You have been asked to prepare a December cash budget for Ashton Company, a distributor of exercise equipment. The following information is available about the company's operations: a. The cash balance on December 1 is $40,000. b. Actual sales for October and November and expected sales for December are as follows: Cash sales Sales on account October $ 65,000 $ 400,000 November $ 70,000 $ 525,000 December $ 83,000 $ 600,000 Sales on account are collected over a three-month period as follows: 20% collected in the month of sale, 60% collected in the month following sale, and 18% collected in the second month following sale. The remaining 2% is uncollectible. c. Purchases of inventory will total $280,000 for December. Thirty percent of a month's inventory purchases are paid during the month of purchase. The accounts payable remaining from November's inventory purchases total $161,000, all of which will be paid in December. d. Selling and administrative expenses are budgeted at $430,000 for December. Of this amount, $50,000 is for depreciation. e. A new web server for the Marketing Department costing $76,000 will be purchased for cash during December, and dividends totaling $9,000 will be paid during the month. f. The company maintains a minimum cash balance of $20,000. An open line of credit is available from the company's bank to

You have been asked to prepare a December cash budget for Ashton Company, a distributor of exercise equipment. The following information is available about the company's operations: a. The cash balance on December 1 is $40,000. b. Actual sales for October and November and expected sales for December are as follows: Cash sales Sales on account October $ 65,000 $ 400,000 November $ 70,000 $ 525,000 December $ 83,000 $ 600,000 Sales on account are collected over a three-month period as follows: 20% collected in the month of sale, 60% collected in the month following sale, and 18% collected in the second month following sale. The remaining 2% is uncollectible. c. Purchases of inventory will total $280,000 for December. Thirty percent of a month's inventory purchases are paid during the month of purchase. The accounts payable remaining from November's inventory purchases total $161,000, all of which will be paid in December. d. Selling and administrative expenses are budgeted at $430,000 for December. Of this amount, $50,000 is for depreciation. e. A new web server for the Marketing Department costing $76,000 will be purchased for cash during December, and dividends totaling $9,000 will be paid during the month. f. The company maintains a minimum cash balance of $20,000. An open line of credit is available from the company's bank to

Chapter4: Financial Planning And Forecasting

Section: Chapter Questions

Problem 4P

Related questions

Question

I need help with this three part problem

1. Calculate the expected cash collections for December.

2. Calculate the expected cash disbursements for merchandise purchases for December.

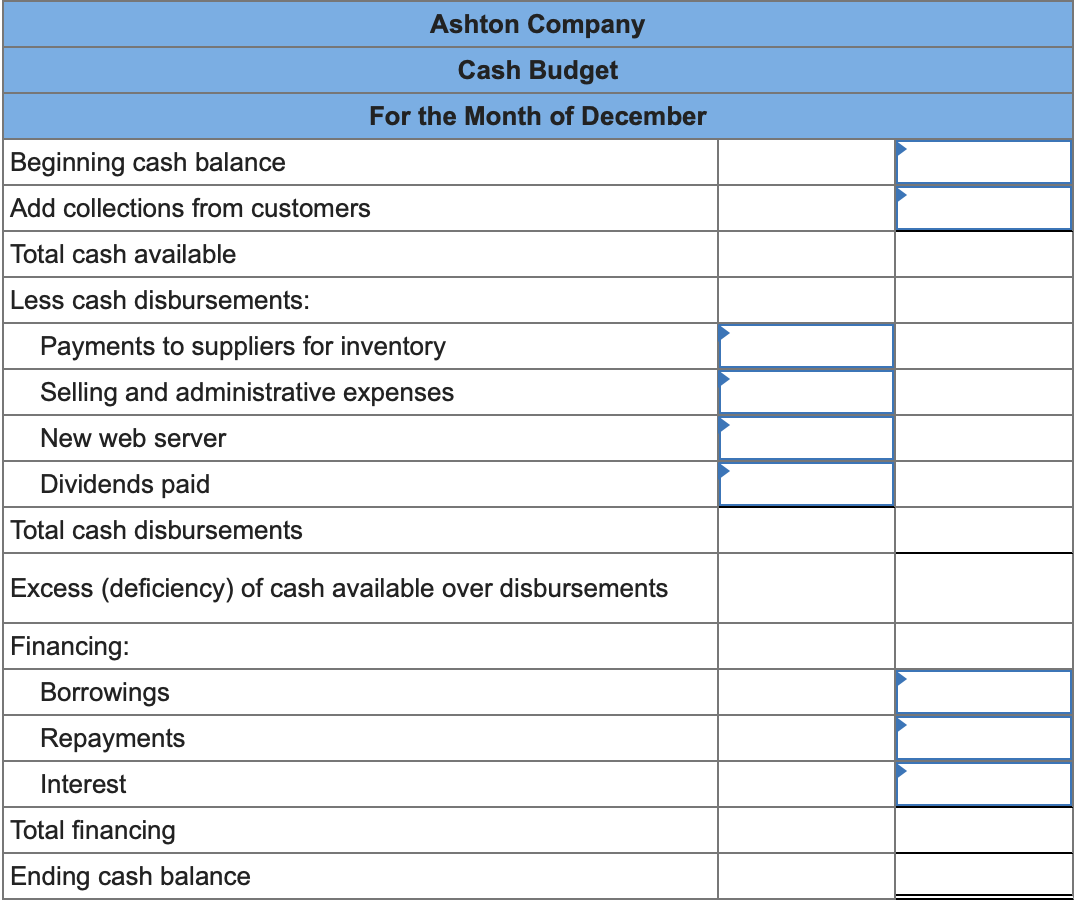

Transcribed Image Text:Ashton Company

Cash Budget

For the Month of December

Beginning cash balance

Add collections from customers

Total cash available

Less cash disbursements:

Payments to suppliers for inventory

Selling and administrative expenses

New web server

Dividends paid

Total cash disbursements

Excess (deficiency) of cash available over disbursements

Financing:

Borrowings

Repayments

Interest

Total financing

Ending cash balance

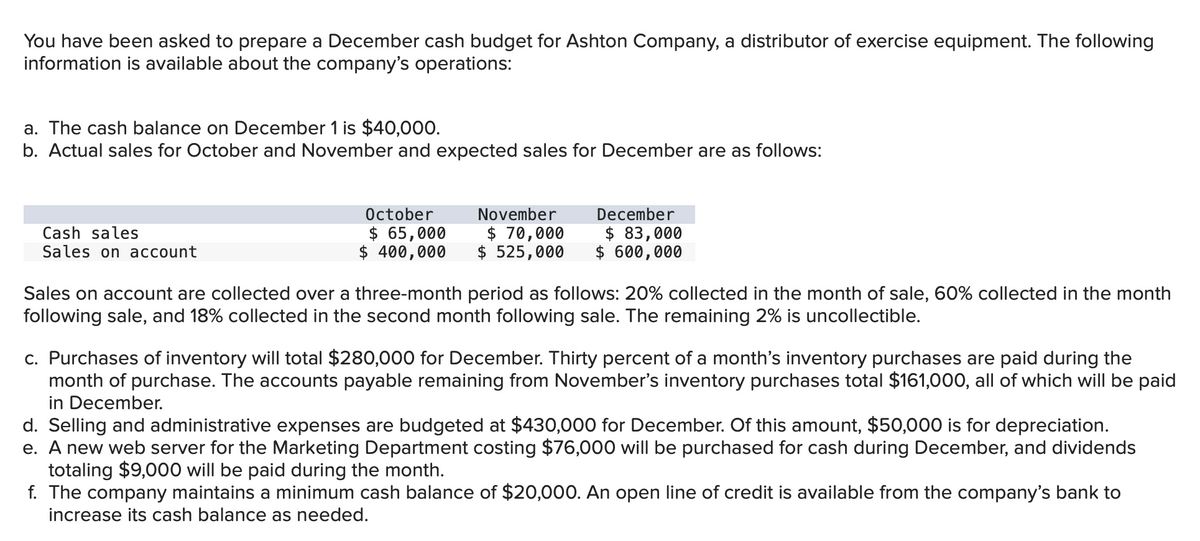

Transcribed Image Text:You have been asked to prepare a December cash budget for Ashton Company, a distributor of exercise equipment. The following

information is available about the company's operations:

a. The cash balance on December 1 is $40,000.

b. Actual sales for October and November and expected sales for December are as follows:

October

December

$ 83,000

$ 600,000

November

Cash sales

Sales on account

$ 65,000

$ 400,000

$ 70,000

$ 525,000

Sales on account are collected over a three-month period as follows: 20% collected in the month of sale, 60% collected in the month

following sale, and 18% collected in the second month following sale. The remaining 2% is uncollectible.

c. Purchases of inventory will total $280,000 for December. Thirty percent of a month's inventory purchases are paid during the

month of purchase. The accounts payable remaining from November's inventory purchases total $161,000, all of which will be paid

in December.

d. Selling and administrative expenses are budgeted at $430,000 for December. Of this amount, $50,000 is for depreciation.

e. A new web server for the Marketing Department costing $76,000 will be purchased for cash during December, and dividends

totaling $9,000 will be paid during the month.

f. The company maintains a minimum cash balance of $20,000. An open line of credit is available from the company's bank to

increase its cash balance as needed.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning