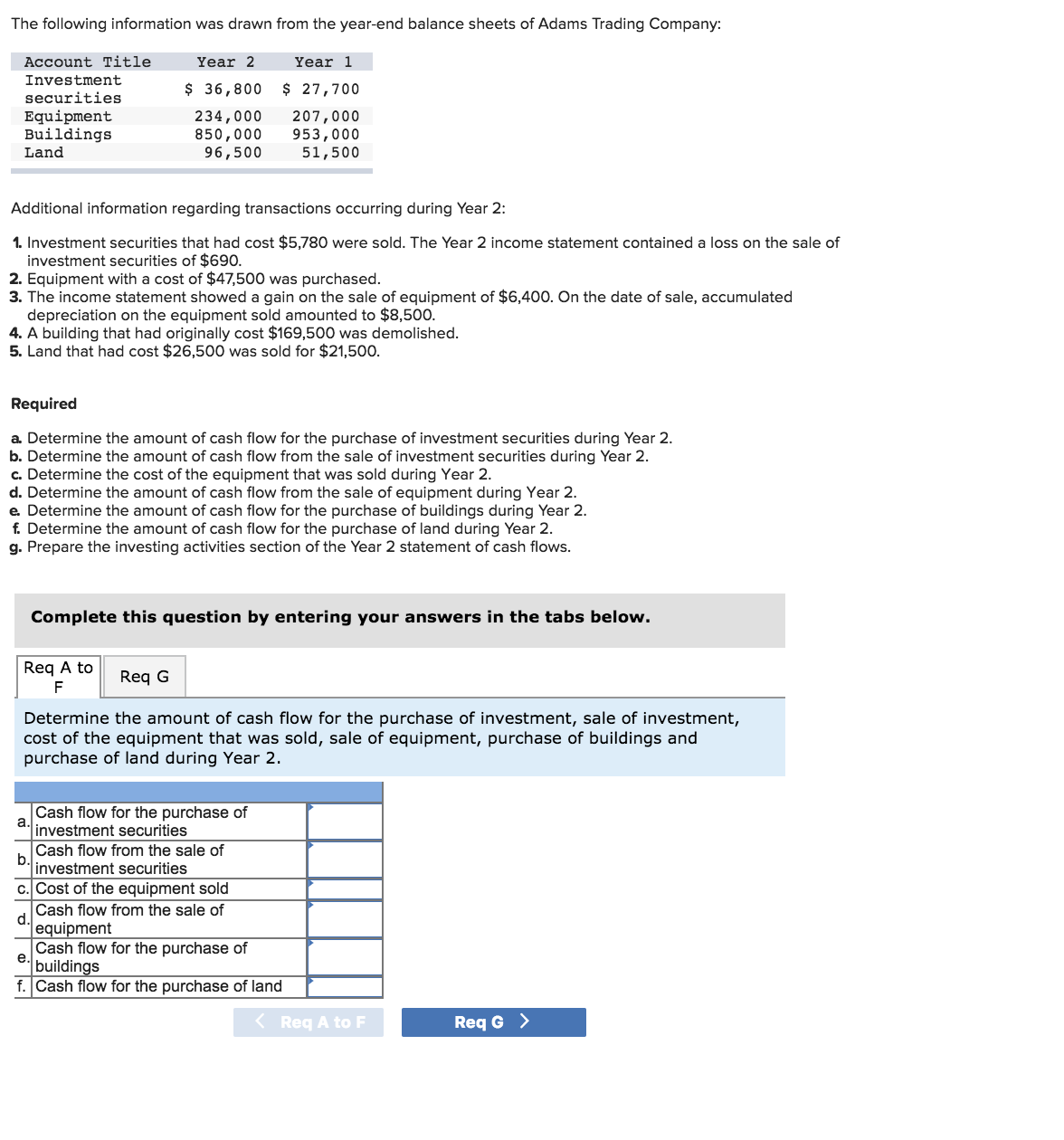

The following information was drawn from the year-end balance sheets of Adams Trading Company: Account Title Year 1 Year 2 Investment $ 36,800 $ 27,700 securities Equipment Buildings 234,000 850,000 96,500 207,000 953,000 51,500 Land Additional information regarding transactions occurring during Year 2: 1. Investment securities that had cost $5,780 were sold. The Year 2 income statement contained a loss on the sale of investment securities of $690. 2. Equipment with a cost of $47,500 was purchased. 3. The income statement showed a gain on the sale of equipment of $6,400. On the date of sale, accumulated depreciation on the equipment sold amounted to $8,500. 4. A building that had originally cost $169,500 was demolished. 5. Land that had cost $26,500 was sold for $21,500. Required a. Determine the amount of cash flow for the purchase of investment securities during Year 2. b. Determine the amount of cash flow from the sale of investment securities during Year 2 c. Determine the cost of the equipment that was sold during Year 2 d. Determine the amount of cash flow from the sale of equipment during Year 2 e. Determine the amount of cash flow for the purchase of buildings during Year 2 f. Determine the amount of cash flow for the purchase of land during Year 2 g. Prepare the investing activities section of the Year 2 statement of cash flows. Complete this question by entering your answers in the tabs below. Req A to Req G F Determine the amount of cash flow for the purchase of investment, sale of investment, cost of the equipment that was sold, sale of equipment, purchase of buildings and purchase of land during Year 2. Cash flow for the purchase of а. investment securities Cash flow from the sale of investment securities c. Cost of the equipment sold Cash flow from the sale of d. equipment Cash flow for the purchase of е. buildings f. Cash flow for the purchase of land Req G Req A to F

The following information was drawn from the year-end balance sheets of Adams Trading Company: Account Title Year 1 Year 2 Investment $ 36,800 $ 27,700 securities Equipment Buildings 234,000 850,000 96,500 207,000 953,000 51,500 Land Additional information regarding transactions occurring during Year 2: 1. Investment securities that had cost $5,780 were sold. The Year 2 income statement contained a loss on the sale of investment securities of $690. 2. Equipment with a cost of $47,500 was purchased. 3. The income statement showed a gain on the sale of equipment of $6,400. On the date of sale, accumulated depreciation on the equipment sold amounted to $8,500. 4. A building that had originally cost $169,500 was demolished. 5. Land that had cost $26,500 was sold for $21,500. Required a. Determine the amount of cash flow for the purchase of investment securities during Year 2. b. Determine the amount of cash flow from the sale of investment securities during Year 2 c. Determine the cost of the equipment that was sold during Year 2 d. Determine the amount of cash flow from the sale of equipment during Year 2 e. Determine the amount of cash flow for the purchase of buildings during Year 2 f. Determine the amount of cash flow for the purchase of land during Year 2 g. Prepare the investing activities section of the Year 2 statement of cash flows. Complete this question by entering your answers in the tabs below. Req A to Req G F Determine the amount of cash flow for the purchase of investment, sale of investment, cost of the equipment that was sold, sale of equipment, purchase of buildings and purchase of land during Year 2. Cash flow for the purchase of а. investment securities Cash flow from the sale of investment securities c. Cost of the equipment sold Cash flow from the sale of d. equipment Cash flow for the purchase of е. buildings f. Cash flow for the purchase of land Req G Req A to F

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter15: Investments And Fair Value Accounting

Section: Chapter Questions

Problem 3PA: Forte Inc. produces and sells theater set designs and costumes. The company began operations on...

Related questions

Question

Transcribed Image Text:The following information was drawn from the year-end balance sheets of Adams Trading Company:

Account Title

Year 1

Year 2

Investment

$ 36,800

$ 27,700

securities

Equipment

Buildings

234,000

850,000

96,500

207,000

953,000

51,500

Land

Additional information regarding transactions occurring during Year 2:

1. Investment securities that had cost $5,780 were sold. The Year 2 income statement contained a loss on the sale of

investment securities of $690.

2. Equipment with a cost of $47,500 was purchased.

3. The income statement showed a gain on the sale of equipment of $6,400. On the date of sale, accumulated

depreciation on the equipment sold amounted to $8,500.

4. A building that had originally cost $169,500 was demolished.

5. Land that had cost $26,500 was sold for $21,500.

Required

a. Determine the amount of cash flow for the purchase of investment securities during Year 2.

b. Determine the amount of cash flow from the sale of investment securities during Year 2

c. Determine the cost of the equipment that was sold during Year 2

d. Determine the amount of cash flow from the sale of equipment during Year 2

e. Determine the amount of cash flow for the purchase of buildings during Year 2

f. Determine the amount of cash flow for the purchase of land during Year 2

g. Prepare the investing activities section of the Year 2 statement of cash flows.

Complete this question by entering your answers in the tabs below.

Req A to

Req G

F

Determine the amount of cash flow for the purchase of investment, sale of investment,

cost of the equipment that was sold, sale of equipment, purchase of buildings and

purchase of land during Year 2.

Cash flow for the purchase of

а.

investment securities

Cash flow from the sale of

investment securities

c. Cost of the equipment sold

Cash flow from the sale of

d.

equipment

Cash flow for the purchase of

е.

buildings

f. Cash flow for the purchase of land

Req G

Req A to F

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning