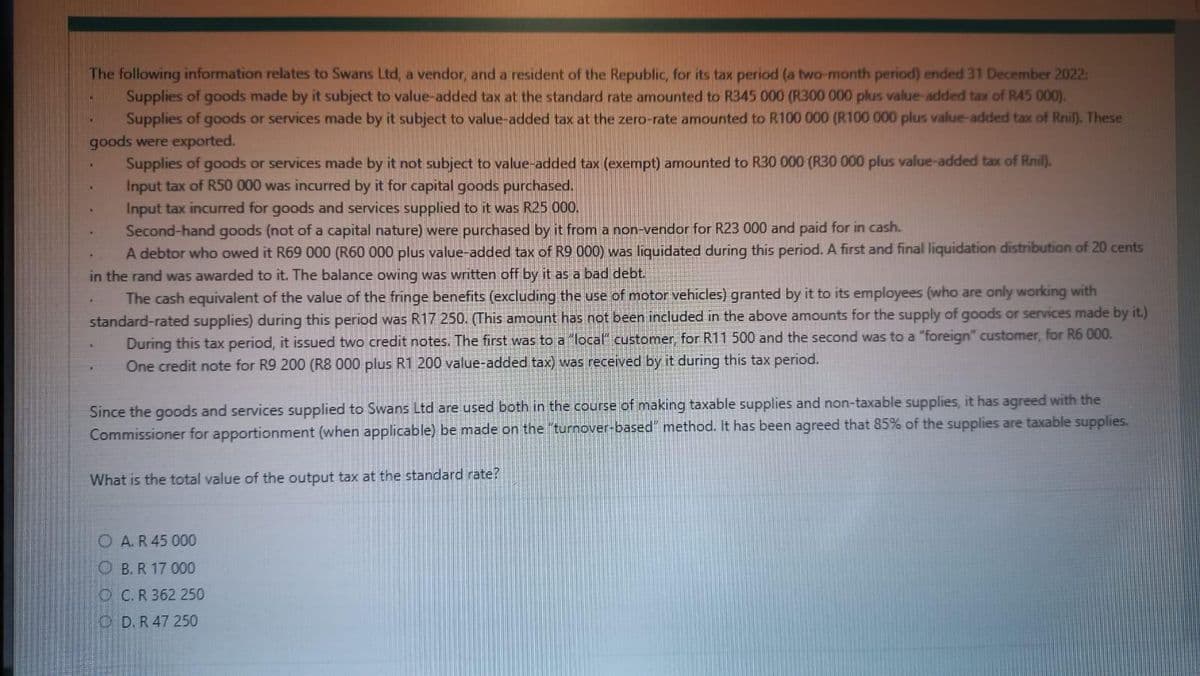

The following information relates to Swans Ltd, a vendor, and a resident of the Republic, for its tax period (a two-month period) ended 31 December 2022: Supplies of goods made by it subject to value-added tax at the standard rate amounted to R345 000 (R300 000 plus value-added tax of R45 000). Supplies of goods or services made by it subject to value-added tax at the zero-rate amounted to R100 000 (R100 000 plus value-added tax of Rnil). These goods were exported. Supplies of goods or services made by it not subject to value-added tax (exempt) amounted to R30 000 (R30 000 plus value-added tax of Rnil). Input tax of R50 000 was incurred by it for capital goods purchased. Input tax incurred for goods and services supplied to it was R25 000. Second-hand goods (not of a capital nature) were purchased by it from a non-vendor for R23 000 and paid for in cash. A debtor who owed it R69 000 (R60 000 plus value-added tax of R9 000) was liquidated during this period. A first and final liquidation distribution of 20 cents in the rand was awarded to it. The balance owing was written off by it as a bad debt. The cash equivalent of the value of the fringe benefits (excluding the use of motor vehicles) granted by it to its employees (who are only working with standard-rated supplies) during this period was R17 250. (This amount has not been included in the above amounts for the supply of goods or services made by it.) During this tax period, it issued two credit notes. The first was to a "local" customer, for R11 500 and the second was to a "foreign" customer, for R6 000. One credit note for R9 200 (R8 000 plus R1 200 value-added tax) was received by it during this tax period. . Since the goods and services supplied to Swans Ltd are used both in the course of making taxable supplies and non-taxable supplies, it has agreed with the Commissioner for apportionment (when applicable) be made on the "turnover-based" method. It has been agreed that 85% of the supplies are taxable supplies. What is the total value of the output tax at the standard rate? O A. R 45 000 OB. R 17 000 OC. R 362 250 OD. R 47 250

The following information relates to Swans Ltd, a vendor, and a resident of the Republic, for its tax period (a two-month period) ended 31 December 2022: Supplies of goods made by it subject to value-added tax at the standard rate amounted to R345 000 (R300 000 plus value-added tax of R45 000). Supplies of goods or services made by it subject to value-added tax at the zero-rate amounted to R100 000 (R100 000 plus value-added tax of Rnil). These goods were exported. Supplies of goods or services made by it not subject to value-added tax (exempt) amounted to R30 000 (R30 000 plus value-added tax of Rnil). Input tax of R50 000 was incurred by it for capital goods purchased. Input tax incurred for goods and services supplied to it was R25 000. Second-hand goods (not of a capital nature) were purchased by it from a non-vendor for R23 000 and paid for in cash. A debtor who owed it R69 000 (R60 000 plus value-added tax of R9 000) was liquidated during this period. A first and final liquidation distribution of 20 cents in the rand was awarded to it. The balance owing was written off by it as a bad debt. The cash equivalent of the value of the fringe benefits (excluding the use of motor vehicles) granted by it to its employees (who are only working with standard-rated supplies) during this period was R17 250. (This amount has not been included in the above amounts for the supply of goods or services made by it.) During this tax period, it issued two credit notes. The first was to a "local" customer, for R11 500 and the second was to a "foreign" customer, for R6 000. One credit note for R9 200 (R8 000 plus R1 200 value-added tax) was received by it during this tax period. . Since the goods and services supplied to Swans Ltd are used both in the course of making taxable supplies and non-taxable supplies, it has agreed with the Commissioner for apportionment (when applicable) be made on the "turnover-based" method. It has been agreed that 85% of the supplies are taxable supplies. What is the total value of the output tax at the standard rate? O A. R 45 000 OB. R 17 000 OC. R 362 250 OD. R 47 250

Chapter14: Taxes On The Financial Statements

Section: Chapter Questions

Problem 52P

Related questions

Question

Transcribed Image Text:The following information relates to Swans Ltd, a vendor, and a resident of the Republic, for its tax period (a two-month period) ended 31 December 2022:

Supplies of goods made by it subject to value-added tax at the standard rate amounted to R345 000 (R300 000 plus value-added tax of R45 000).

Supplies of goods or services made by it subject to value-added tax at the zero-rate amounted to R100 000 (R100 000 plus value-added tax of Rnil). These

goods were exported.

Supplies of goods or services made by it not subject to value-added tax (exempt) amounted to R30 000 (R30 000 plus value-added tax of Rnil).

Input tax of R50 000 was incurred by it for capital goods purchased.

Input tax incurred for goods and services supplied to it was R25 000.

Second-hand goods (not of a capital nature) were purchased by it from a non-vendor for R23 000 and paid for in cash.

A debtor who owed it R69 000 (R60 000 plus value-added tax of R9 000) was liquidated during this period. A first and final liquidation distribution of 20 cents

in the rand was awarded to it. The balance owing was written off by it as a bad debt.

The cash equivalent of the value of the fringe benefits (excluding the use of motor vehicles) granted by it to its employees (who are only working with

standard-rated supplies) during this period was R17 250. (This amount has not been included in the above amounts for the supply of goods or services made by it.)

During this tax period, it issued two credit notes. The first was to a "local" customer, for R11 500 and the second was to a "foreign" customer, for R6 000.

One credit note for R9 200 (R8 000 plus R1 200 value-added tax) was received by it during this tax period.

Since the goods and services supplied to Swans Ltd are used both in the course of making taxable supplies and non-taxable supplies, it has agreed with the

Commissioner for apportionment (when applicable) be made on the "turnover-based" method. It has been agreed that 85% of the supplies are taxable supplies.

What is the total value of the output tax at the standard rate?

O A. R 45 000

OB. R 17 000

OC. R 362 250

D. R 47 250

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning