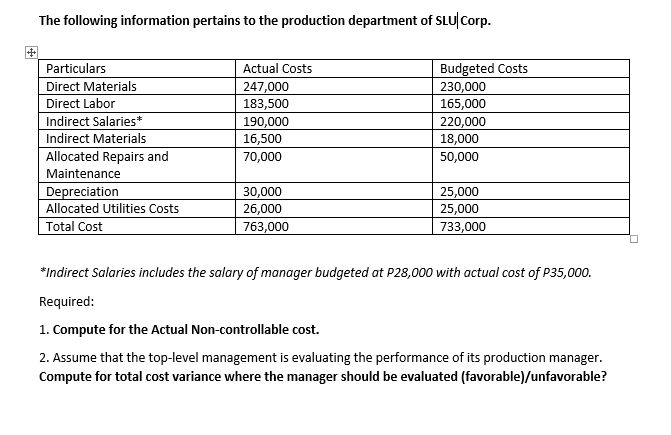

The following information pertains to the production department of SLU Corp. Particulars Direct Materials Direct Labor Indirect Salaries* Indirect Materials Allocated Repairs and Actual Costs 247,000 183,500 Budgeted Costs 230,000 165,000 220,000 18,000 50,000 190,000 16,500 70,000 Maintenance Depreciation Allocated Utilities Costs 30,000 26,000 25,000 25,000 733,000 Total Cost 763,000 *Indirect Salaries includes the salary of manager budgeted at P28,000 with actual cost of P35,000. Required:

The following information pertains to the production department of SLU Corp. Particulars Direct Materials Direct Labor Indirect Salaries* Indirect Materials Allocated Repairs and Actual Costs 247,000 183,500 Budgeted Costs 230,000 165,000 220,000 18,000 50,000 190,000 16,500 70,000 Maintenance Depreciation Allocated Utilities Costs 30,000 26,000 25,000 25,000 733,000 Total Cost 763,000 *Indirect Salaries includes the salary of manager budgeted at P28,000 with actual cost of P35,000. Required:

Chapter5: Process Costing

Section: Chapter Questions

Problem 13PB: Selected information from Hernandez Corporation shows the following: Prepare journal entries to...

Related questions

Question

Transcribed Image Text:The following information pertains to the production department of SLU Corp.

Particulars

Direct Materials

Direct Labor

Indirect Salaries*

Indirect Materials

Allocated Repairs and

Maintenance

Depreciation

Allocated Utilities Costs

Budgeted Costs

230,000

165,000

Actual Costs

247,000

183,500

190,000

220,000

16,500

18,000

70,000

50,000

30,000

25,000

26,000

25,000

733,000

Total Cost

763,000

*Indirect Salaries includes the salary of manager budgeted at P28,000 with actual cost of P35,000.

Required:

1. Compute for the Actual Non-controllable cost.

2. Assume that the top-level management is evaluating the performance of its production manager.

Compute for total cost variance where the manager should be evaluated (favorable)/unfavorable?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning