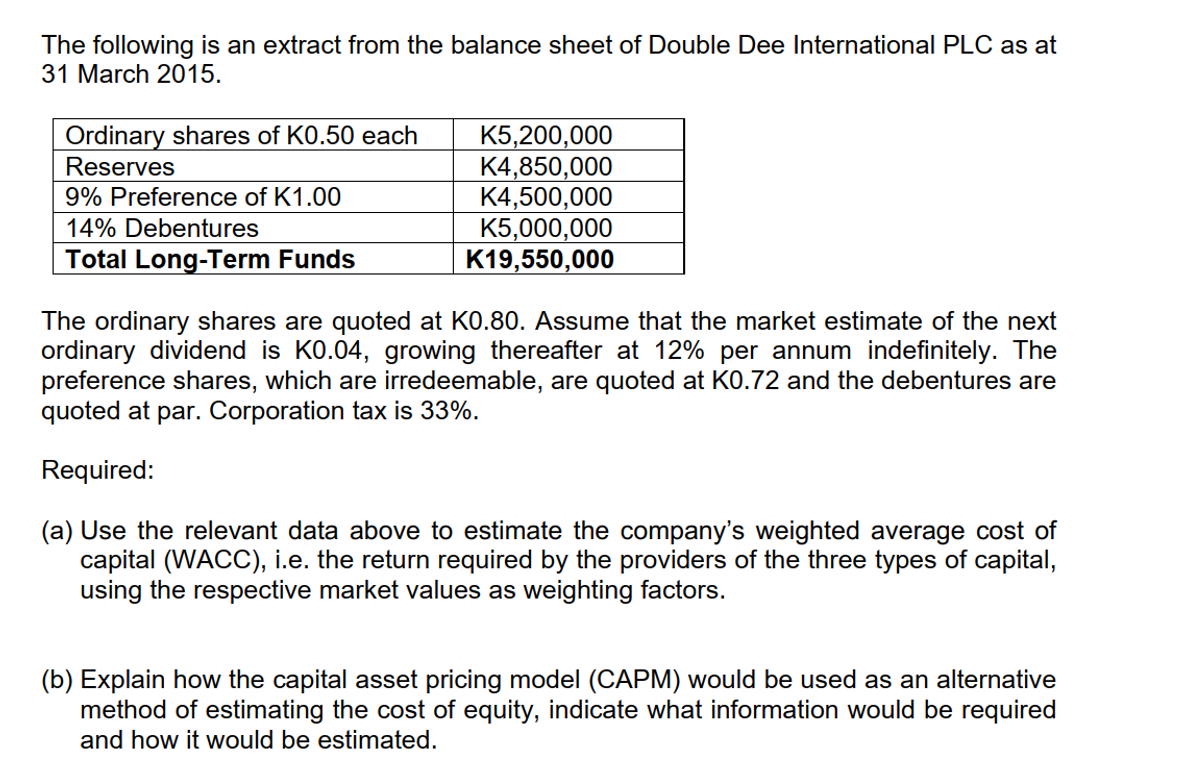

The following is an extract from the balance sheet of Double Dee International PLC as at 31 March 2015. Ordinary shares of K0.50 each K5,200,000 K4,850,000 K4,500,000 K5,000,000 K19,550,000 Reserves 9% Preference of K1.00 14% Debentures Total Long-Term Funds The ordinary shares are quoted at K0.80. Assume that the market estimate of the next ordinary dividend is K0.04, growing thereafter at 12% per annum indefinitely. The preference shares, which are irredeemable, are quoted at K0.72 and the debentures are quoted at par. Corporation tax is 33%. Required: (a) Use the relevant data above to estimate the company's weighted average cost of capital (WACC), i.e. the return required by the providers of the three types of capital, using the respective market values as weighting factors. (b) Explain how the capital asset pricing model (CAPM) would be used as an alternative method of estimating the cost of equity, indicate what information would be required and how it would be estimated.

The following is an extract from the balance sheet of Double Dee International PLC as at 31 March 2015. Ordinary shares of K0.50 each K5,200,000 K4,850,000 K4,500,000 K5,000,000 K19,550,000 Reserves 9% Preference of K1.00 14% Debentures Total Long-Term Funds The ordinary shares are quoted at K0.80. Assume that the market estimate of the next ordinary dividend is K0.04, growing thereafter at 12% per annum indefinitely. The preference shares, which are irredeemable, are quoted at K0.72 and the debentures are quoted at par. Corporation tax is 33%. Required: (a) Use the relevant data above to estimate the company's weighted average cost of capital (WACC), i.e. the return required by the providers of the three types of capital, using the respective market values as weighting factors. (b) Explain how the capital asset pricing model (CAPM) would be used as an alternative method of estimating the cost of equity, indicate what information would be required and how it would be estimated.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 2MAD

Related questions

Question

Transcribed Image Text:The following is an extract from the balance sheet of Double Dee International PLC as at

31 March 2015.

Ordinary shares of K0.50 each

K5,200,000

K4,850,000

K4,500,000

K5,000,000

K19,550,000

Reserves

9% Preference of K1.00

14% Debentures

Total Long-Term Funds

The ordinary shares are quoted at K0.80. Assume that the market estimate of the next

ordinary dividend is K0.04, growing thereafter at 12% per annum indefinitely. The

preference shares, which are irredeemable, are quoted at KO.72 and the debentures are

quoted at par. Corporation tax is 33%.

Required:

(a) Use the relevant data above to estimate the company's weighted average cost of

capital (WACC), i.e. the return required by the providers of the three types of capital,

using the respective market values as weighting factors.

(b) Explain how the capital asset pricing model (CAPM) would be used as an alternative

method of estimating the cost of equity, indicate what information would be required

and how it would be estimated.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning