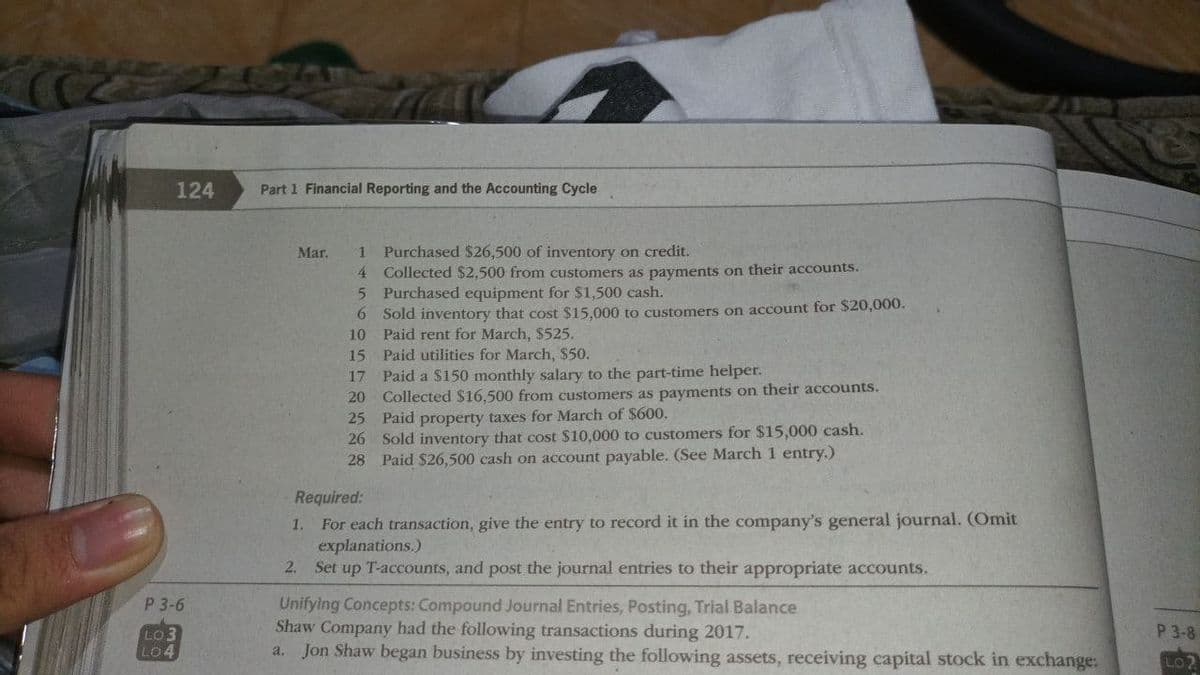

Mar. 1 Purchased $26,500 of inventory on credit. 4 Collected $2,500 from customers as payments on their accounts. Purchased equipment for $1,500 cash. 5 6 Sold inventory that cost $15,000 to customers on account for $20,000. 10 Paid rent for March, $525. 15 17 20 25 26 28 Paid utilities for March, $50. Paid a $150 monthly salary to the part-time helper. Collected $16,500 from customers as payments on their accounts. Paid property taxes for March of $600. Sold inventory that cost $10,000 to customers for $15,000 cash. Paid $26,500 cash on account payable. (See March 1 entry.) Required: 1. For each transaction, give the entry to record it in the company's general journal. (Omit explanations.) 2. Set up T-accounts, and post the journal entries to their appropriate accounts.

Mar. 1 Purchased $26,500 of inventory on credit. 4 Collected $2,500 from customers as payments on their accounts. Purchased equipment for $1,500 cash. 5 6 Sold inventory that cost $15,000 to customers on account for $20,000. 10 Paid rent for March, $525. 15 17 20 25 26 28 Paid utilities for March, $50. Paid a $150 monthly salary to the part-time helper. Collected $16,500 from customers as payments on their accounts. Paid property taxes for March of $600. Sold inventory that cost $10,000 to customers for $15,000 cash. Paid $26,500 cash on account payable. (See March 1 entry.) Required: 1. For each transaction, give the entry to record it in the company's general journal. (Omit explanations.) 2. Set up T-accounts, and post the journal entries to their appropriate accounts.

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter5: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 5.5BPR: Multiple-step income statement and balance sheet The following selected accounts and their current...

Related questions

Question

Transcribed Image Text:124

P 3-6

LO3

LO4

Part 1 Financial Reporting and the Accounting Cycle

Mar. 1

4

5

6

10

15

Purchased $26,500 of inventory on credit.

Collected $2,500 from customers as payments on their accounts.

Purchased equipment for $1,500 cash.

Sold inventory that cost $15,000 to customers on account for $20,000.

Paid rent for March, $525.

Paid utilities for March, $50.

17 Paid a $150 monthly salary to the part-time helper.

20

Collected $16,500 from customers as payments on their accounts.

25 Paid property taxes for March of $600.

26 Sold inventory that cost $10,000 to customers for $15,000 cash.

28 Paid $26,500 cash on account payable. (See March 1 entry.)

Required:

1. For each transaction, give the entry to record it in the company's general journal. (Omit

explanations.)

2. Set up T-accounts, and post the journal entries to their appropriate accounts.

Unifying Concepts: Compound Journal Entries, Posting, Trial Balance

Shaw Company had the following transactions during 2017.

a. Jon Shaw began business by investing the following assets, receiving capital stock in exchange:

P 3-8

LO2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,