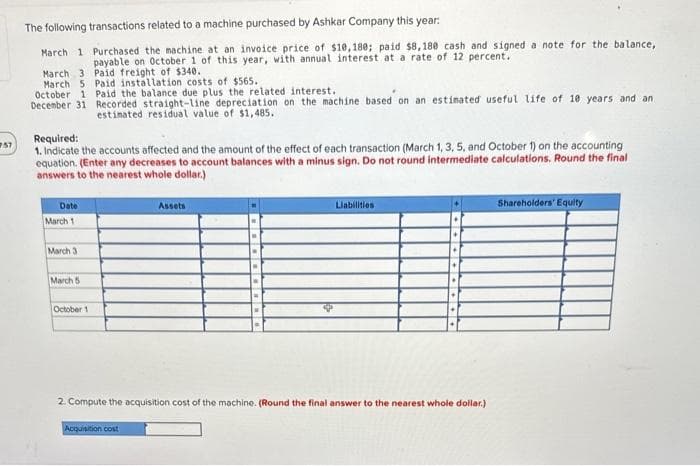

The following transactions related to a machine purchased by Ashkar Company this year: March 1 Purchased the machine at an invoice price of $10,180; paid $8,180 cash and signed a note for the balance, payable on October 1 of this year, with annual interest at a rate of 12 percent. March 3 Paid freight of $340. March 5 Paid installation costs of $565. October 1 Paid the balance due plus the related interest. December 31 Recorded straight-line depreciation on the machine based on an estimated useful life of 10 years and an estimated residual value of $1,485. Required: 1. Indicate the accounts affected and the amount of the effect of each transaction (March 1, 3, 5, and October 1) on the accounting equation. (Enter any decreases to account balances with a minus sign. Do not round intermediate calculations. Round the final answers to the nearest whole dollar) Date Assets Liabilities Shareholders' Equity

The following transactions related to a machine purchased by Ashkar Company this year: March 1 Purchased the machine at an invoice price of $10,180; paid $8,180 cash and signed a note for the balance, payable on October 1 of this year, with annual interest at a rate of 12 percent. March 3 Paid freight of $340. March 5 Paid installation costs of $565. October 1 Paid the balance due plus the related interest. December 31 Recorded straight-line depreciation on the machine based on an estimated useful life of 10 years and an estimated residual value of $1,485. Required: 1. Indicate the accounts affected and the amount of the effect of each transaction (March 1, 3, 5, and October 1) on the accounting equation. (Enter any decreases to account balances with a minus sign. Do not round intermediate calculations. Round the final answers to the nearest whole dollar) Date Assets Liabilities Shareholders' Equity

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 5MC: A machine with a 4-year estimated useful life and an estimated 15% residual value was acquired on...

Related questions

Question

Please Correct answer with Explanation And Do not Give solution in image format

Transcribed Image Text:7.57

The following transactions related to a machine purchased by Ashkar Company this year:

March 1

March 3

March 5 Paid installation costs of $565.

October 1 Paid the balance due plus the related interest.

December 31 Recorded straight-line depreciation on the machine based on an estimated useful life of 10 years and an

estimated residual value of $1,485.

Required:

1. Indicate the accounts affected and the amount of the effect of each transaction (March 1, 3, 5, and October 1) on the accounting

equation. (Enter any decreases to account balances with a minus sign. Do not round intermediate calculations. Round the final

answers to the nearest whole dollar.)

Date

March 1

Purchased the machine at an invoice price of $10,180; paid $8,180 cash and signed a note for the balance,

payable on October 1 of this year, with annual interest at a rate of 12 percent.

Paid freight of $340.

March 3

March 5

October 1

Assets

Acquisition cost

Liabilities

2. Compute the acquisition cost of the machine. (Round the final answer to the nearest whole dollar.)

Shareholders' Equity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning