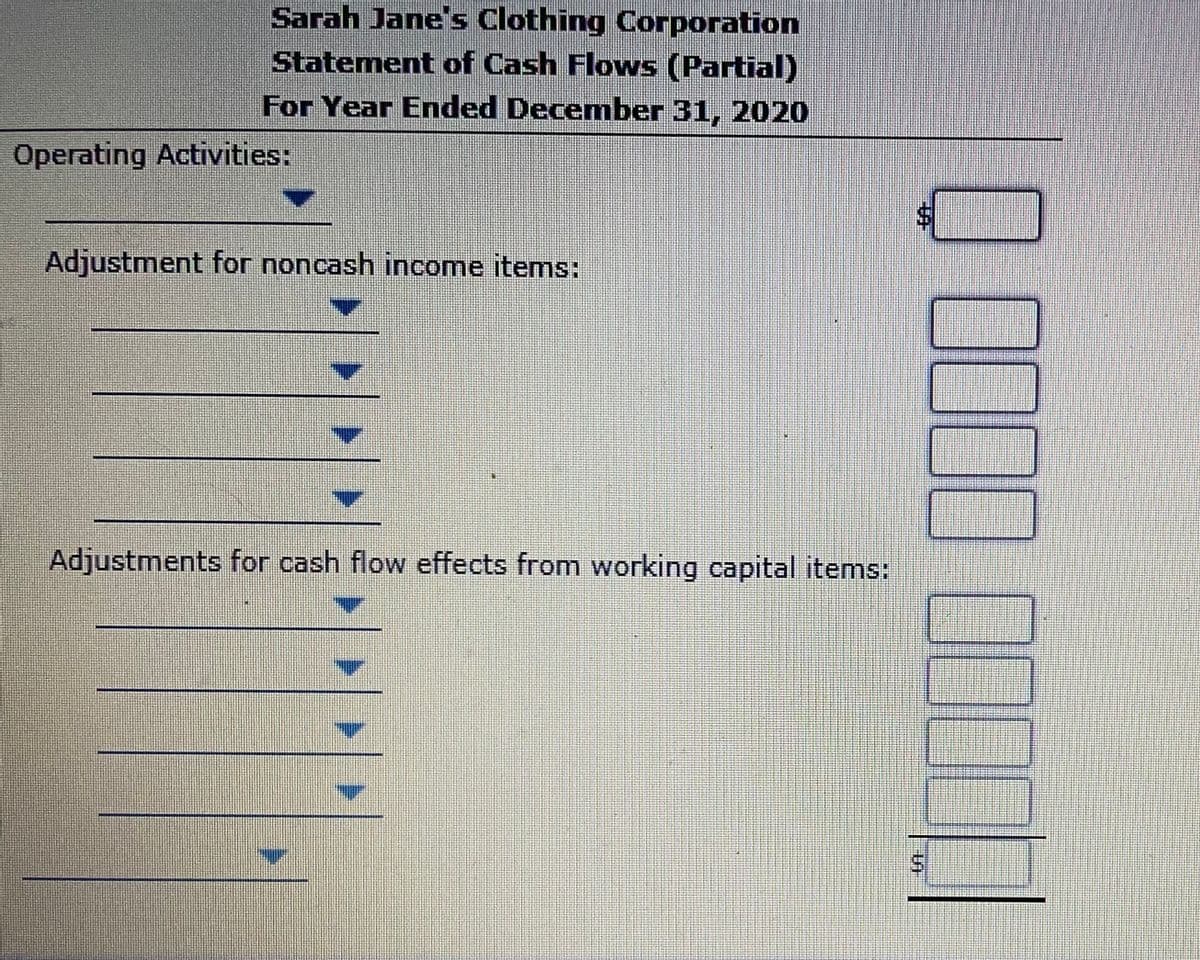

Transcribed Image Text:Sarah Jane's Clothing Corporation

Statement of Cash Flows (Partial)

For Year Ended December 31, 2020

Operating Activities:

Adjustment for noncash income items:

Adjustments for cash flow effects from working capital items:

%24

Transcribed Image Text:Accounting information from the records of the Sarah Jane's Clothing Corporation at the end of 2020 is shown below:

Net income

$100,000

Proceeds from sale of long-term investment in marketable securities

20,000

Proceeds from sale of building

80,000

Gain on sale of building

35,000

Increase in accounts receivable

5,000

Increase in accounts payable

7,000

Cash dividends dedared

5,000

Depreciation expense

18,000

Patent amortization expense

1,000

Amortization of premium on bonds payable

1,500

Purchase of equipment

30,000

Issue of common stock

25,000

Increase in accrued liabilities

4,000

Decrease in prepaid expenses

2,000

Required:

Prepare Sarah Jane's Clothing 's 2020 Net Cash Flow from Operating Activities section of a statement of cash flows, using the indirect method. For those boxes in which you must enter subtractive or negative numbers use a

minus sign.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT