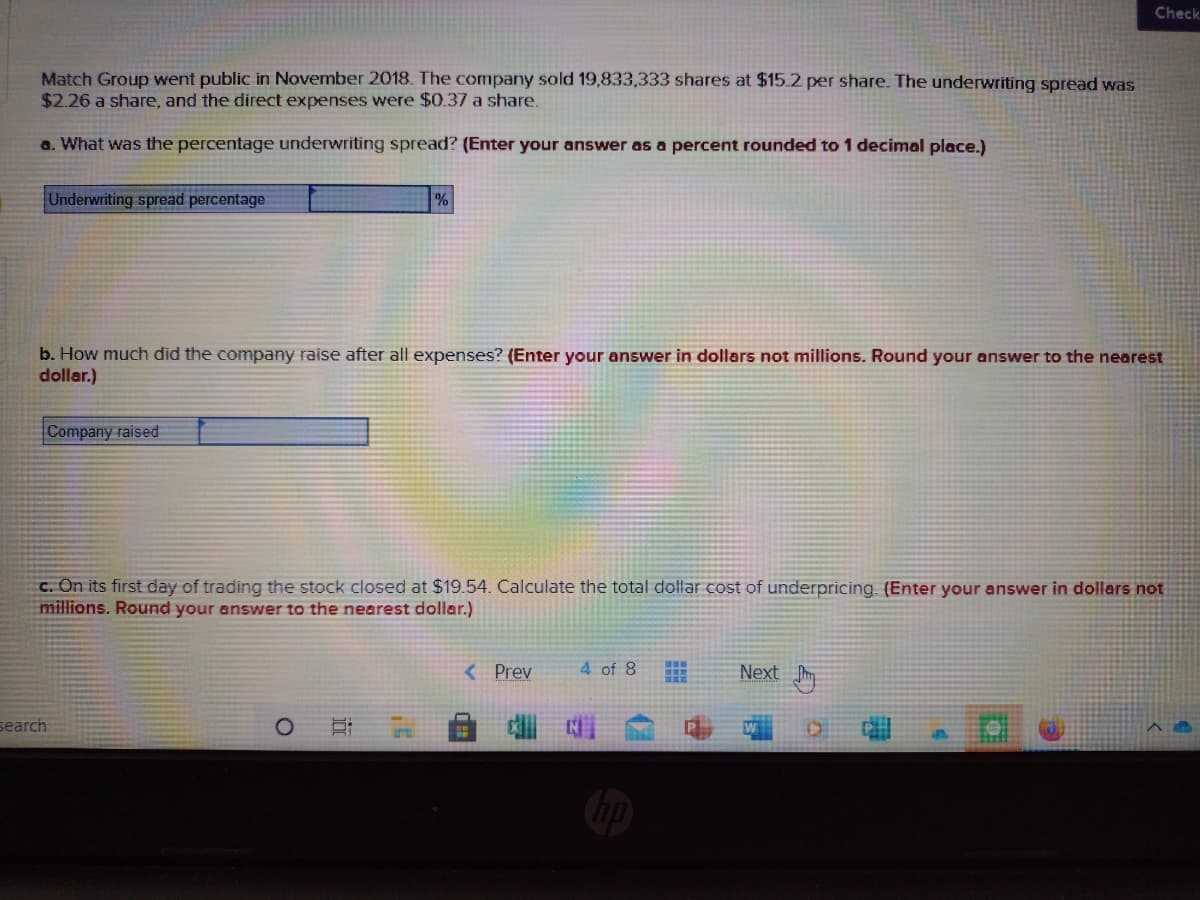

Match Group went public in November 2018. The company sold 19,833,333 shares at $15.2 per share. The underwriting spread was $2.26 a share, and the direct expenses were $0.37 a share. a. What was the percentage underwriting spread? (Enter your answer as a percent rounded to 1 decimal place.) Underwriting spread percentage b. How much did the company raise after all expenses? (Enter your answer in dollars not millions. Round your answer to the nearest dollar.) Company raised c. On its first day of trading the stock closed at $19.54. Calculate the total dollar cost of underpricing. (Enter your answer in dollars not millions. Round your answer to the nearest dollar.)

Match Group went public in November 2018. The company sold 19,833,333 shares at $15.2 per share. The underwriting spread was $2.26 a share, and the direct expenses were $0.37 a share. a. What was the percentage underwriting spread? (Enter your answer as a percent rounded to 1 decimal place.) Underwriting spread percentage b. How much did the company raise after all expenses? (Enter your answer in dollars not millions. Round your answer to the nearest dollar.) Company raised c. On its first day of trading the stock closed at $19.54. Calculate the total dollar cost of underpricing. (Enter your answer in dollars not millions. Round your answer to the nearest dollar.)

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter18: Initial Public Offerings, Investment Banking, And Capital Formation

Section: Chapter Questions

Problem 9MC

Related questions

Question

Transcribed Image Text:Check

Match Group went public in November 2018. The company sold 19,833,333 shares at $15.2 per share. The underwriting spread was

$2.26 a share, and the direct expenses were $0.37 a share.

a. What was the percentage underwriting spread? (Enter your answer as a percent rounded to 1 decimal place.)

Underwriting spread percentage

b. How much did the company raise after all expenses? (Enter your answer in dollars not millions. Round your answer to the nearest

dollar.)

Company raised

C. On its first day of trading the stock closed at $19.54. Calculate the total dollar cost of underpricing. (Enter your answer in dollars not

millions. Round your answer to the nearest dollar.)

< Prev

4 of 8

Next

search

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning