The following information was available to the accountant of Boots Company when preparing the monthly bank reconciliation: Outstanding cheques: #643 for $502 #651 for $43 Bank service charges $25 Deposits in transit $190 Interest received from bank $5 Customer cheque returned by bank as NSF $20 Cash balance per bank statement $975 Cash balance per books (prior to $660 reconciliation) The amount of cash that should appear on the Balance Sheet following completion of the reconciliation and adjustment of the accounting records is: Multiple Choice $660 Drov 38 of 50 Next

The following information was available to the accountant of Boots Company when preparing the monthly bank reconciliation: Outstanding cheques: #643 for $502 #651 for $43 Bank service charges $25 Deposits in transit $190 Interest received from bank $5 Customer cheque returned by bank as NSF $20 Cash balance per bank statement $975 Cash balance per books (prior to $660 reconciliation) The amount of cash that should appear on the Balance Sheet following completion of the reconciliation and adjustment of the accounting records is: Multiple Choice $660 Drov 38 of 50 Next

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter8: Internal Control And Cash

Section: Chapter Questions

Problem 21E

Related questions

Question

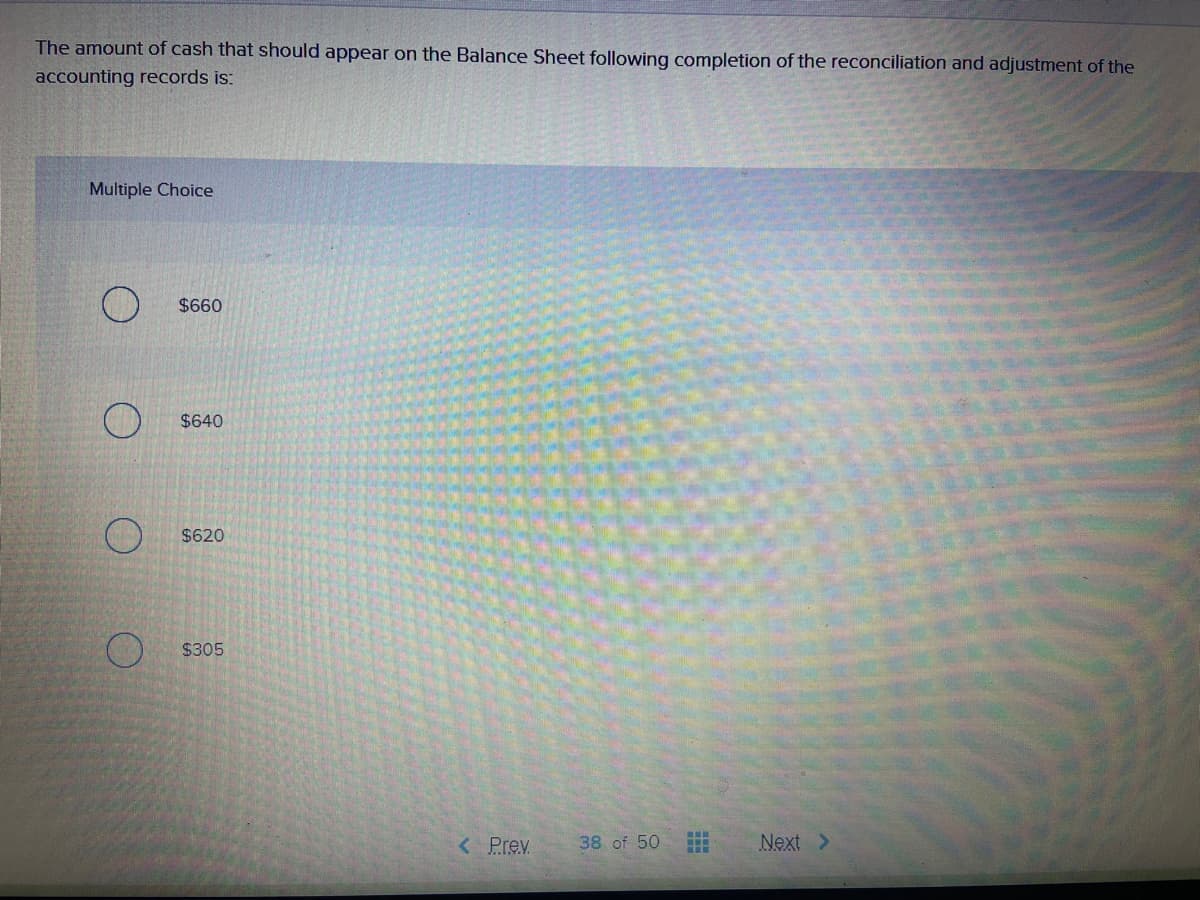

Transcribed Image Text:The amount of cash that should appear on the Balance Sheet following completion of the reconciliation and adjustment of the

accounting records is:

Multiple Choice

$660

$640

$620

$305

< Prev

38 of 50

Next >

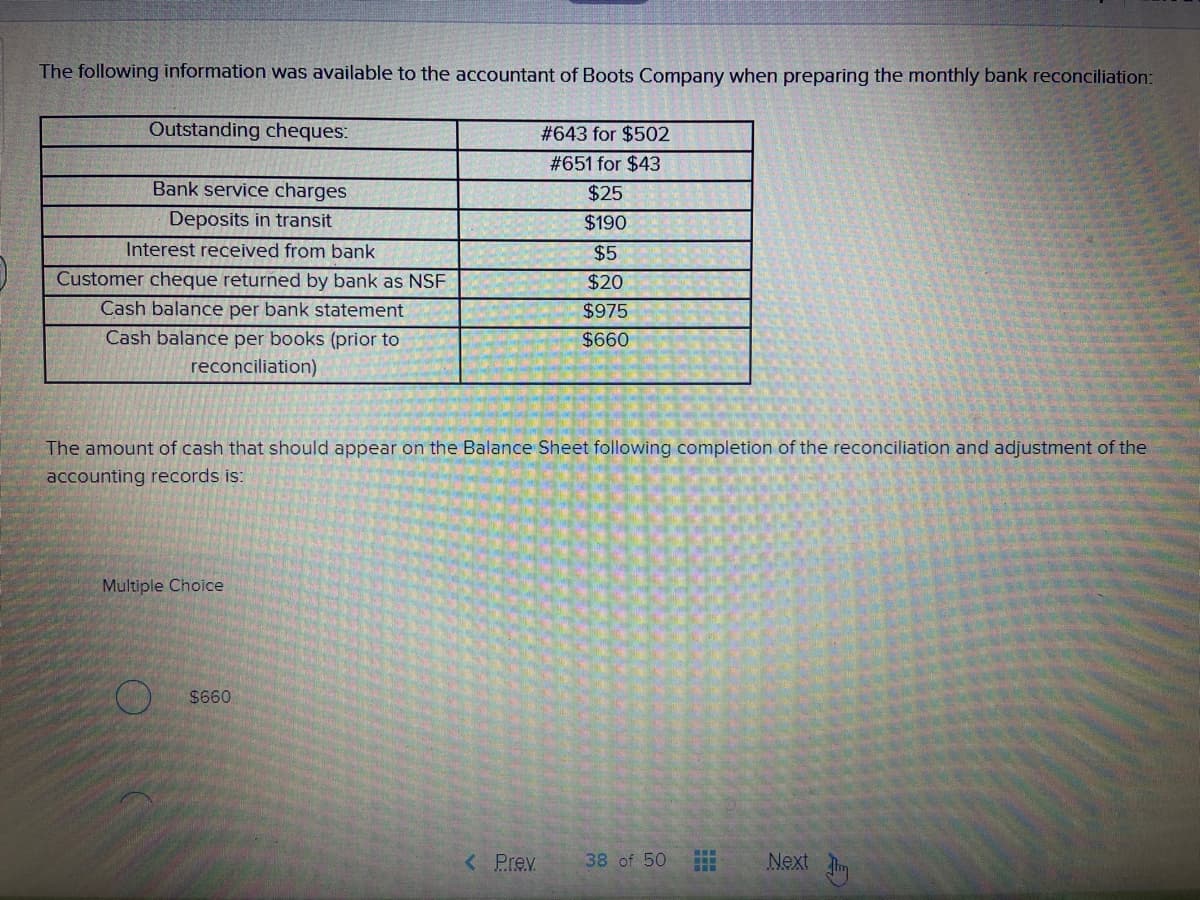

Transcribed Image Text:The following information was available to the accountant of Boots Company when preparing the monthly bank reconciliation:

Outstanding cheques:

#643 for $502

#651 for $43

Bank service charges

$25

Deposits in transit

$190

Interest received from bank

$5

Customer cheque returned by bank as NSF

$20

Cash balance per bank statement

$975

Cash balance per books (prior to

$660

reconciliation)

The amount of cash that should appear on the Balance Sheet following completion of the reconciliation and adjustment of the

accounting records is:

Multiple Choice

$660

<Prev

38 of 50

Next m

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage