Concept explainers

Forte Inc. produces and sells theater set designs and costumes. The company began operations on January 1, Year 1. The following transactions relate to securities acquired by Forte Inc., which has a fiscal year ending on December 31:

Instructions

- 1.

Journalize the entries to record these transactions. - 2. Prepare the investment-related asset and stockholders’ equity balance sheet presentation for Forte Inc. on December 31, Year 2, assuming that the

Retained Earnings balance on December 31, Year 2, is $389,000.

(1)

Journalize the stock investment transactions for Company F.

Explanation of Solution

Equity investments: Equity investments are stock instruments which claim ownership in the investee company and pay a dividend revenue to the investor company.

Equity method: Equity method is the method used for accounting equity investments which claim a significant influence of above 20% but less than 50% in the outstanding stock of the investee company.

Available-for-sale securities: These are short-term or long-term investments in debt and equity securities with an intention of holding the investment for some strategic purposes like meeting liquidity needs, or manage interest risk.

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Prepare journal entry for the purchase of 22,000 shares of Company S, at $18 per share.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| Year 1 | |||||

| January | 22 | Investments–Company S Stock | 396,000 | ||

| Cash | 396,000 | ||||

| (To record purchase of shares for cash) | |||||

Table (1)

- Investments–Company S Stock is an asset account. Since stock investments are purchased, asset value increased, and an increase in asset is debited.

- Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Working Notes:

Compute amount of cash paid to purchase Company S’s stock.

Prepare journal entry for the dividend received from Company S for 22,000 shares.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| Year 1 | |||||

| March | 8 | Cash | 4,840 | ||

| Dividend Revenue | 4,840 | ||||

| (To record receipt of dividend revenue) | |||||

Table (2)

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Dividend Revenue is a revenue account. Since revenues increase equity, equity value is increased, and an increase in equity is credited.

Working Notes:

Compute amount of dividend received on Company S’s stock.

Prepare journal entry for the dividend received from Company S for 22,000 shares.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| Year 1 | |||||

| September | 8 | Cash | 5,500 | ||

| Dividend Revenue | 5,500 | ||||

| (To record receipt of dividend revenue) | |||||

Table (3)

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Dividend Revenue is a revenue account. Since revenues increase equity, equity value is increased, and an increase in equity is credited.

Working Notes:

Compute amount of dividend received on Company S’s stock.

Prepare journal entry for sale of 3,000 shares of Company S, at $16, with a brokerage of $75.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| Year 1 | |||||

| October | 17 | Cash | 47,925 | ||

| Loss on Sale of Investments | 6,075 | ||||

| Investments–Company S Stock | 54,000 | ||||

| (To record sale of shares) | |||||

Table (4)

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Loss on Sale of Investments is an expense account. Since expenses and losses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Investments–Company S Stock is an asset account. Since stock investments are sold, asset value decreased, and a decrease in asset is credited.

Working Notes:

Calculate the realized gain (loss) on sale of stock.

Step 1: Compute cash received from sale proceeds.

Step 2: Compute cost of stock investment sold.

Step 3: Compute realized gain (loss) on sale of stock.

Note: Refer to Steps 1 and 2 for value and computation of cash received and cost of stock investment sold.

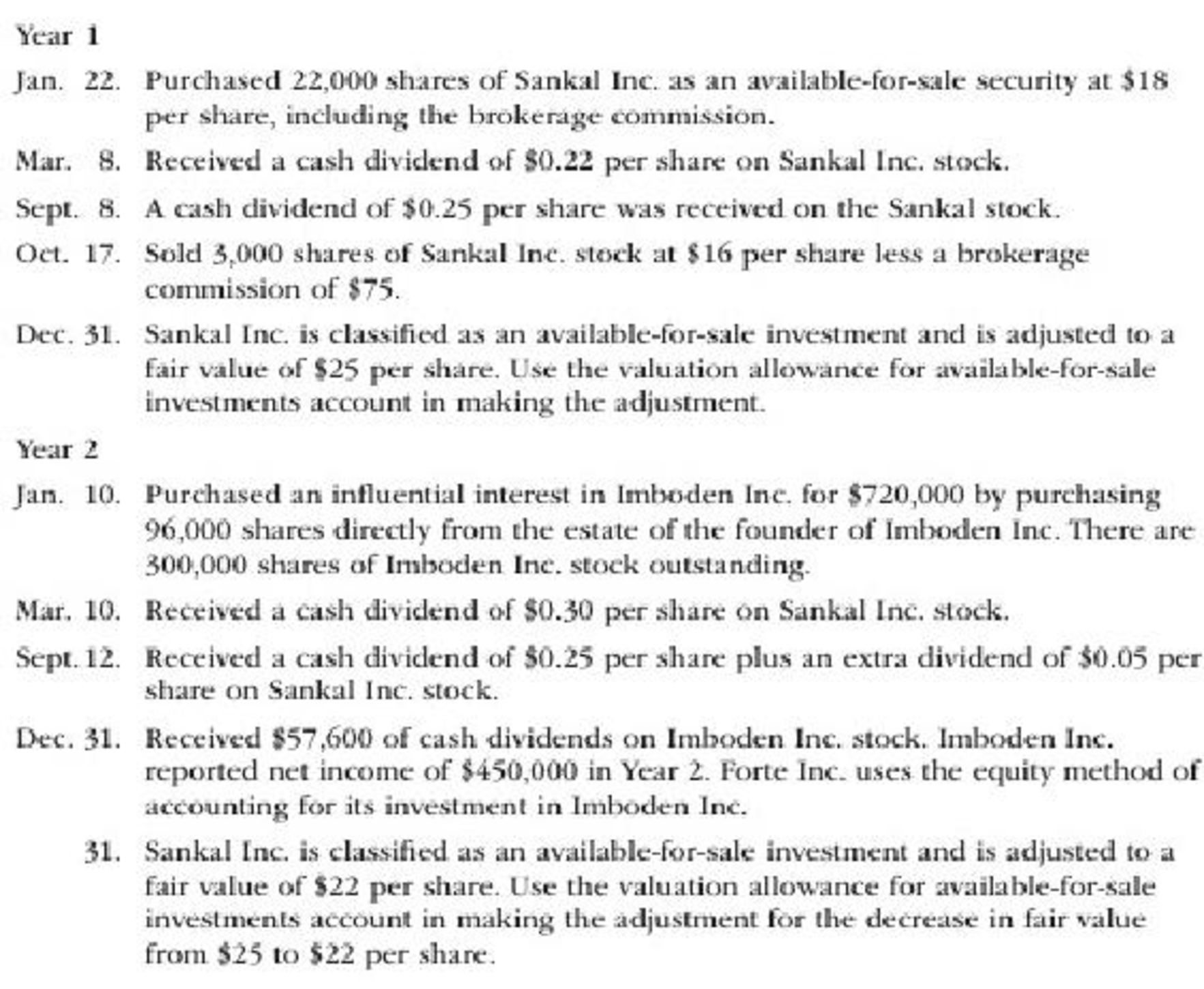

Prepare adjusting entry for valuation of available-for-sale securities transaction.

Table (5)

- Valuation Allowance for Available-for-Sale Investments is a contra-asset account. The account is debited because the market price was increased (loss) to $475,000 from the cost of $342,000.

- Unrealized Gain (Loss) on Available-for-Sale Investments is an adjustment account used to report gain or loss on adjusting cost of investment at fair market value. Since gain has occurred and gains increase stockholders’ equity value, and an increase in stockholders’ equity value is credited.

Working Notes:

Compute the unrealized gain (loss) as on December 31, Year 1.

| Details | Amount ($) |

| Available-for-sale investments at fair value, December 31, | $475,000 |

| Less: Available-for-sale investments at cost, December 31, | (342,000) |

| Unrealized gain (loss) on available-for-sale investments | $133,000 |

Table (6)

Prepare journal entry for the purchase of 96,000 shares out of the outstanding stock of 300,000 shares of Company I at $720,000.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| Year 2 | |||||

| January | 10 | Investment in Company I Stock | 720,000 | ||

| Cash | 720,000 | ||||

| (To record purchase of shares of Company I for cash) | |||||

Table (7)

- Investment in Company I Stock is an asset account. Since stock investments are purchased, asset value increased, and an increase in asset is debited.

- Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Prepare journal entry for the dividend received from Company S for 19,000 shares.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| Year 2 | |||||

| March | 10 | Cash | 5,700 | ||

| Dividend Revenue | 5,700 | ||||

| (To record receipt of dividend revenue) | |||||

Table (8)

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Dividend Revenue is a revenue account. Since revenues increase equity, equity value is increased, and an increase in equity is credited.

Working Notes:

Compute amount of dividend received on Company S’s stock.

Prepare journal entry for the dividend received from Company S for 19,000 shares.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| Year 2 | |||||

| September | 12 | Cash | 5,700 | ||

| Dividend Revenue | 5,700 | ||||

| (To record receipt of dividend revenue) | |||||

Table (9)

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Dividend Revenue is a revenue account. Since revenues increase equity, equity value is increased, and an increase in equity is credited.

Working Notes:

Compute amount of dividend received on Company S’s stock.

Prepare journal entry for dividends received from Company I.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| Year 2 | |||||

| December | 31 | Cash | 57,600 | ||

| Investment in Company I Stock | 57,600 | ||||

| (To record dividends received from Company I) | |||||

Table (10)

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Investment in Company I Stock is an asset account. Since stock investments are reduced as an effect of receipt of dividends, asset value decreased, and a decrease in asset is credited.

Prepare journal entry for share of income received from Company I.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| Investment in Company I Stock | 144,000 | ||||

| Income of Company T | 144,000 | ||||

| (To record income realized from Company I) | |||||

Table (11)

- Investment in Company I Stock is an asset account. Since income of the investee is reported as the increase in the investment, asset value increased, and an increase in asset is debited.

- Income of Company I is a revenue account. Revenues increase stockholders’ equity value, and an increase in stockholders’ equity is credited.

Working Notes:

Compute amount of income received from Company I.

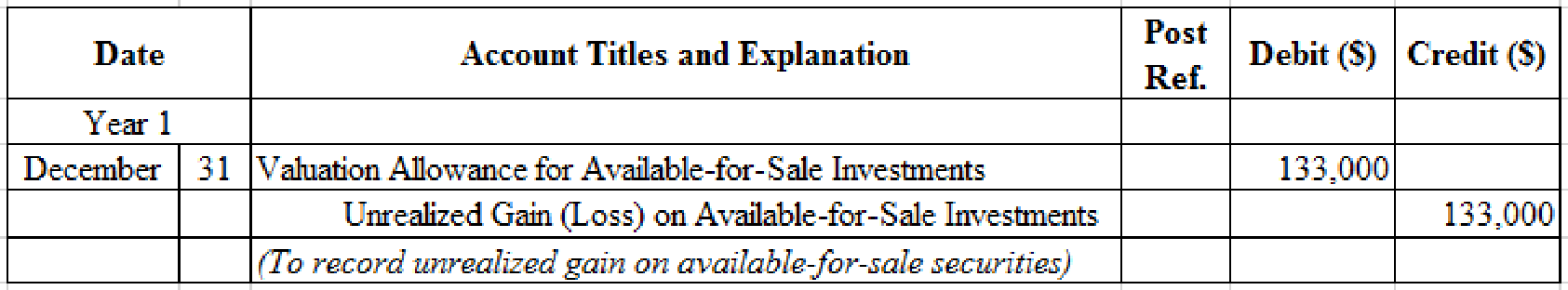

Prepare adjusting entry for valuation of available-for-sale securities transaction.

Table (12)

- Unrealized Gain (Loss) on Available-for-Sale Investments is an adjustment account used to report gain or loss on adjusting cost of investment at fair market value. Since loss has occurred and losses reduce stockholders’ equity value, and a decrease in stockholders’ equity value is debited.

- Valuation Allowance for Available-for-Sale Investments is a contra-asset account. The account is credited because the market price was decreased (loss) to $364,100 from the cost of $430,300.

Working Notes:

Compute the unrealized gain (loss) as on December 31.

| Details | Amount ($) |

| Available-for-sale investments at fair value, December 31, | $418,000 |

| Less: Available-for-sale investments at cost, December 31, | (475,000) |

| Unrealized gain (loss) on available-for-sale investments | $(57,000) |

Table (13)

(2)

Indicate the presentation of available-for-sale investments, equity method investments, and stockholders’ equity on the balance sheet as on December 31, Year 2.

Explanation of Solution

Balance sheet presentation:

| Company F | ||

| Balance Sheet (Partial) | ||

| December 31, Year 2 | ||

| Assets | ||

| Current assets: | ||

| Available-for-sale investments (at cost) | $342,000 | |

| Add valuation allowance for available-for-sale investments | 76,000 | |

| Available-for-sale investments (at fair value) | $418,000 | |

| Investments: | ||

| Investment in Company I Stock | 806,400 | |

| Stockholders’ equity: | ||

| Retained earnings | 389,000 | |

| Unrealized gain (loss) on available-for-sale investments | 76,000 | |

Table (14)

Working Notes:

Compute the cost of available-for-sale investments.

Compute valuation allowance balance as on December 31, Year 2.

| Details | Amount ($) |

| Valuation allowance debit balance, December 31, Year 1 | $133,000 |

| Valuation allowance credit balance, December 31, Year 2 | (57,000) |

| Valuation allowance balance | $76,000 |

Table (15)

Prepare Investment in Company I Stock account to find the stock investment balance as on December 31, Year 2.

Investment in Company I Stock account

| Investment in Company I Stock | ||||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| Cash | 720,000 | Cash(dividends) | 57,600 | |||

| Income | 144,000 | |||||

| Total | 864,000 | Total | 57,600 | |||

| Balance | $806,400 | |||||

Table (16)

Want to see more full solutions like this?

Chapter 15 Solutions

Financial Accounting

- Glacier Products Inc. is a wholesaler of rock climbing gear. The company began operations on January 1, Year 1. The following transactions relate to securities acquired by Glacier Products Inc., which has a fiscal year ending on December 31: Instructions 1. Journalize the entries to record the preceding transactions. 2. Prepare the investment-related asset and stockholders equity balance sheet presentation for Glacier Products Inc. on December 31, Year 2, assuming that the Retained Earnings balance on December 31, Year 2, is 700,000.arrow_forwardRios Financial Co. is a regional insurance company that began operations on January 1, Year 1. The following transactions relate to trading securities acquired by Rios Financial Co., which has a fiscal year ending on December 31: Instructions 1. Journalize the entries to record these transactions. 2. Prepare the investment-related current asset balance sheet presentation for Rios Financial Co. on December 31, Year 2. 3. How are unrealized gains or losses on trading investments presented in the financial statements of Rios Financial Co.?arrow_forwardSoto Industries Inc. is an athletic footware company that began operations on January 1, Year 1. The following transactions relate to debt investments acquired by Soto Industries Inc., which has a fiscal year ending on December 31: Instructions 1. Journalize the entries to record these transactions. 2. If the bond portfolio is classified as available for sale, what impact would this have on financial statement disclosure?arrow_forward

- Yerbury Corp. manufactures construction equipment. Journalize the entries to record the following selected equity investment transactions completed by Yerbury during a recent year:arrow_forwardEntries for selected corporate transactions Morrow Enterprises Inc. manufactures bathroom fixtures. Morrow Enterprises stockholders equity accounts, with balances on January 1, 20Y6, are as follows: The following selected transactions occurred during the year: Instructions 1. Enter the January 1 balances in T accounts for the stockholders equity accounts listed. Also prepare T accounts for the following: Paid-In Capital from Sale of Treasury Stock; Stock Dividends Distributable; Stock Dividends; Cash Dividends. 2. Journalize the entries to record the transactions, and post to the eight selected accounts. Assume that the closing entry for revenues and expenses has been made and post net income of 1,125,000 to the retained earnings account. 3. Prepare a statement of stockholders equity for the year ended December 31, 20Y6. Assume that net income was 1,125,000 for the year ended December 31, 20Y6. 4. Prepare the Stockholders Equity section of the December 31, 20Y6, balance sheet.arrow_forwardRekya Mart Inc. is a general merchandise retail company that began operations on January 1, Year 1. The following transactions relate to debt investments acquired by Rekya Mart Inc., which has a fiscal year ending on December 31: Instructions 1. Journalize the entries to record these transactions. 2. If the bond portfolio is classified as available for sale, what impact would this have on financial statement disclosure?arrow_forward

- The following equity investment transactions were completed by Romero Company during a recent year: Journalize the entries for these transactions.arrow_forwardEntries for selected corporate transactions Nav-Go Enterprises Inc. produces aeronautical navigation equipment. Navo-Go Enterprises stockholders equity accounts, with balances on January 1, 20Y1, are as follows: The following selected transactions occurred during the year: Instructions 1. Enter the January 1 balances in T accounts for the stockholders equity accounts listed. Also prepare T accounts for the following: Paid-In Capital from Sale of Treasury Stock; Stock Dividends Distributable; Stock Dividends; Cash Dividends. 2. Journalize the entries to record the transactions, and post to the eight selected accounts. Assume that the closing entry for revenues and expenses has been made and post net income of 775,000 to the retained earnings account. 3. Prepare a statement of stockholders equity for the year ended December 31, 20Y1. Assume that net income was 775,000 for the year ended December 31, 20Y6. 4. Prepare the Stockholders Equity section of the December 31, 20Y1, balance sheet.arrow_forwardThe income statement, statement of retained earnings, and balance sheet for Somerville Company are as follows: Includes both state and federal taxes. Brief Exercise 15-20 Calculating the Average Common Stockholders Equity and the Return on Stockholders Equity Refer to the information for Somerville Company on the previous pages. Required: Note: Round answers to four decimal places. 1. Calculate the average common stockholders equity. 2. Calculate the return on stockholders equity.arrow_forward

- The accountant of Crane Shoe has compiled the following information from the company’s records as a basis for an income statement for the year ended December 31, 2022. Rent revenue £ 23,200 Interest expense 14,400 Unrealized gain on equity securities designated at fair value through other comprehensive income, net of tax 24,800 Selling expenses 112,000 Income tax 24,480 Administrative expenses 144,800 Cost of goods sold 412,800 Net sales 784,000 Cash dividends declared 12,800 Loss on sale of plant assets 12,000 There were 20,000 ordinary shares outstanding during the year. (a) New attempt is in progress. Some of the new entries may impact the last attempt grading. Your answer is partially correct. Prepare a comprehensive income statement using the combined statement approach. (Round earnings per share to 2 decimal places, e.g. 1.48.) CRANE SHOEStatement of Comprehensive Incomechoose the accounting…arrow_forwardA. Select a publicly-traded company that is traded on U.S. exchange. Locate the annual report for at least the last three fiscal years. Analyze the financial statements for the company and review for large movements in specific accounts from one year to the next. In addition, review the notes to the financial statements as these are an integral part of the financial reporting package. Evaluate the balance sheet to determine if there are large changes in the company's assets, liabilities, or equity accounts. In addition, analyze the income statement and statement of cash flows.B. At a minimum, calculate the following ratios for two years, the debt-to-equity ratio, current ratio, quick ratio, return on equity, and net profit margin. For each ratio, explain what the ratio tells you about the company.arrow_forwardPresented below are the captions of Faulk Company’s balance sheet. a. Current assets. b. Investments. c. Property, plant, and equipment. d. Intangible assets. e. Other assets. f. Current liabilities. g. Noncurrent liabilities. h. Capital stock. i. Additional paid-in capital. j. Retained earnings. Instructions Indicate by letter where each of the following items would be classified. 1. Preferred stock. 2. Goodwill. 3. Salaries and wages payable. 4. Accounts payable. 5. Buildings. 6. Equity investments (to be sold within one year). 7. Current maturity of long-term debt. 8. Premium on bonds payable. 9. Allowance for doubtful accounts. 10. Accounts receivable. 11. Cash surrender value of life insurance. 12. Notes payable (due next year). 13. Supplies. 14. Common stock. 15. Land. 16. Bond sinking fund. 17. Inventory. 18. Prepaid insurance. 19. Bonds payable. 20. Income taxes payable.arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning