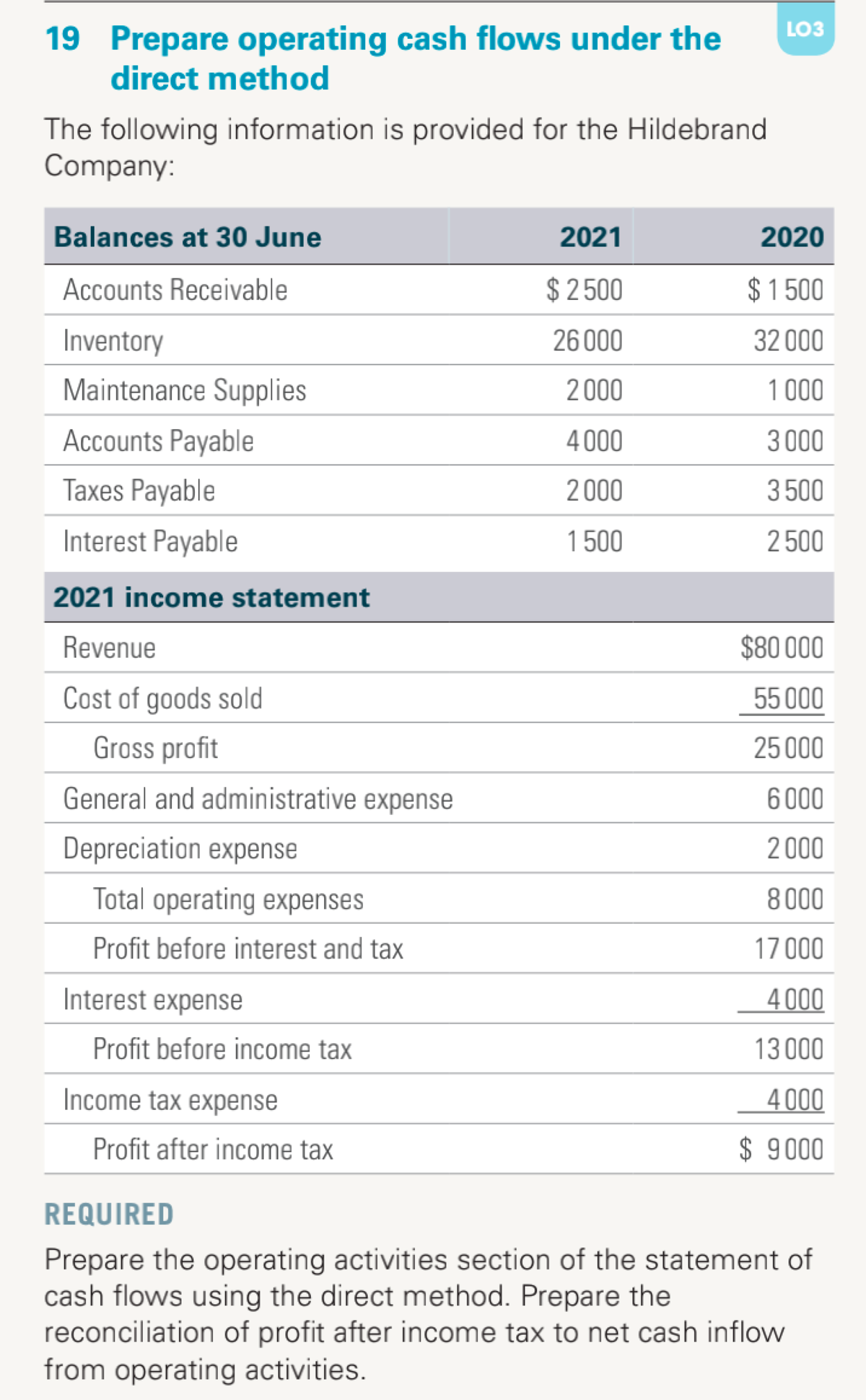

The following information is provided for the Hildebrand Company: Balances at 30 June 2021 2020 Accounts Receivable $ 2 500 $ 1 500 Inventory 26 000 32 000 Maintenance Supplies 2 000 1 000 Accounts Payable 4 000 3 000 Taxes Payable 2000 3500 Interest Payable 1500 2 500 2021 income statement Revenue $80 000 Cost of goods sold 55 000 Gross profit 25 000 General and administrative expense 6000 Depreciation expense 2 000 Total operating expenses 8 000 Profit before interest and tax 17 000 Interest expense _ 4 000 Profit before income tax 13 000 Income tax expense 4 000 Profit after income tax $ 9000 REQUIRED Prepare the operating activities section of the statement of

The following information is provided for the Hildebrand Company: Balances at 30 June 2021 2020 Accounts Receivable $ 2 500 $ 1 500 Inventory 26 000 32 000 Maintenance Supplies 2 000 1 000 Accounts Payable 4 000 3 000 Taxes Payable 2000 3500 Interest Payable 1500 2 500 2021 income statement Revenue $80 000 Cost of goods sold 55 000 Gross profit 25 000 General and administrative expense 6000 Depreciation expense 2 000 Total operating expenses 8 000 Profit before interest and tax 17 000 Interest expense _ 4 000 Profit before income tax 13 000 Income tax expense 4 000 Profit after income tax $ 9000 REQUIRED Prepare the operating activities section of the statement of

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter21: The Statement Of Cash Flows

Section: Chapter Questions

Problem 14P: (Appendix 21.1) Operating Cash Flows Refer to the information for Lamberson Company in P21-6....

Related questions

Topic Video

Question

Transcribed Image Text:LO3

19 Prepare operating cash flows under the

direct method

The following information is provided for the Hildebrand

Company:

Balances at 30 June

2021

2020

Accounts Receivable

$ 2500

$ 1 500

Inventory

26 000

32 000

Maintenance Supplies

2 000

1 000

Accounts Payable

4 000

3 000

Taxes Payable

2 000

3500

Interest Payable

1500

2 500

2021 income statement

Revenue

$80 000

Cost of goods sold

55 000

Gross profit

25 000

General and administrative expense

6000

Depreciation expense

2 000

Total operating expenses

8 000

Profit before interest and tax

17 000

Interest expense

4 000

Profit before income tax

13 000

Income tax expense

4 000

Profit after income tax

$ 9000

REQUIRED

Prepare the operating activities section of the statement of

cash flows using the direct method. Prepare the

reconciliation of profit after income tax to net cash inflow

from operating activities.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning