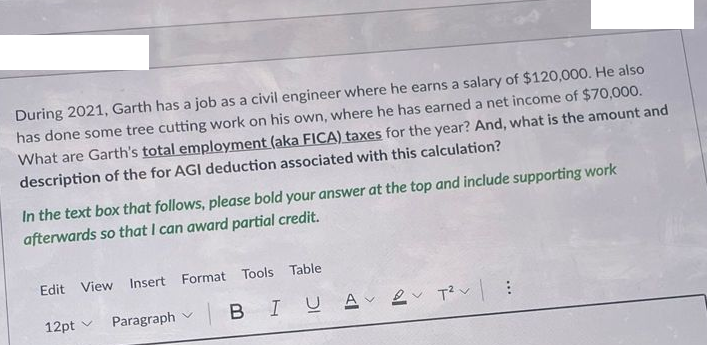

During 2021, Garth has a job as a civil engineer where he earns a salary of $120,000. He also has done some tree cutting work on his own, where he has earned a net income of $70,000. What are Garth's total employment (aka FICA) taxes for the year? And, what is the amount and description of the for AGI deduction associated with this calculation? In the text box that follows, please bold your answer at the top and include supporting work afterwards so that I can award partial credit.

During 2021, Garth has a job as a civil engineer where he earns a salary of $120,000. He also has done some tree cutting work on his own, where he has earned a net income of $70,000. What are Garth's total employment (aka FICA) taxes for the year? And, what is the amount and description of the for AGI deduction associated with this calculation? In the text box that follows, please bold your answer at the top and include supporting work afterwards so that I can award partial credit.

Chapter5: Deductions For And From Agi

Section: Chapter Questions

Problem 3P: Karen, 28 years old and a single taxpayer, has a salary of $33,000 and rental income of $33,000 for...

Related questions

Question

Transcribed Image Text:During 2021, Garth has a job as a civil engineer where he earns a salary of $120,000. He also

has done some tree cutting work on his own, where he has earned a net income of $70,000.

What are Garth's total employment (aka FICA) taxes for the year? And, what is the amount and

description of the for AGI deduction associated with this calculation?

In the text box that follows, please bold your answer at the top and include supporting work

afterwards so that I can award partial credit.

Edit View Insert Format Tools Table

12pt v

Paragraph v

|BIU A 2 Tv:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT